'Uber'charged Earnings: Uber's Pro Card Play

Future of Fintech - Edition #109 (5th-11th Mar)

Feeling Fintech FOMO? ☕

Watch as banks & tech platforms kick off an epic embedded bromance, and the collab craze hits an all-time high! Unlock the secrets of cutting-edge fintech & see what's brewing!

Love sipping on the latest fintech buzz with our newsletter? Help keep the brew flowing by pledging your support through a premium subscription! It's like adding an extra shot to your favourite latte – makes the experience even more flavourful and satisfying! 😊☕

What’s on the fintech menu today?

📖 Today’s Must Read: Top 20 Milestones in Open Banking

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

Innovate to Elevate: 2023's Open Banking Milestone Countdown

2023 has been a revolutionary year in Open Banking, unveiling unprecedented partnerships, technological breakthroughs, and regulatory triumphs!

WhiteSight takes you on a journey exploring the 20 most significant milestones in Open Banking's 2023 saga.

Prepare to be surprised as we delve into groundbreaking advancements - from frictionless lending that empowers you to access funds in a snap, to supercharged personal finance management tools that put you in control. Witness how Open Banking is:

Empowering fintech startups to challenge the status quo and deliver innovative solutions.

Fueling a wave of creativity in areas like account verification and data analysis.

Transforming the customer experience with finances through seamless data sharing and hyper-personalized offerings tailored to your unique needs.

From tech giants like Apple to established players like J.P. Morgan and Mastercard, alongside regulatory bodies like the CFPB, key industry figures are shaping a more secure, efficient, and empowered financial future.

Discover the many trends shaping this revolution in the 2023 Roundup: Top 20 Milestones in Open Banking and what it means for the future of finance!

See further in Fintech with WhiteSight Radar. 🔮

Steer your course with exclusive insights and actionable intelligence on the hottest fintech themes, including Embedded Finance, Digital Banking, Open Banking, SME Lending, BaaS… and more!

WhiteSight Radar delivers actionable intelligence through in-depth reports, industry trends, and expert analysis. Become a member and stay ahead of the curve with:

✅ Emerging themes: Discover the next big Fintech disruptions.

✅ Innovative models: Unpack the latest business strategies.

✅ Industry initiatives: Stay informed on key market movements.

✅ Exclusive content & analyses: Deep dives delivered straight to you.

Supercharge your Fintech IQ with WhiteSight Radar.

Get ready to dive into the latest fintech marvels in Edition #109 - your weekly ticket to the cutting-edge of finance!

The Week's Hot 10! ♨️🔟

Fintech Takes Center Stage Globally: Uber partnered with Mastercard and Payfare to launch the new Uber Pro Card in Canada. The card offers instant payouts after each trip or delivery, along with enhanced loyalty perks. On the other hand, Vietnam-based digital services provider SAVIS partnered with Konsentus, an open banking advisory service provider, to lay the groundwork for open banking in Vietnam.

MetaMask Dominates the DeFi Headlines: Revolut teamed up with MetaMask for seamless crypto purchases in Europe. The new service’s name, “Revolut Ramp,” is meant to make it easier for UK and EEA people to buy digital commodities. Not just that, but Metamask also expanded its services to Latin America, integrating local payment methods and boosting financial empowerment in the region.

Fintech Firms Fill Their Financial Vaults: Digital bank Monzo raised $430M in new funding, reaching a post-money valuation of $5B (£4B). The fresh capital will accelerate its business growth, product development, and expansion plans. At the same time, US neobank Dave achieved profitability with Q4 GAAP Net Income of $0.2M and Q4 Adjusted EBITDA of $10M.

Financial Processes Get a Streamlined Sprint: ChargeAfter unveiled The Lending Hub, transforming banks' lending solutions for merchants and their customers. Also, Deutsche Bahn and Tink partnered to offer customers optimised direct debit setups - enabling instant, easy, and secure account onboarding.

Enhancing Security and Convenience: MinkasuPay, a biometric authentication solution, was granted a patent in India for its biometric 2-factor Authentication (2FA) technology, providing an immediate big leap in payment security. Qatar Central Bank launched its instant payment service called Fawran, which will enable users to send and receive funds instantly while offering round-the-clock availability.

Now, for the ‘byte’-sized fintech buzz –

The ever-evolving world of Embedded Finance continues to see exciting developments. Last week brought developments on the industry's payments front:

Multinational payments provider OKTO’s strategic portfolio business U4C received approval to process payments for the Paraiba Lottery in Brazil. The move underscores the international payment services provider’s readiness to adapt to changes in local betting legislation, expanding its influence in the Brazilian market and strengthening its position in various industries.

Neonomics and Bislab, a data enrichment innovator, joined forces to create and release a suite of embedded finance solutions. The two partners have previously developed stand-alone products within embedded finance and will now merge their offerings, strengthening the accuracy and agility of their next-generation joint product.

The week's Open Finance headlines highlight a continued push for smoother user experiences and increased efficiency.

Fintech infrastructure company Prometeo launched its “account-to-account payments” product to the Mexican market. This technological solution allows for real-time payments directly to a bank account, eliminating intermediaries and using a single API.

Tarabut teamed up with Bahrain-based, BENEFIT to introduce a new consent authentication method to streamline Bahrain's Open Banking ecosystem. The partnership will enhance customer experience by eliminating the scattered customer journeys typified by the need to switch between notifications and bank apps.

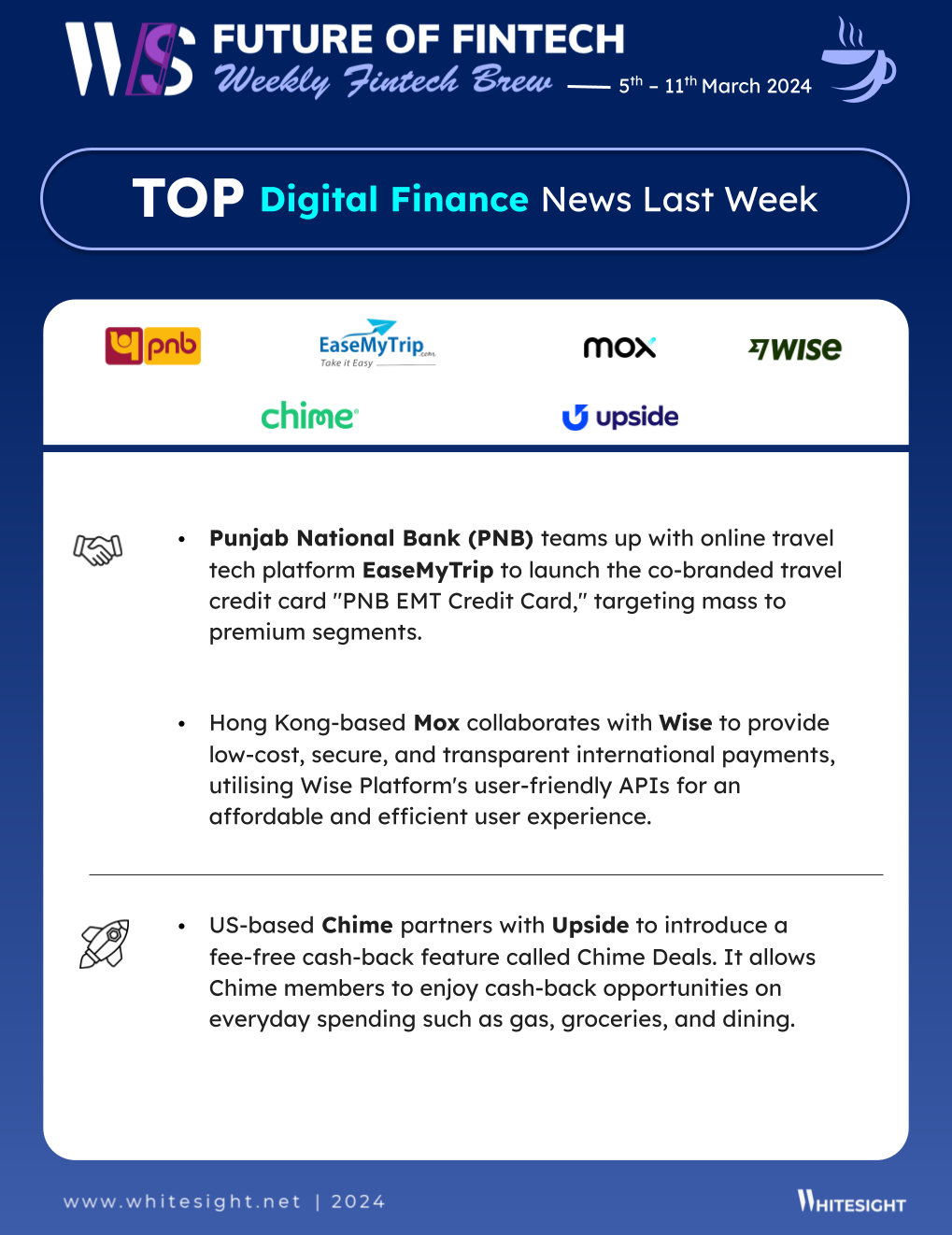

The Digital Finance realm witnessed players teaming up to empower users with groundbreaking tools 一 from streamlining to safeguarding.

Egypt-based Alexbank partnered with payments giant Mastercard to enhance its payment solutions strategy. Additionally, through this partnership, ALEXBANK will leverage Mastercard’s advanced fraud detection tools and cybersecurity solutions, reinforcing payment safety to the bank’s clients.

American Express and American Express Global Business Travel (AmEx GBT) joined forces to issue virtual cards, designed for small and mid-sized businesses, that aim to refine the expense management process. This change lets businesses control their spending in a more automated and cohesive way, which is helpful for smaller enterprises that have fewer resources.

The Fintech Infrastructure arena was bustling with a powerful combo of growth and empowerment for businesses.

Grasshopper partnered with white-label embedded financial solution Pocketbook and Treasury Prime for the development of the small business community through the use of Embedded Banking. By selecting Grasshopper, Pocketbook is expected to provide its customers and clients with secure and white-labeled FDIC-insured commercial checking accounts.

BaaS platform Griffin secured $24M in funding and obtained a full banking licence from the UK’s Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA) to lift restrictions, allowing Griffin to exit mobilisation and launch as a fully operational bank. Further, the fresh funding will be used to scale the bank and enhance infrastructure for new and existing customers.

The DeFi space observed major strides towards legitimacy and institutional adoption last week, paving the way for wider participation from established financial players.

Digital asset custody and wallet infrastructure provider Liminal launched an Institutional Custody Offering. This move comes in response to the increasing demand from institutional investors for secure and compliant digital asset solutions.

Deutsche Börse went live with a regulated spot platform for institutional trading in crypto assets. Trading on the Deutsche Börse Digital Exchange (DBDX) will take place on a Request for Quote basis, followed by multilateral trading.

Various moves in the Green Finance segment took the spotlight the past week with developments on both the regulatory and investment fronts, accelerating the path towards a more sustainable future.

The Securities and Exchange Commission adopted rules to enhance and standardise climate-related disclosures by public companies and in public offerings. The final rules reflect the Commission’s efforts to respond to investors’ demand for more consistent, comparable, and reliable information about the financial effects of climate-related risks on a registrant’s operations and how it manages those risks while balancing concerns about mitigating the associated costs of the rules.

Electric vehicle financing platform Mufin Green Finance raised $5M in a debt funding round led by BlueOrchard. The funds will be utilised to propel its initiatives in the green and energy space, driving innovation, and facilitating sustainable development.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it all the way here, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Open Banking APIs Worldwide Report - NDGIT

Rise of Digital Money Report -IMF

Smart moves with smart meters: how commercial VRP could support pay-as-you-use billing models Blog - Tink

The big picture of embedded finance and how it’s taking shape in Canada Blog - WhiteSight

2023 Roundup: From Vision to Victory in the Race of Profitability Blog - WhiteSight

Apple’s Embedded Finance Playbook Report - WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

Fintech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️