BigTechs Go Big on Payments

Future of Fintech - Edition #110 (12th-18th Mar)

Fintech Tea Alert!

Ready to sip the hottest Fintech tea? We’ve got the scoop on how: charting uncharted territories is the norm now; how the bank-fintech tech affair is heating up, and how Europe takes the spotlight @ Fintechaverse! 🫖

Love sipping on the latest fintech buzz with our newsletter? Help keep the brew flowing by pledging your support through a premium subscription! It's like adding an extra shot to your favourite latte – makes the experience even more flavourful and satisfying! 😊☕

What’s on the fintech menu today?

📖 Today’s Must Read: Stripe - $1 Trillion Strong and Powering the Internet Economy

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

Stripe - $1 Trillion Strong and Powering the Internet Economy

In its recently released annual letter of 2023, global payment processing platform Stripe highlights its remarkable achievements and provides insights into its future vision. The letter emphasises Stripe's mission to grow the GDP of the internet by providing better economic infrastructure to companies and entrepreneurs worldwide. With businesses running on Stripe surpassing $1T in total payment volume, accounting for approximately 1% of global GDP, the platform's impact on the digital economy is undeniable.

Stripe's commitment to optimising the online payment experience is evident in its checkout suite, which includes over 100 conversion-focused optimisations. By leveraging economies of scale, Stripe continuously improves its pre-built payment surfaces and UI components, resulting in measurable gains for businesses. Furthermore, Stripe's support for new payment methods, such as Swish and Block's Cash App Pay, allows companies to cater to diverse consumer preferences, tapping into younger audiences.

The letter also highlights Stripe's Revenue and Finance Automation (RFA) suite, which helps businesses streamline their financial operations, including pricing management, usage-based billing, prorating, failed payment handling, and international billing complexity. The comprehensive suite enables companies to overcome billing system challenges, facilitating growth and global expansion.

To gain in-depth analyses, market research, and thought leadership to help you make informed decisions and capitalise on the transformative trends that are fueling Stripe’s growth, check out our “Stripe’s Economic Infrastructure Playbook” report. Through this comprehensive 50-page analysis, examine Stripe's investment strategies and their advancements in automated learning and predictive technology, helping you gain valuable insights into the future of fintech.

See further in Fintech with WhiteSight Radar. 🔮

Steer your course with exclusive insights and actionable intelligence on the hottest fintech themes, including Embedded Finance, Digital Banking, Open Banking, SME Lending, BaaS… and more!

WhiteSight Radar delivers actionable intelligence through in-depth reports, industry trends, and expert analysis. Become a member and stay ahead of the curve with:

✅ Emerging themes: Discover the next big fintech disruptions.

✅ Strategy Teardowns: Unpack the latest fintech strategies of leading companies like Apple, Stripe, Starling Bank, Amazon, Grab, Wise, Shopify, and more through our premium content pipeline.

✅ Industry initiatives: Stay informed on key market movements.

✅ Exclusive content & analyses: Bespoke research requests and briefing calls with our in-house experts… all just a click away!

Supercharge your Fintech IQ with WhiteSight Radar. Keep your eyes peeled… we’re launching VERY soon, putting expert fintech intel at your fingertips! 🚀

Big players’ payments innovations, DeFi tests, open banking, global expansion, and even insurance - Edition #110 has it all! 👇

The Week's Hot 10! ♨️🔟

Payment networks focus on payment enhancement: Visa teamed with SAP-owned Taulia for a streamlined payment experience. The partnership will enable SAP business applications to work natively with virtual payment credentials. Meanwhile, Mastercard and CinemaPlus, an Azerbaijan premium-class cinema chain, teamed up for the latter to be rebranded as “CineMastercard,” combining cinematic experiences with unparalleled payment innovations.

DeFi takes flight! Tests go mainstream: Bluechip financial blockchain provider Digital Asset completed a test of its so-called Canton Network, with the participation of financial heavyweights like Goldman Sachs, and BNY Mellon. At the same time, cryptocurrency wallet MetaMask tested an entirely on-chain payment card running on Mastercard's giant network and issued by Baanx.

Exploring novel fintech frontiers: Citi Ventures invested in core banking provider Tuum as part of its Series B extension round. This comes with a pledge to introduce Tuum to key stakeholders within the bank to gauge interest in commercialisation opportunities. On the other hand, Klarna introduced open banking settlements in the UK for its Pay Now instant programme option, allowing consumers to pay Klarna directly from their bank accounts.

Fintech players spread their wings! German neobank N26 extended its Instant Savings Accounts to 13 European Countries. This move allows customers in Austria, Belgium, Estonia, Finland, Greece, Ireland, Latvia, Lithuania, Luxembourg, the Netherlands, Portugal, Slovakia, and Slovenia to earn up to 4% interest annually on their savings. Meanwhile, VoPay partnered with Cross River Bank for an expansion of VoPay's operations in the United States, facilitating access to an extensive range of financial solutions and enhancing its market presence.

New roles in evolving markets: Insurance regulator SUSEP accredited CA2C Corretora de Seguros SA as a Customer Order Processing Company (SPOC) within the scope of Open Insurance (OPIN). Alternatively, US banking platform Oxygen “temporarily suspended” its banking services as it looks to redirect its focus towards health-focused solutions via Oxygen Health.

Now, for the ‘byte’-sized fintech buzz –

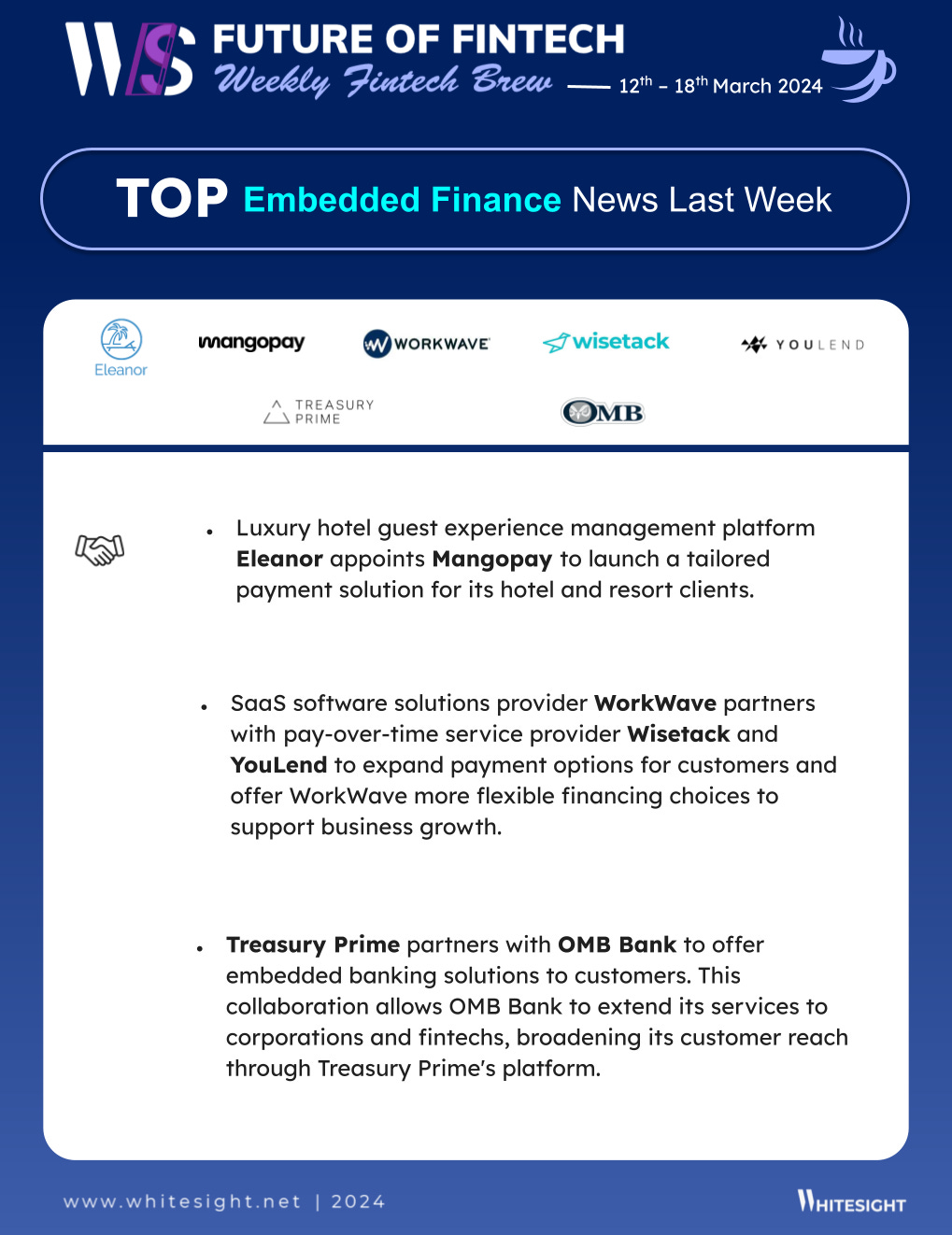

The world of Embedded Finance had quite the collaborative ventures grabbing attention last week! Fintechs were seen joining forces to offer broader payment options & banking solutions:

SaaS software solutions provider WorkWave partnered with pay-over-time service provider Wisetack and embedded financing platform YouLend. The partnerships will complement the already comprehensive financial services offered by WorkWave, giving their customers the ability to offer even more flexible payment options to end customers.

Treasury Prime partnered with OMB Bank to offer embedded banking solutions to customers. By partnering with Treasury Prime, OMB Bank will be able to work with corporations and fintechs to expand their services, connecting with more customers.

The Open Finance realm is on the rise, where new solutions are leveraging secure data access to empower consumers and drive innovation.

Open banking provider Tell. Money announced its support for Griffin’s launch as a fully operational UK Bank by providing essential compliance and open banking capabilities, driving innovation and growth in the dynamic fintech landscape. Tell. money will ensure that Griffin adheres to the PSD2 legislation, which mandates secure and standardised easy-to-integrate access to financial data for third-party providers.

Mastercard unveiled Smart Subscriptions, an open banking-powered subscription management solution. Smart Subscriptions delivers individual spend analysis, expenditure categorisation, and personalised offers - all in a single user-friendly experience.

Synctera integrated with Plaid's Core Exchange, enabling seamless financial connectivity for its customers' end-user account holders. This integration enables the secure and seamless linking of accounts and efficient fund transfers, creating a more interconnected and user-centric experience.

Last week's Digital Finance news brought a taste of international expansion and tools designed to empower both businesses and consumers to manage their finances better.

UK fintech Unlimit secured authorisation as a payments service provider (PSP) by the Bank of Tanzania (BOT), with plans to introduce “new offerings such as business payments, merchant services and outbound payments” to the Tanzanian market.

Lloyds Bank teamed up with fintech startup ApTap to offer a bill management tool for Halifax and Lloyds Bank mortgage customers. The tool will be accessible through the Lloyds Bank and Halifax mobile banking apps, providing insights into the costs of broadband, energy, and mobile phone contracts, and allowing users to switch providers for cheaper plans.

The Fintech Infrastructure realm is building the backbone for a smarter financial future with partnerships and solutions that are powering instant payment adoption and improving data management!

Philippines' Metrobank partnered with Swiss banking solutions vendor Temenos to implement its private wealth management offering. The company will implement the Temenos Wealth solution to enhance its private wealth unit, which currently offers investment advisory, wealth planning, trust and fiduciary services, among others, to high and ultra-high-net-worth clients and their families.

TransUnion introduced OneTru™, its solution enablement platform for managing, governing, analysing, and delivering data and insights. The OneTru platform connects separate data and analytic assets built for credit risk, marketing and fraud prevention and concentrates them in a single, layered and unified environment that sits at the core of the business.

DeFi headlines were simmering with both regulatory progress and innovative solutions, as the industry continues to mature.

Cryptocurrency exchange Binance spun off its venture capital arm, Binance Labs. Binance Labs will operate as an independent entity. Despite this new arrangement, Binance Labs will continue to license the Binance brand, ensuring its connection to the renowned cryptocurrency exchange.

The Dubai International Financial Centre (DIFC) passed a new digital assets law and security law and amendments to existing law, in an effort to remove any lingering uncertainty investors and users may have in embracing the revolutionary digital assets technology.

The Green Finance segment goes global with initiatives that are making sustainability more accessible for businesses and consumers worldwide; making sustainability a win-win for all.

The Commonwealth Bank of Australia (CBA) launched a loan product called Business Green Loan to support Australian businesses to finance assets and initiatives that can reduce emissions, build climate change resilience, and protect natural resources.

Development bank Sidbi secured $120M for its Avaana Sustainability Fund Project. The principal objective of the ASF initiative is to provide capital to early-stage companies that are leveraging technology-driven innovation to promote climate solutions and sustainability in India.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it all the way here, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Banking Transformed White Paper: The Power of Primacy Report - Pinwheel

Understanding card issuing platforms: A buyer’s guide for building an RFP Report - Marqeta

Boosting Customer Experience and Sales with Omnichannel Payment Strategies Blog - Brankas

2023 Roundup: Navigating the Rise of In-Car Payments Blog - WhiteSight

2023 Roundup: SoftPOS Takes the Stage for a Swipe-Free Serenade Blog - WhiteSight

Toast Teardown: Vertical SaaS meets Embedded Finance Report - WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

Fintech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️