Future of FinTech | Edition #12 – March 2022

We’re back with another brewing edition of the Future of FinTech newsletter with headlines from events of the last week of the month! If you're new and curious, read on to find out what happened in the world of FinTech across six dynamic themes, and join 643 other FinTech nerds in receiving some fresh Weekly FinTech Brew delivered right to your inbox every Tuesday ☕️

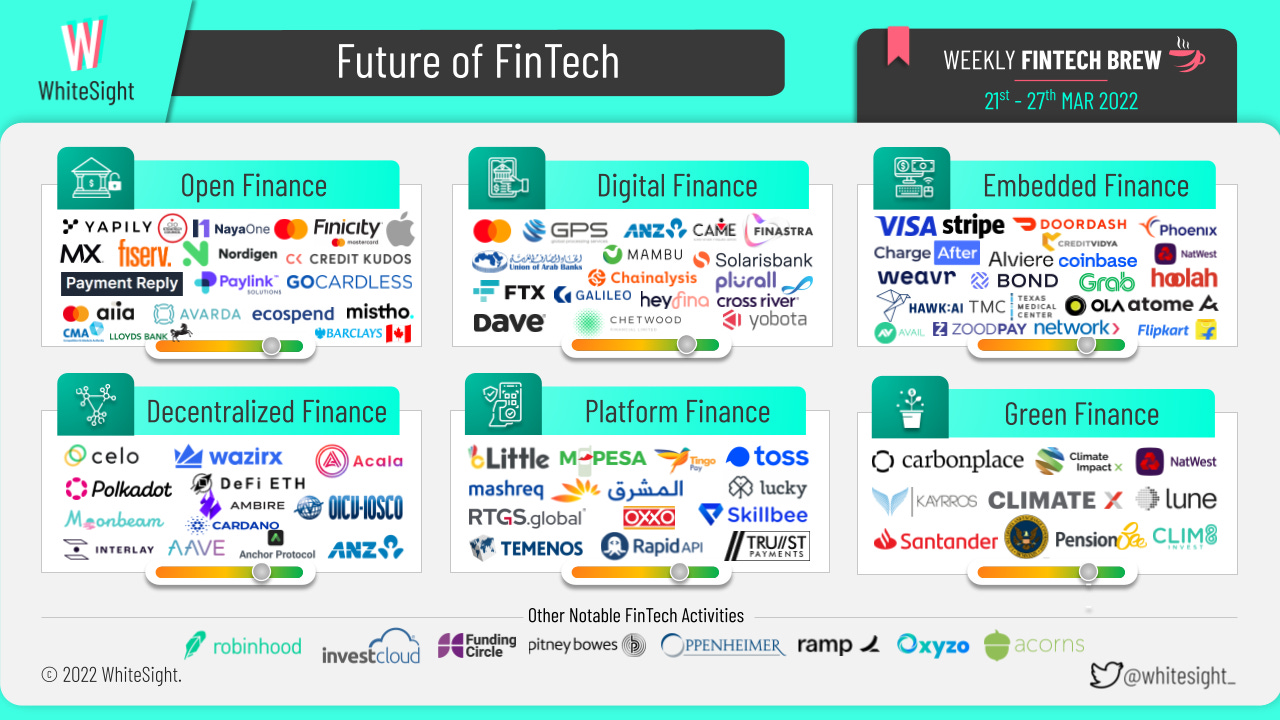

Edition #12 witnesses the Open and Digital Finance verticals side-by-side while taking the crown for being the most active segments of the week.

Here's the TL;DR

Some partnerships that turned heads with their collaborative moves:

Nordigen grabbed headlines for not one but two partnerships – Nordigen + SeeDCash for streamlined financial data import and Nordigen + Payment Reply for Open Banking-powered direct accounts,

Mastercard + GPS to further scale card programs for FinTechs,

Visa + DoorDash + Stripe to enable faster payouts,

Temenos Exchange + RTGS.global to offer instant cross-border settlement, and

Carbonplace + Climate Impact X on a pilot for the voluntary carbon market.

On the regulatory front, the Government of Canada moved forward with Open Banking by appointing a new lead, and CIO Strategy Council also released the first draft of their proposed standard for open finance in Canada.

For the longer read, let's get going –

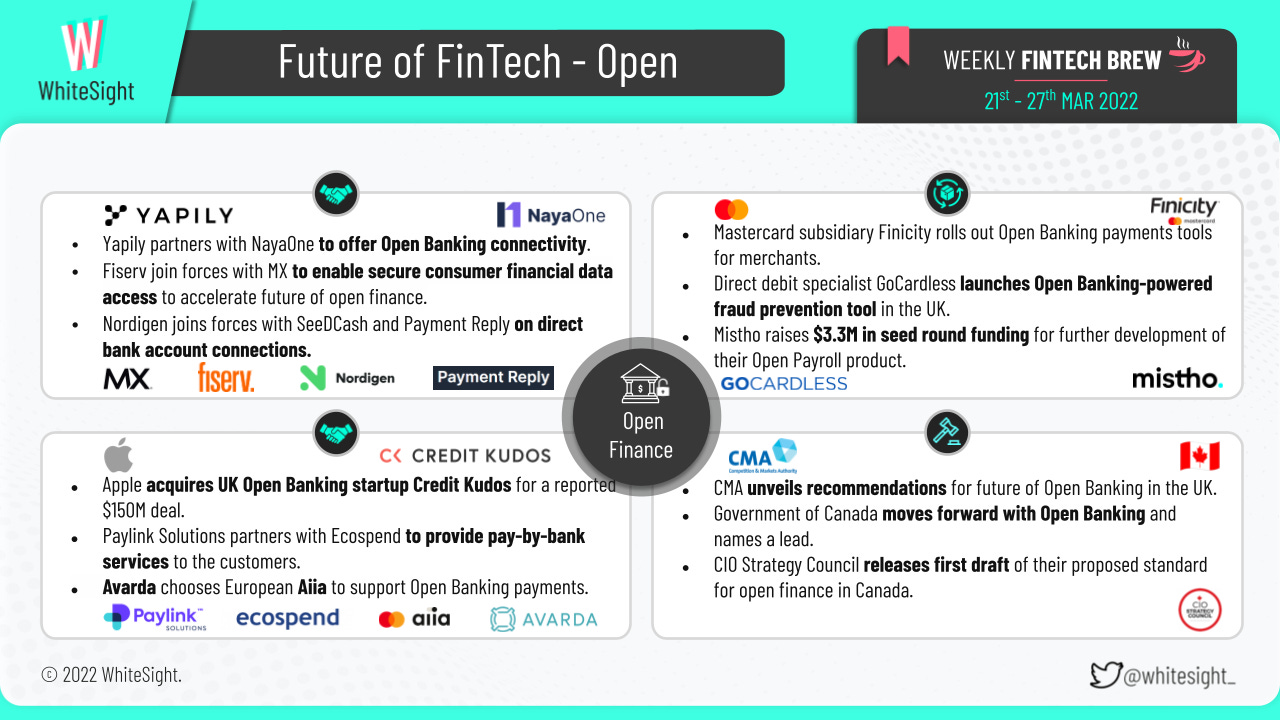

With Open Banking-powered payments gaining traction across diverse geographies, numerous partnerships remained at the forefront of the Open Finance vertical.

Nordic-based payment service provider Avarda teamed up with European Open Banking provider Aiia to facilitate Open Banking payments via its white-label payment solutions for an extensive range of retailers and merchants.

Fiserv announced a partnership with MX to accelerate the future of open finance through secure, reliable consumer financial data sharing.

Yapily collaborated with NayaOne and their Digital Sandpit to provide organizations access to Yapily’s next-generation financial data and payment initiation solutions, enabling NayaOne’s customers to innovate and build next-generation financial products and services.

Nordigen’s collaborations with SeeDCash and Payment Reply on different Open Banking initiatives also garnered attention. While Spanish FinTech platform SeeDCash chose Nordigen for an improved financial data import process, Payment Reply teamed up with the freemium Open Banking platform for direct bank account connections.

Paylink Solutions’ partnership with Ecospend to provide customers who’ve fallen behind their repayment schedule with ‘pay-by-bank’ services also grabbed headlines. The feature will allow them to make instant payments and get back on track with their arrangements.

Tech giant Apple was in the news for acquiring UK Open Banking platform Credit Kudos, a move that valued the startup at $150M. Read our analysis on the acquisition here. Mastercard unveiled a pair of Open Banking tools – the Payment Success Indicator and Payment Routing Optimizer – developed by Finicity to improve predictability and transparency for merchants. GoCardless announced the launch of Verified Mandates in the UK, a feature within its global bank pay platform that combines the Account Information Services (AIS) capabilities of Open Banking with direct debit to prevent fraud.

The Competition and Markets Authority (CMA) also captured headlines for announcing the formation of a new committee – the Joint Regulatory Oversight Committee (JROC) – which will oversee the regulatory framework and support a robust evolution of Open Banking technology in the UK. The CMA also wrote to Barclays and Lloyds banks about a series of failures to make accurate and comprehensive data on its products and services available through open APIs. The Canadian Open Banking space was buzzing with activities, with the Government announcing the appointment of Abraham Tachjian as the country’s Open Banking lead and the CIO Strategy Council releasing the first draft of their proposed standard for open finance in Canada.

The Digital Finance sphere was lit up with stirring affairs that made for some attention-grabbing scoop for the week.

When it comes to partnerships, payment technology platform Global Processing Services (GPS) announced a new collaboration with Mastercard, which has also made an undisclosed strategic investment in the company. US-based Cross River teamed up with blockchain data platform Chainalysis to boost risk management for its clients involved in crypto. Solarisbank joined forces with Berlin-based neobroker fina to launch a white-label securities brokerage solution over a single API. Finastra’s collaboration with the Union of Arab Banks was also in the news, as it will help financial institutions across the Arab League member states offer enhanced digital services to their customers. Mexican microlender CAME migrated its operations to cloud banking platform Mambu to support its expansion plans and ambition to triple its customer base by 2025.

On the fundings front, the venture arm of FTX invested $100M in Dave as part of a partnership that aims to expand the digital assets ecosystem. Colombian FinTech Plurall closed a pre-seed round raising $1.5M equity and $10M backed by prominent strategic investors in the UK, US, Mexico, Spain, and Colombia.

Additionally, ANZ launched a new digital banking service, ANZ Plus, designed to give Australians more visibility and control of their money. Digital bank Chetwood Financial announced its acquisition of core banking provider Yobota to extend its banking-as-a-service capabilities. Galileo, a subsidiary of SoFi, accelerated its LatAm expansion plans by announcing its launch in Colombia, where it is partnering with issuers, banks, e-commerce, and FinTechs to enable their digital financial services offerings.

A plethora of partnerships were at the top of the list regarding the diverse activities in the Embedded Finance sphere last week.

Visa Canada announced the new DoorDash Fast Pay feature facilitated by Stripe’s Instant Payouts product to enable faster payouts for eligible Dashers across Canada. Global embedded FinTech Alviere added crypto products via a partnership with Coinbase Global Inc. Hawk AI and Weavr also made the bulletin for joining forces to deliver real-time, effective AML surveillance. Additionally, Bond partnered with Texas Medical Center to introduce embedded finance for the healthcare vertical. ZoodPay and Network International collaborated on BNPL solutions in Jordan. Flipkart’s integration of CreditVidya for offering an embedded BNPL credit solution and Ola’s acquisition of FinTech Avail Finance were also key highlights in the embedded happenings.

As for other events, NatWest grabbed headlines for planning to join the booming BNPL market this summer, becoming the first UK high street bank to announce a move into the multi-billion-pound sector. Multi-lender BNPL platform ChargeAfter secured $44M Series B funding from multiple banks, including Citi Ventures, Banco Bradesco, and MUFG. The Singapore Fintech Association (SFA) made news for leading the “BNPL Working Group,” an industry-led initiative co-established by Grab, Atom, and Hoolah to develop a BNPL framework for the local market.

As the DeFi & Crypto industry continues to garner more attention by the day, many are placing their bets on the emerging potentialities of the sphere.

Mobile-first open-source ecosystem Celo Foundation and crypto exchange WazirX joined forces to list CELO tokens allowing users to buy, sell, and trade the crypto in WazirX’s INR and USDT market and bring financial stability to those who need it most. Non-custodial DeFi wallet Ambire integrated Moonbeam Network, allowing users to use native Moonbeam DeFi protocols and send transactions.

On the fundings front, Acala (ACA), a DeFi-focused network built on Polkadot, launched a $250M “aUSD Ecosystem Fund” to support Polkadot’s DeFi ecosystem startups. Innovative financial trading platform DeFi ETH also made the news after it obtained a strategic investment from Gray Investment Trust to jointly carry out in-depth cooperation in the business field to expand blockchain's financial, ecological development.

Several products also hit the headlines as they announced intriguing innovations to disrupt the segment. Newly appointed Polkadot parachain network Interlay was in the news for nearing the completion of a two-year Bitcoin bridge development project on Polkadot, with the launch announcement on its sandbox platform Kusama. DeFi protocol Achor passed a proposal to let the decentralized money market implement a more sustainable semi-dynamic earn rate. Moreover, Anchor leapfrogged Aave to become the third-largest dApp in DeFi. The Cardano Network also reached a new milestone, having issued more than 4 million native tokens on top of it across nearly 50,000 minting policies.

Interested in more crypto-related buzz? 🧐 Well, you need to get yourself a weekly cuppa of the Future of Crypto newsletter!

The Platform Finance segment witnessed a series of funding rounds for the week.

Skillbee, a startup that helps migrant workers get jobs, raised $3.2M in a seed funding round to strengthen its presence among migrant workers and double the number of companies hiring through it. Egyptian super app Lucky secured a $25M Series A funding round to build out its credit capabilities, expand its market share, and drive further overseas growth. RapidAPI also grabbed headlines for its $150M funding round at a $1B valuation to continue building out more API functionality. Furthermore, South Korea’s Viva Republica was in the news for its plans to raise up to $1B to fund the growth of its mobile app Toss and compete in Southeast Asia with SoftBank-backed rivals Grab and GoTo.

As for the various product launches, London’s FinTech disruptor Trust Payments launched an all-in-one e-commerce platform via the acquisition of Stor to revolutionize payments offerings for SMEs. Mexico’s biggest convenience store chain, Oxxo, introduced its ready-to-use Spin debit card and app in an attempt to merge its massive retail infrastructure with financial services. Additionally, Nigerian financial and agricultural technology company Tingo made the news for launching a new super app to address the challenges for SME businesses by tackling limited payment options. Mashreq Bank also hit the headlines for betting on the super app phenomenon to boost customer experience. At the same time, hospitality industry booking service Makao and transport provider Little became the latest “mini-apps” additions to the M-Pesa app. RTGS.global also joined Temenos Exchange’s open marketplace to solve friction in cross-border settlements.

The Green Finance segment had various activities that made up for most headlines.

The Lemonade Foundation formed a crypto climate coalition to build a blockchain-based climate insurance offering for subsistence farmers and livestock keepers in developing markets. Santander created Santander Green Investment, a platform to invest in renewable energy projects under development and construction. NatWest also made the list for its plans to pilot a carbon tracking app for SMEs developed in partnership with CoGo. Speaking of partnerships, carbon credit settlement platform Carbonplace and carbon marketplace and exchange Climate Impact X teamed up on a pilot to lower entry barriers for organizations seeking high-quality carbon credits on the voluntary carbon market.

On the fundings front, London-based climate risk analytics provider Climate X raised $5.4M in a seed funding round to accelerate the scaling of their climate risk analytics solution. BNP Paribas joined a $44M funding round in climate data and analytics startup Kayrros to support its geospatial detection technologies that assess climate impact resulting from economic activity. Climate tech startup Lune also announced a $4M funding round led by early-stage VC Crane, with participation from 15 reputable angel investors.

In other news, the Securities and Exchange Commission (SEC) proposed rule changes that would require registrants to include certain climate-related disclosures in their registration statements and periodic reports. Clim8, the investment app for climate impact, announced a new TV advertising campaign with renowned science presenter and mathematician Hannah Fry to raise awareness around the importance of climate impact investing. Furthermore, a new analysis from PensionBee revealed that most pension savers (63%) viewed net-zero pledges as disingenuous and making little difference to the climate crisis. However, a small proportion (18%) felt net-zero pledges still represent an essential first step towards addressing climate change.

Some other happenings in the FinTech universe 🪐

Many other stirring affairs from beyond the six dynamic themes made for some eye-grabbing news for the week, with –

Robinhood announcing its new Robinhood Cash Card that automatically invests in stocks and crypto users spend,

Acorns adding Bitcoin exposure option for long-term investing,

Pitney Bowes and Funding Circle partnering to support small business lending,

InvestCloud working with Oppenheimer on a digital wealth platform,

Oxyzo raising $200M in a Series A round, turning it into a unicorn,

Ramp hitting a $8.1B valuation after closing a $200M funding round, and

Jeeves raising a $180M Series C at a valuation of $2.1B.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include entering the immersive universe of Gamification—Into The Metaverse, and exploring the many Female-focused Crypto Initiatives that are ‘DeFi’ning the way for women in the blockchain world.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some 💛