The Exterminators: AI and Open Banking Crack the Fraud Code

Future of Fintech - Edition #120 (21st-27th May)

The Fintech Express is Now Boarding! 🚅

Central banks are waving the checkered flag, licences fuel the fintech engine, and the LATAM crypto scene is ready for takeoff! The way we manage money is changing. Are you ready to see what unfolds?

Love sipping on the latest fintech buzz with our newsletter? Pour your support and elevate your sip with a subscription donation! 😊☕

What’s on the fintech menu today?

📖 Today’s Must Read: Stripe's UK Launch: A Playbook for Growth

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

Stripe's UK Launch: A Playbook for Growth

Stripe has unleashed a powerful toolkit in the UK that solves two of businesses’ biggest headaches: access to capital and sluggish payouts.

This announcement underscores Stripe’s commitment to accelerating growth and enhancing financial accessibility in its second-largest market.

Let's unpack the goodies:

Unlocking New Avenues for Growth with Stripe Capital

Traditional bank loans are increasingly elusive, with approval rates dropping from 80% in 2018 to just 50% last year. Stripe Capital offers a transformative solution by leveraging transaction data to proactively qualify businesses for flexible financing. Funds are deposited the next business day, and repayments are seamlessly tied to daily earnings. This model provides immediate, stress-free access to capital, empowering businesses to invest in expansion, hire staff, and enhance operations without the usual financial friction.

Streamlined, Real-Time Payments with Pay by Bank

The introduction of Pay by Bank, powered by Open Banking, offers a low-cost, real-time payment solution. This method allows consumers to pay directly from their bank accounts, reducing transaction costs and enhancing payment speed. This innovation is particularly advantageous for businesses seeking to streamline operations and improve customer satisfaction with faster, more efficient payment processing.

Fast-tracked Earnings with Faster Payouts

Additionally, Stripe’s use of the UK’s Faster Payments Scheme has drastically reduced payout times from days to mere hours. This capability is critical for businesses that rely on swift access to funds to manage daily operations and reinvest in growth. Faster payouts mean improved cash flow management, allowing businesses to respond agilely to market demands and opportunities.

The expansion of Stripe’s payment method support—from 50 to over 100 options, including Revolut Pay—further cements its position as a versatile payment processor. Coupled with the AI-powered Optimized Checkout Suite, which intelligently selects the best payment methods for customers, Stripe is enhancing the checkout experience, reducing cart abandonment, and driving higher conversion rates.

Stripe’s latest offerings are not just incremental upgrades; they are strategic enhancements that align with the evolving needs of the UK’s fintech ecosystem. By providing robust, flexible financing options, streamlining payment processes, and enhancing cash flow management, Stripe is positioning itself as an indispensable partner for UK businesses. This is particularly significant as over 600 UK businesses join the Stripe network daily, including innovators like Monzo and Octopus Energy, and established firms such as ITV and Nando’s.

Stripe's new UK tools are exciting, but they're just one piece of a much larger strategy. Our exclusive 50-page report, “Stripe's Economic Infrastructure Playbook”, decodes the strategic genius behind Stripe's explosive success and gives a roadmap to:

Learn from Stripe's strategic bets on booming sectors like the creators' economy, digital assets & web3.

Understand its approach to omnichannel commerce and unlock the secrets to frictionless transactions across every touchpoint.

Connect the dots between Stripe’s recent moves and its long-term goals. Uncover the hidden logic behind their product development and market expansion.

Get the complete picture with "Stripe's Economic Infrastructure Playbook". Order your copy today!

This report is just a taste of the intel you'll uncover with a WhiteSight Radar subscription.

Unlock this report and a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition #120 dives into the engine room of financial technology, exploring the forces driving its rapid evolution 👇

The Week's Hot 10! ♨️🔟

Staying one step ahead of scammers -

⤷ Mastercard leveraged generative AI to double the speed at which it can detect potentially compromised cards, reducing false positives and identifying at-risk merchants more efficiently.

⤷ Plaid Beacon enhanced its fraud defence by providing bank account insights and bolstering protection against stolen identities, synthetic accounts, and account takeovers (ATO).

Central authorities kicked into high gear -

⤷ The US Securities and Exchange Commission approved applications from Nasdaq, CBOE and NYSE to list exchange-traded funds (ETFs) tied to the price of Ethereum (ether), potentially paving the way for the crypto products to begin trading later this year.

⤷ Bank of Spain unveiled a wholesale CBDC trial with payment processor Minsait. The trial will explore using a wholesale CBDC to settle the issuance and secondary market transactions of a natively digital bond.

Making payments a breeze -

⤷ Payments giant Stripe introduced new payment tools and financing options in the UK to enhance access to capital and support the growth of UK businesses. The new features include business financing through Stripe Capital, cost-effective open banking payments, and faster payouts for UK companies.

⤷ Atomic launched PayLink Manage, a subscription management technology that lets account holders view, update, and optimise recurring payments within their financial institution’s app. This tool helps users cut unnecessary spending and manage their money more effectively.

Enhancing features for peak performance -

⤷ US-based Banking-as-a-Service platform Synctera launched the ‘Bring Your Own Bank’ model, allowing fintech companies to use the Synctera Platform with any bank, enhancing flexibility and fostering robust partnerships.

⤷ Saudi Arabia-based Arab National Bank upgraded its long-standing core banking solution Infosys Finacle to version 11x to future-proof its banking technology and improve customer satisfaction.

Milestone Mania -

⤷ Islamic digital bank AEON Bank debuted in Malaysia, commencing with personal banking services before expanding to cater to small businesses.

⤷ UAE-based platform bank Wio Bank achieved profitability, marking its first full year of operations with impressive profitability since its launch in September 2022.

Now, for the ‘byte’-sized fintech buzz –

In the evolving landscape of Embedded Finance, key players are leveraging BaaS for innovative solutions:

Mbanq, a provider of banking technology and compliance solutions, became a full member of the Banking-as-a-Service (BaaS) Association. By aligning with the BaaS Association, Mbanq will help drive best practices within an industry that is rapidly changing in response to regulatory and technology shifts.

AppTech Payments completed the pilot program for its BaaS platform using the solution to launch InstaCash. InstaCash utilises the BaaS for virtual accounts, debit and credit cards, and high-interest-yielding financial products.

Open Finance revolution takes root in Asia! Last week's headlines showcased how Asian markets are democratising finance and building trust in data sharing.

The Bangko Sentral ng Pilipinas (BSP) announced plans to establish a platform that expands Filipinos' accessibility to diverse pension and insurance services, as a key component of its efforts to bolster financial inclusion nationwide. BSP Governor Eli Remolona Jr. highlighted the central bank's commitment to open finance, with an initial API focus on pensions within the PERA program.

Taiwan's Financial Supervisory Commission released the "Data Governance Consultation Document.” The consultation categorises FIs' customer data into four levels and proposes corresponding governance methods for each level during data sharing.

In the fast-evolving Digital Finance arena, financial institutions are locking in banking licences to ignite growth and spark innovation.

UK-based SilverRock Bank secured its banking authorisation from the Prudential Regulation Authority after receiving ~$64M (GBP 50M) in funding. The licence is set to support SilverRock Bank’s development strategy, with the financial institution providing a model that allows it to partner with non-bank and other lenders to assist them to compete more efficiently over the long term.

MercadoLibre's fintech arm, Mercado Pago, initiated discussions with Mexico's central bank, finance ministry, and banking regulators to seek a banking licence, aiming to broaden its product offerings within the country.

Last week's Fintech Infrastructure news was brimming with product enhancements, setting new standards for user experience, security, and intelligent responsiveness!

Global financial technology leader FIS launched an enhanced version of its flagship mobile banking application for financial institutions. New functionality includes enhanced user experience, security, and money movement capabilities.

Jaja Finance launched a Gen AI chat assistant using Anthropic’s Claude 3 model. The new service, ‘Airi,’ uses Amazon Bedrock, a fully managed service from Amazon Web Services (AWS) that offers a choice of high-performing foundation models (FMs) to access Claude 3 models. This offers increased intelligence with near-human levels of responsiveness and improved data accuracy.

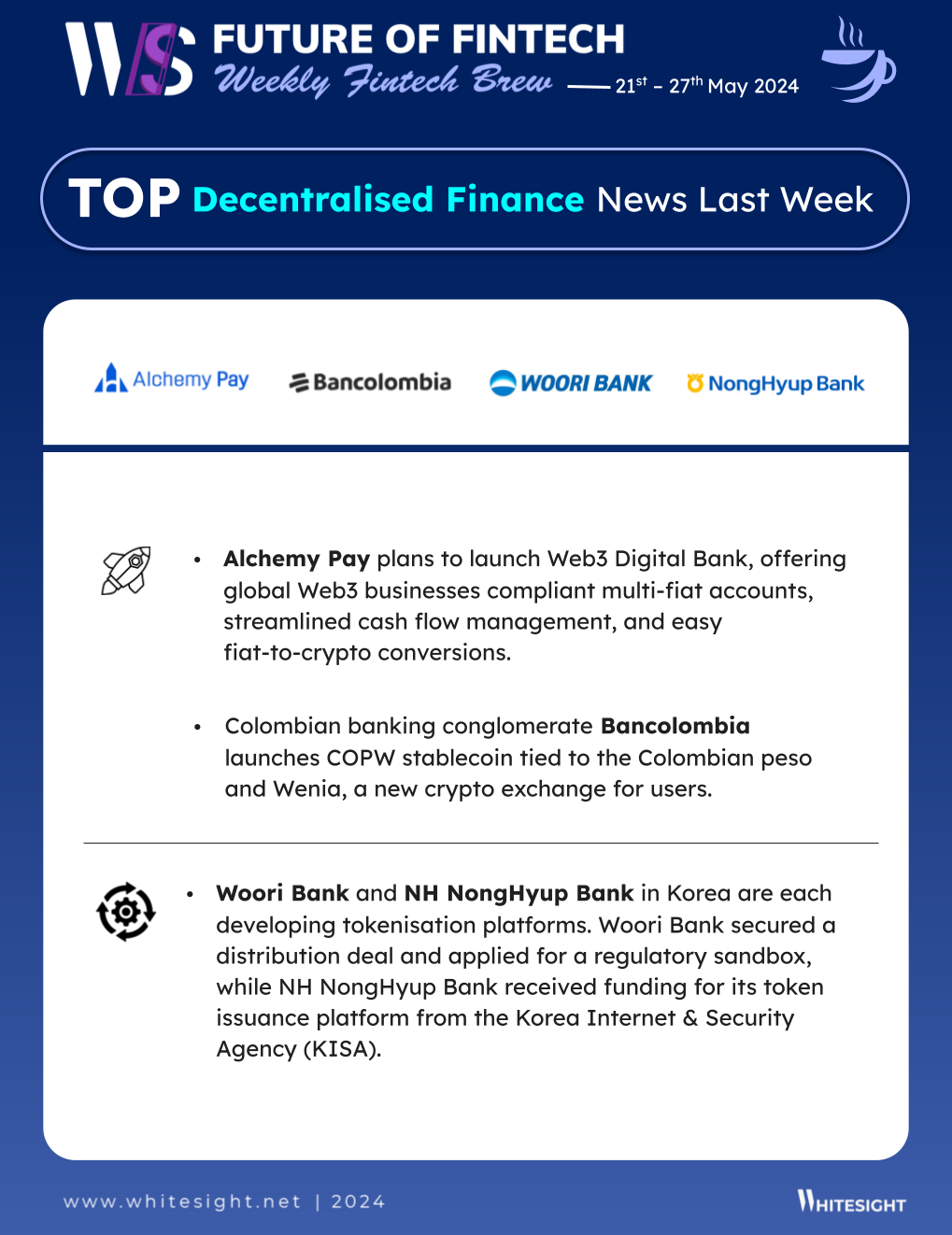

Latin America's DeFi revolution is picking up steam, with regulatory frameworks and innovative financial products taking centre stage.

Brazil's central bank planned to split the regulation of crypto-assets and virtual asset service providers into phases, with regulatory proposals anticipated by year-end. The central bank announced that a second public consultation would commence in the second half of this year, focusing on drafting the regulatory texts.

Colombian banking conglomerate Bancolombia entered the cryptocurrency sector by launching a new stablecoin, COPW, tied to the Colombian peso. Simultaneously, it also introduced a new cryptocurrency exchange named Wenia, which allows users to purchase, convert, receive, send, and trade cryptocurrencies.

Regulatory advancements and eco-friendly innovations took hold over the Green Finance landscape:

The UK Financial Conduct Authority (FCA) published a policy statement confirming the final rules under the Sustainability Disclosure Requirements (SDR) and investment labels regime. The main goal of these new requirements is to provide consumers with consistent and reliable information about funds marketed as sustainable investments.

Thames Technology, a provider of innovative payment solutions, now offers Mastercard-approved prepaid paperboard cards. Thames Technology's financial board cards catered to the demand for sustainable payment solutions, tailored for limited-use MasterCard-branded prepaid cards with magnetic stripes.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it all the way here, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

The Future of UK Fintech: 2015 – 2035 Report - Innovate Finance X Finextra

The State of Payments Report - Yapily

Designing new digital financial services under the European open banking regulation triumvirate Blog - Platformable

Why embedded finance has moved up the priority list for UK B2B SaaS products Blog - Weavr

Open Banking Beyond Open Pipes (OB in verification, fraud, and risk) Blog - WhiteSight

The State of Embedded Finance (Q1 2024) Report - WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

Fintech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️