J.P. Morgan's Blockchain Vaults Open - Tokenisation Takeoff?

Future of Fintech - Edition #118 (7th-13th May)

Today’s Fintech Forecast: Expect heavy showers of funding💸, sunshine on financial inclusion 🌞, and a hot UK fintech scene🔥. Fintech’s blurring the lines between finance and everyday life – buckle up, Fintech Fam – the future is here!

Love sipping on the latest fintech buzz with our newsletter? Pour your support and elevate your sip with a subscription donation! 😊☕

What’s on the fintech menu today?

📖 Today’s Must Read: From 0 to 100 Real Quick: NuBank Hits a Nu Milestone

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

From 0 to 100 Real Quick: NuBank Hits a Nu Milestone 💯

NuBank, the Brazilian digital bank, just smashed through a 100 million user barrier across Brazil, Mexico, and Colombia! This makes it the first non-Asian digital bank to reach this milestone. The vast majority are in Brazil (92 million), with 7 million in Mexico and 1 million in Colombia. What’s more – in the past 12 months, it has launched more than 40 products.

Here's why Nubank is a game-changer:

➥ It has cracked the engagement code: Most new banks struggle to keep users hooked. Nubank? It has got 80% of its customers actively using its app every month. Talk about sticky!

➥ And on its way to cracking the profitability code: Nubank isn't just burning through cash. This news follows its “record” 2023 financial results, with more than $1B in net profit and revenues in excess of $8B.

But can it keep this hot streak going? The big question is: where does it go from here?

↪ Latin America is its current stomping ground, and its home turf, Brazil, is pretty much saturated. Mexico and Colombia are next, but it faces tougher competition in Mexico and a relatively new market in Colombia.

↪ The US? It's tempting with all the cross-border trade, but becoming a US bank is a bureaucratic maze. Maybe a partner can help Nubank navigate it?

↪ Asia is a whole different ballgame, with its own payment systems and giants already in the game.

The future of Nubank and the entire digital banking landscape hangs in the balance.

Our latest blog, “From Vision to Victory in the Race of Profitability”, dives deep into the strategies that separate profitable fintech leaders from the pack. This Nubank news is a perfect case study – is their success replicable in new markets?

Dive deeper into the strategies powering profitable digital banks and how the changing digital banking scene holds more promise for digital banks to seize new opportunities.

See further in Fintech with WhiteSight Radar. 🔮

Steer your course with exclusive insights and actionable intelligence on the hottest fintech themes, including Embedded Finance, Digital Banking, Open Banking, SME Lending, BaaS… and more!

WhiteSight Radar delivers actionable intelligence through in-depth reports, industry trends, and expert analysis. Become a member and stay ahead of the curve with:

✅ Emerging themes: Discover the next big fintech disruptions.

✅ Strategy Teardowns: Unpack the latest fintech strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast. PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!

✅ Industry initiatives: Stay informed on key market movements.

✅ Exclusive content & analyses: Bespoke research requests and briefing calls with our in-house experts… all just a click away!

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🚀

Edition #118 says hello, peering into the crystal ball of finance to show you what's next. 🔮

The Week's Hot 10! ♨️🔟

Global Glance:

⤷ Brazilian digital bank Nubank surpassed more than 100 million customers in the three countries it operates in - Brazil, Mexico, and Colombia. This makes it the first non-Asian digital bank to reach this milestone.

⤷ Filipino digital challenger GoTyme Bank acquired lendtech SAVii to help boost the bank’s expansion into payroll-enabled financial products.

⤷ Leading global fintech Banked and National Australia Bank (NAB) teamed up to accelerate the number of Australian merchants adopting and integrating A2A payment solutions.

Tech-driven decisions to drive innovation:

⤷ J.P. Morgan announced plans to open its licensed blockchain Onyx for third-party application deployment, facilitating asset tokenisation on the platform.

⤷ Fireblocks announced plans to launch its Global Custodian Partner Program, allowing clients on the Fireblocks Network to access multiple custodians.

⤷ CIBC Mellon partnered with UK-based Duco to implement AI-powered data automation technology into its asset servicing platform.

New products parade:

⤷ Global payments service provider FIS launched an embedded finance platform named Atelio by FIS. This platform provides tools for institutions, businesses, and developers to integrate financial services into products.

⤷Financial information services company Experian introduced the Cashflow Attributes solution to support financial inclusion and expand access to credit.

Cracking down & cleaning up:

⤷ Taiwan updated its Money Laundering Control Act, increasing oversight of virtual assets and enhancing penalties for non-compliance to align with global standards.

⤷ TabaPay cancelled plans to purchase the assets of troubled banking-as-a-service startup Synapse due to failure to meet closing conditions.

Now, for the ‘byte’-sized fintech buzz –

In the fast lane of Embedded Finance, alliances are forging a path to a future where finance seamlessly blends into your life, supercharging the customer experience.

South Florida Motorsports (SFM) extended collaboration with J.P. Morgan Payments for the Formula 1 Crypto.com Miami Grand Prix 2024. This partnership aims to elevate the fan shopping experience with enhanced retail options both in-person and online.

Global issuer-processor Paymentology and Diamond Trust Bank, an East African commercial banking franchise, joined forces to facilitate the expansion of BIN sponsorship services and the embedding of financial services with Kenya’s regulatory framework.

Open Finance continues on its mission to bring finance to every corner. Get ready for a wave of accessibility, innovation, and partnerships:

New Zealand's ASB Bank partnered with Māori fintech BlinkPay, allowing customers to shop online securely without credit or debit cards. Through BlinkPay technology, users can click “Blink PayNow,” redirecting them to ASB's mobile banking app to log in and confirm their payment. The partnership comes ahead of open banking implementation in New Zealand.

CRIF, Europe's open banking provider, was authorised by the Crown Commercial Service (CCS). It can now offer its solutions to the UK government and other organisations. CCS aims to streamline open banking services for the public sector.

The Digital Finance segment saw digital giants snagging up funding to fuel their expansion.

UK-based SME lender Iwoca landed a debt funding package totalling ~$339M (£270M) to increase its presence in both domestic and international markets amid the “mounting demand for finance from small businesses”.

Monzo secured an additional $190M in its latest round of funding, with its post-money valuation now surpassing $5.2B. The digital challenger plans to leverage its latest funds to fuel ongoing growth initiatives. The new funds will also likely help fuel the company’s renewed push to tap into the US market.

The gears are shifting in the Fintech Infrastructure space, where acquisitions were the name of the game the past week.

US-based WaFd Bank tapped Fiserv to deploy a new digital payment and cash flow management solution called CashFlow Central for its small business customers. CashFlow Central enables small businesses to send electronic invoices, accept payments through ACH transfers and credit cards, and pay billers and suppliers via a bank account or credit card.

New Peoples Bank, a US-based community bank, selected Jack Henry’s core processing solution to drive “growth and innovation”. The bank will also adopt its partner’s Banno digital banking platform as part of an effort to “automate and streamline operations and optimise its existing offerings”.

The Decentralised Finance domain had headlines swarming in from the Middle East, where tokenisation and regulation pave the way for the future.

Liv, UAE’s digital bank launched by Emirates NBD, signed a Memorandum of Understanding (MoU) with Ctrl Alt, a B2B alternative asset solutions provider, to explore infrastructure solutions related to the tokenisation of real-world assets.

QCP, a global institutional digital assets company, received In-Principle Approval (IPA) from the Financial Services Regulatory Authority (FSRA) of Abu Dhabi Global Market (ADGM) to conduct regulated activities.

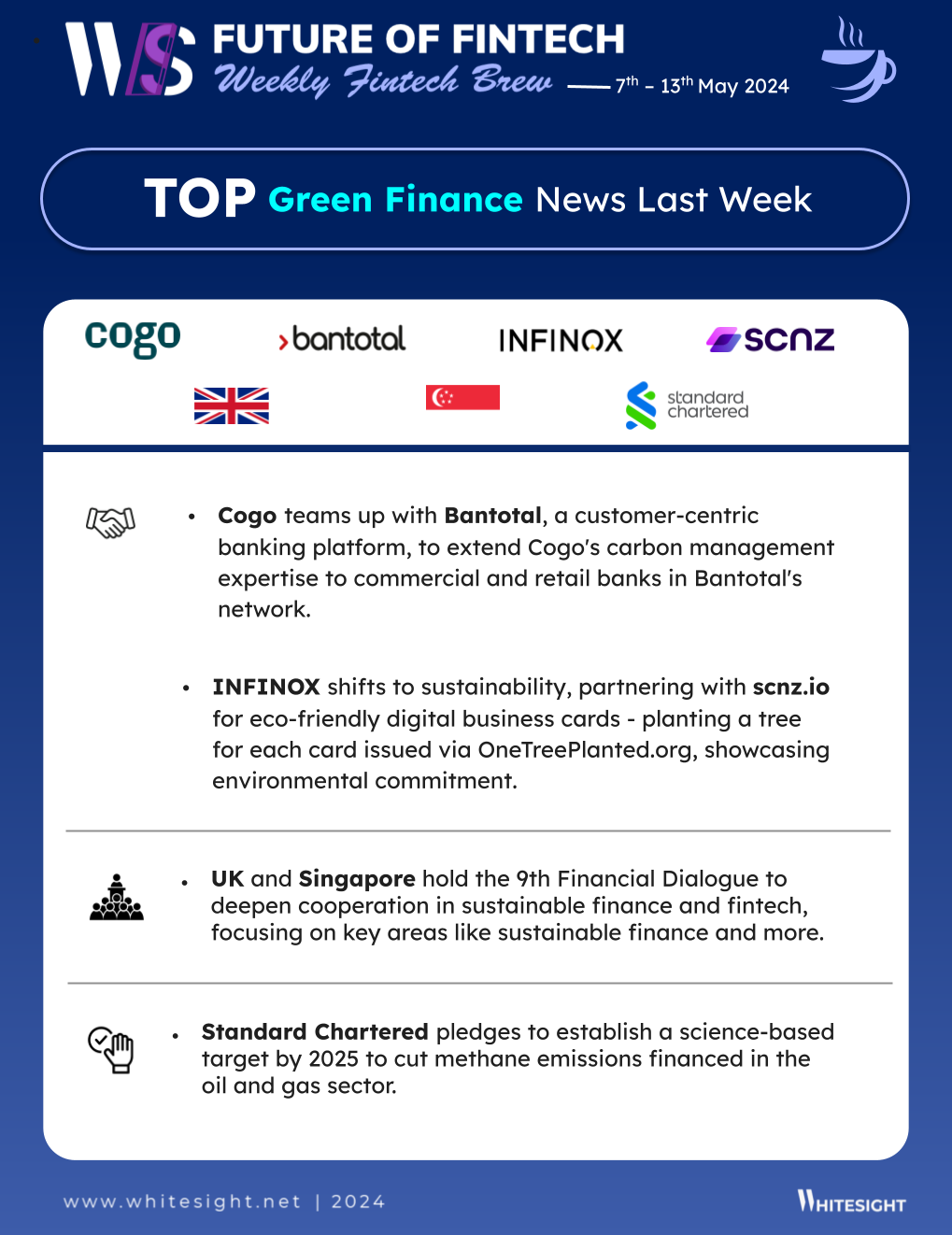

The Green Finance pastures were blooming with partnerships taking root, fostering global unity for a sustainable future.

Sustainability fintech Cogo partnered with Bantotal, the customer-centric banking platform. This partnership aims to bring Cogo's carbon management skills to both commercial and retail banks within Bantotal's network.

The United Kingdom and Singapore convened for the 9th UK-Singapore Financial Dialogue to deepen their cooperation in sustainable finance and fintech. The dialogue focused on various pivotal areas, including sustainable finance, fintech innovation, non-bank financial intermediation, and cross-border payment connectivity.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it all the way here, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

The Rapid Evolution of Payments in Latin America Report - Mckinsey

A Fourth Wave of Open Data? Exploring the Spectrum of Scenarios for Open Data and Generative AI Report - The GovLab X Open Data Policy Lab

Credit Unions Can Win Big With Small Business Banking Blog - Jack Henry

2023 Roundup: Open Banking as the Jackpot for Modern Gambling Blog - WhiteSight

OakNorth’s Challenger Bank Playbook Report - WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

Fintech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️