The "API-phany": More Banks See the Light of Open Banking

Future of Fintech - Edition #117 (30th Apr-6th May)

Come dive with us into the Fintechaverse's hottest trends – because the future of finance is getting built, and you're invited to see the blueprints! ♨️

This week: Regulators are handing out licences like Oprah with cars, banks are seen getting hitched with fintechs, and credit is getting a makeover. Hop in and see what game-changing innovations are on the horizon!

Love sipping on the latest fintech buzz with our newsletter? Pour your support and elevate your sip with a subscription donation! 😊☕

What’s on the fintech menu today?

📖 Today’s Must Read: Visa & Mastercard Soar on Cross-Border Boom

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

Visa & Mastercard Soar on Cross-Border Boom

Visa and Mastercard both reported stellar Q1 results, with a 10% net revenue jump for each giant. The big driver? A surge in cross-border transactions fueled by resurgent travel and booming ecommerce.

Visa's Highlights:

Showcased a remarkable 10% Y-o-Y surge in net revenue, soaring to a substantial $8.8B in Q2 2024.

Payments volume sprang up by 8%, while processed transactions surged by an impressive 11%, totalling a staggering 55.5 billion transactions.

The real standout was the meteoric 16% surge in cross-border volume, a testament to Visa's global footprint.

The Visa Direct platform for instant payments also saw a 31% jump.

Acquired Pismo, a cloud-native banking platform, underscoring its aim to champion emerging payment paradigms and real-time networks.

Mastercard's Momentum:

Mastercard's Q1 2024 voyage mirrors Visa's trajectory, marked by a resounding 10% Y-o-Y revenue escalation (11% on a currency-neutral basis), catapulting to $6.3B.

Global Gross Dollar Volume (GDV) echoed this growth, notching a robust 10% surge to hit $2.3T. While the US witnessed a commendable 6% uptick, the rest of the world stole the spotlight with a commanding 13% ascent.

Particularly noteworthy is the 18% surge in cross-border volume.

Source: FXC Intelligence

While both Visa and Mastercard basked in the glow of impressive quarterly results, nuanced differences emerged. Visa's unwavering focus on cross-border transactions and strategic acquisitions positioned it for sustained growth, eliciting bullish sentiments from investors. Conversely, despite surpassing analyst expectations, Mastercard opted for caution by revising its FY 2024 projections downward, attributing the adjustment to a slightly tempered outlook and a recent volume slowdown in April.

Notably, both giants grapple with underperformance in certain regions, particularly in Europe and Asia Pacific, indicative of the nuanced dynamics shaping the global payments landscape.

See further in Fintech with WhiteSight Radar. 🔮

Steer your course with exclusive insights and actionable intelligence on the hottest fintech themes, including Embedded Finance, Digital Banking, Open Banking, SME Lending, BaaS… and more!

WhiteSight Radar delivers actionable intelligence through in-depth reports, industry trends, and expert analysis. Become a member and stay ahead of the curve with:

✅ Emerging themes: Discover the next big fintech disruptions.

✅ Strategy Teardowns: Unpack the latest fintech strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast. PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!

✅ Industry initiatives: Stay informed on key market movements.

✅ Exclusive content & analyses: Bespoke research requests and briefing calls with our in-house experts… all just a click away!

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🚀

Edition #117 is now ready to serve - decoding the next chapter, byte-sized and brimming with infinite financial possibilities.

The Week's Hot 10! ♨️🔟

Global markets ignite with advancements:

⤷ Marqeta and Uber Eats announced the expansion of their US partnership into eight additional markets: Canada, Australia, Mexico, Brazil, Colombia, Peru, Chile and Costa Rica. Uber Eats will leverage Marqeta’s global scale to allow it to easily launch card programs in new markets and to continue to provide its couriers with the latest digital payments tools to help them earn more.

⤷ Hong Kong launched six spot bitcoin and ether exchange-traded funds — becoming the first in Asia to offer retail investors the ability to trade the cryptocurrencies at spot prices.

A week of API advancements :

⤷ Qatar National Bank launched Qatar’s first Open Banking API services for corporates, enabling direct interaction with a wide array of services.

⤷ The Bank of London unveils GenAI assistant for seamless enterprise API integration, addressing real-time challenges.

⤷ The Central Bank of Argentina launched Main Variables API, the first in a series - offering efficient access to institution-produced information via cutting-edge tech.

Regulators revved up:

⤷ The Central Bank of Egypt granted Misr Digital Innovation preliminary approval to launch digital bank "onebank".

⤷ Outpayce, the travel payments business of Spanish IT group Amadeus, obtained an EMI licence from the Bank of Spain and can now offer regulated payment services.

Firms flourish, fulfilling their objectives:

⤷ UK financial platform Tide partnered with European fintech Adyen to offer small and medium-sized enterprises (SMEs) cost-effective and efficient Tide accounts.

Tokenisation vendor Securitize completed a $47M funding round led by BlackRock. The funds will fuel product development, expand global presence, and bolster partnerships in the financial services ecosystem.

⤷ UK's Delta Capita acquired the London Stock Exchange Group’s Client On-Boarding solution, enhancing its Karbon suite with a comprehensive KYC client lifecycle management solution.

Now, for the ‘byte’-sized fintech buzz –

In the booming universe of Embedded Finance, the UK emerges as a dynamo of fintech innovation and regulatory evolution.

Embedded Insurer Wakam received approval as a licensed and regulated insurer by the Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA) to support the launch of its new UK subsidiary, Wakam UK Limited.

UK-based tile specialist Topps Tiles selected GoCardless to power the payments behind Trade Pay, its newly launched trade credit scheme, which gives traders the ability to regularly pay on credit in Topps Tiles stores.

In the vibrant realm of Open Finance, dynamic partnerships between fintech disruptors and industry veterans fuel the creation and uptake of novel financial solutions globally.

Qvik, a developer of digital consumer products, and Neonomics signed a strategic partnership to jointly scale open banking services across the Nordics and the UK. Throughout this partnership, Qvik will leverage Neonomics’ services and expertise to provide its clients with efficient, secure, and user-friendly account-to-account (A2A) payments and data products.

Mastercard joined forces with Riyadh-based open banking fintech SingleView to extend enhanced corporate and commercial solutions throughout the region, leveraging SingleView technology. The collaborative agreement aims to empower enterprises in the Kingdom with secure access to advanced data capabilities.

Last week, the Digital Finance domain was ablaze with a resounding goal: boosting financial inclusion in our thriving digital universe!

Bengaluru-based neobank Fi secured a non-banking financial company (NBFC) licence from the Reserve Bank of India (RBI). An NBFC licence will allow Fi to offer loans to customers from its books, eliminating external dependencies.

Nottingham Building Society partnered with California-based credit infrastructure and analytics firm Nova Credit to enable foreign nationals in the UK to access and utilise their overseas credit history when applying for mortgages.

Zopa Bank surpassed £4B in customer deposits just under four years after getting its banking licence. The gains for the bank are in part due to Zopa’s Smart Individual Savings Accounts (ISA) that brought in £1B in under a year.

In the bustling landscape of Fintech Infrastructure, a focus on user experience and data-driven decision-making is taking centre stage.

US-based credit management platform Nuvo partnered with Equifax to enhance credit management for B2B sellers, using data-driven insights for faster, informed decisions. Nuvo will utilise Equifax's commercial and business data in its credit application software, streamlining customer onboarding, underwriting, and credit approval for trade credit extension.

Finastra selected OpenFin to redefine the user experience of Finastra Kondor, a leading bank treasury management system. With OpenFin's technology, Finastra will strengthen Kondor's visual real estate with enhanced workspaces and workflows to drive greater efficiencies and streamline the decision-making process for banks.

In the whirlwind world of Decentralised Finance, global institutions pave the way for mainstream adoption through strategic expansions and regulatory compliance.

Hong Kong virtual lender ZA Bank announced plans to roll out services related to virtual assets. The bank’s planned expansion into the digital asset sector comes as Hong Kong’s mandatory licensing regime for centralised cryptocurrency exchanges takes effect from June 1.

Crypto Banking Firm BCB Group was authorised by France’s financial regulators, the Financial Authority (Autorité des Marchés Financiers, AMF) and the Prudential Authority (Autorité de Contrôle Prudentiel et de Résolution, ACPR) to act as an Electronic Money Institution (EMI) and Digital Assets Services Provider (DASP).

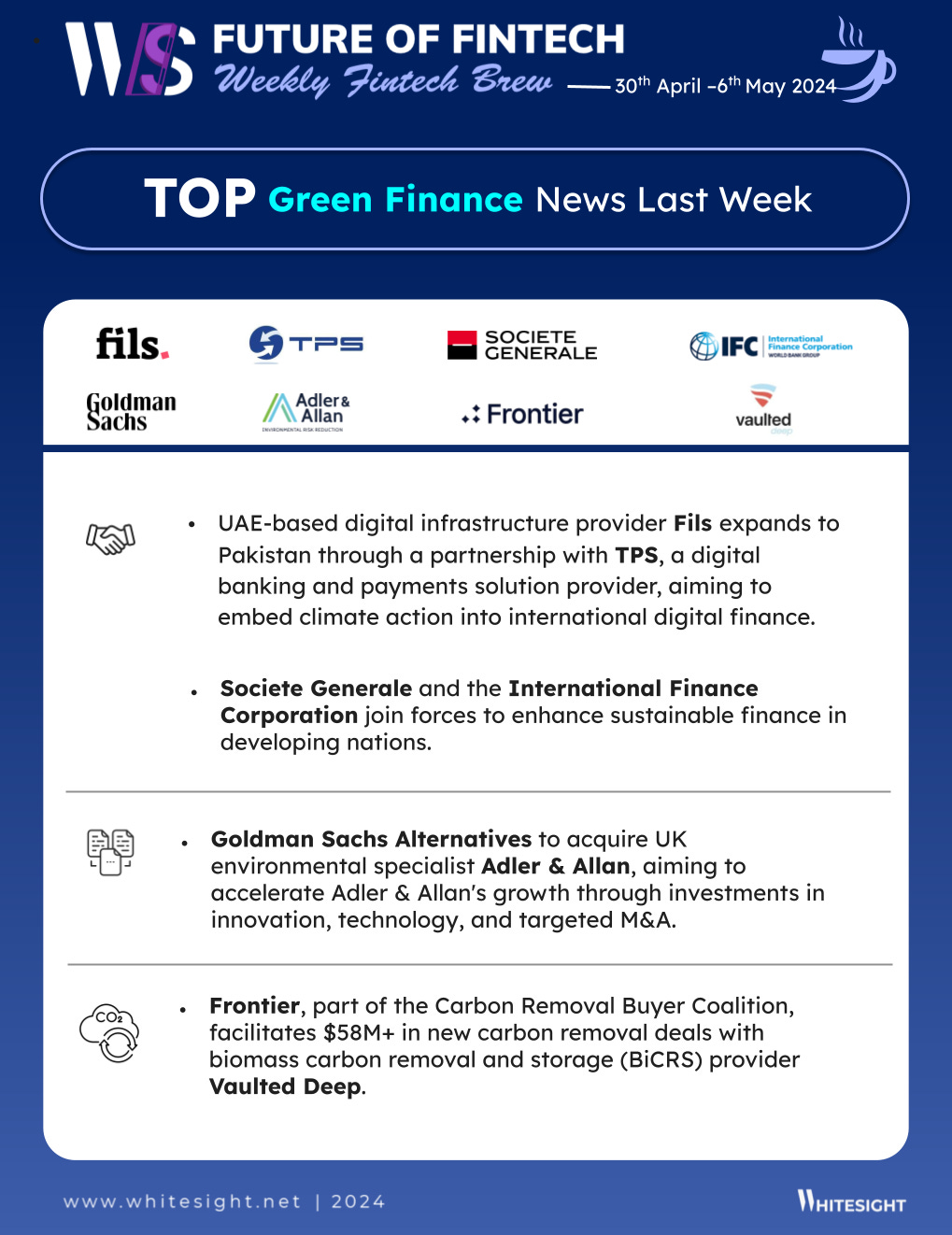

The lush landscape of Green Finance saw a trend that signifies a growing recognition of the need for global cooperation in achieving environmental sustainability.

Fils, the UAE-based enterprise-grade digital infrastructure provider, expanded its offerings to Pakistan with a strategic partnership with TPS, a leading digital banking and payments solution provider. The collaboration aims to make a lasting impact on the international stage, embedding climate action at the core of digital financial services.

Societe Generale and the International Finance Corporation signed a Collaboration Framework Agreement to bolster sustainable finance in developing countries. the deal will tend to sustainable finance projects that boost access to clean energy and water, support sustainable agribusiness, and empower women in small and medium-sized enterprises (SMEs).

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it all the way here, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

The 12 Impact Statements Report - PYMNTS Intelligence X Ingo Payments

Tokenization: Realizing the vision of a future financial ecosystem Report - Deloitte

Web3 and payments: What does the future hold? Blog - Paysafe

Why Now is the Time to Add A2A Payments (Pay by Bank) to Your Checkout Blog - Brite

2023 Roundup: Open banking flips the traditional lending game Blog - WhiteSight

Open Innovation in the Financial Services Sector Report - NayaOne X WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

Fintech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️