Klarna Plus: Will Subscription Services be Fintech's Netflix Moment?

Future of Fintech - Edition #103 (23rd-29th Jan)

Fintech Buzz Incoming! ☕

Brace yourself for a turbocharged Tuesday as we inject your Tuesday with a potent blend of fintech marvels. Immerse yourself in our fresh cuppa of fintech headlines, brewing excitement across the tech landscapes of Europe and the US, where financial revolutions are in full swing. Our handpicked highlights will guide you through the pulsating beats of financial innovation, turning this week into a fintech sensation. Get ready to dive into the fintech frenzy – where every headline is a conversation starter, and every trend is a glimpse into the financial landscape of tomorrow. Spoiler alert: This week’s edition is like a double shot of espresso for your curiosity – bold, invigorating, and impossible to resist! ♨️

What’s on the fintech menu today?

📖 Today’s Must Read: 2023 Roundup: Mortgage Makeover with Open Banking

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

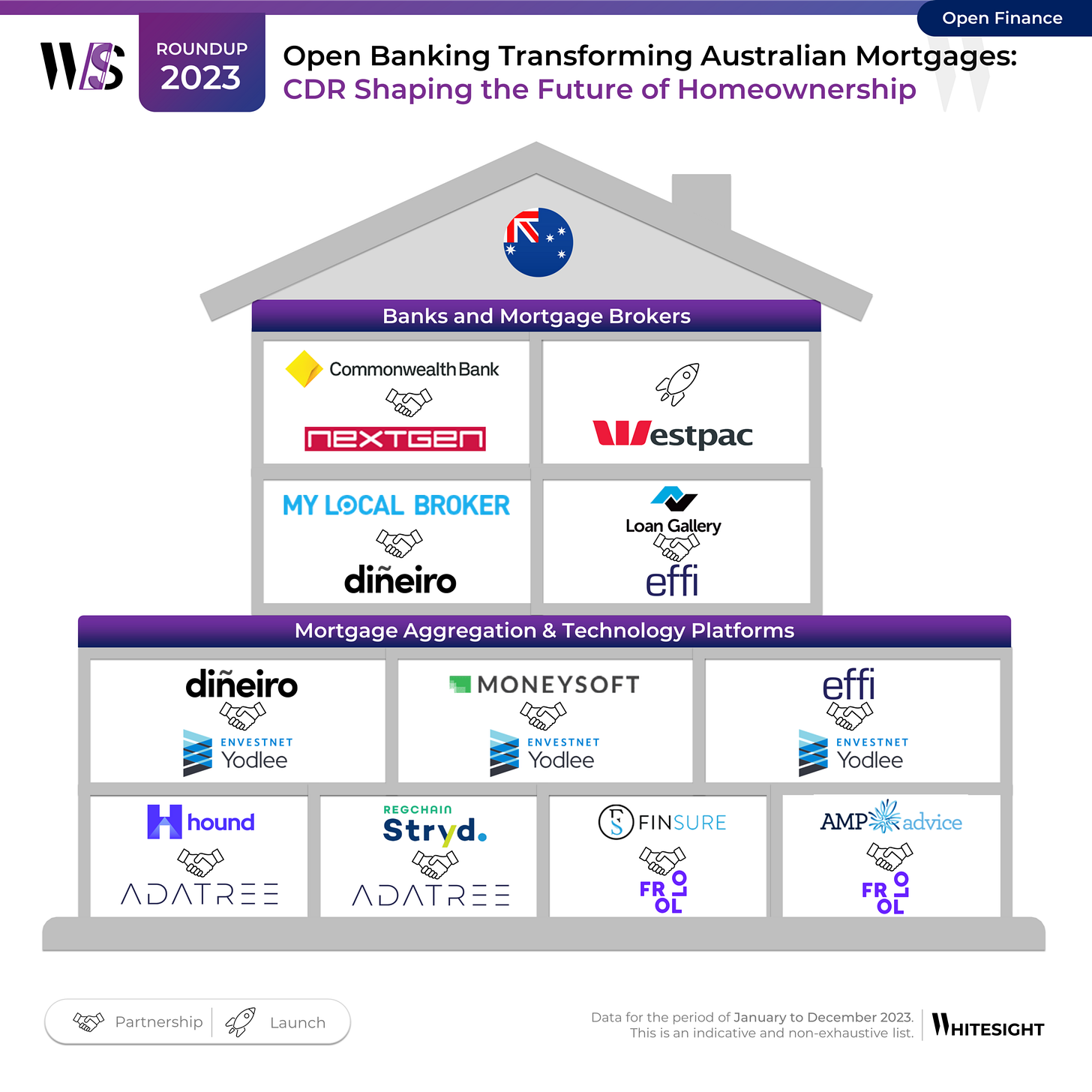

The Open Banking Mortgage Makeover

A seismic shift in Australia's A$2T mortgage industry is in the works, where open banking, aptly named the Consumer Data Right (CDR), is transforming the game. No more drowning in paperwork or enduring endless calls; this is a full-blown makeover redefining how Aussies approach their dream homes.

Major players – Big 4 Banks, non-bank lenders, and even your neighbourhood broker – are steering the open banking bandwagon, not just as passengers, but as drivers of a monumental shift. CDR is the catalyst, revolutionising supply-side trends with digital mortgage platforms, efficiency in service, tailored financial products, and enhanced risk assessment. On the demand side, prospective buyers and homeowners revel in sharing data with trusted advisors, unlocking richer eligibility criteria, and enjoying newfound transparency and security.

Curious? Click through to our blog to explore how CDR is turning the mortgage game upside down, offering faster processes, personalised deals, and a more inclusive system. The journey to your dream home just got a turbo boost! 👇

Grab your virtual coffee mug, because we’re about to pour you a steaming cuppa filled to the brim with the trending fintech scoop in the 103rd Edition!

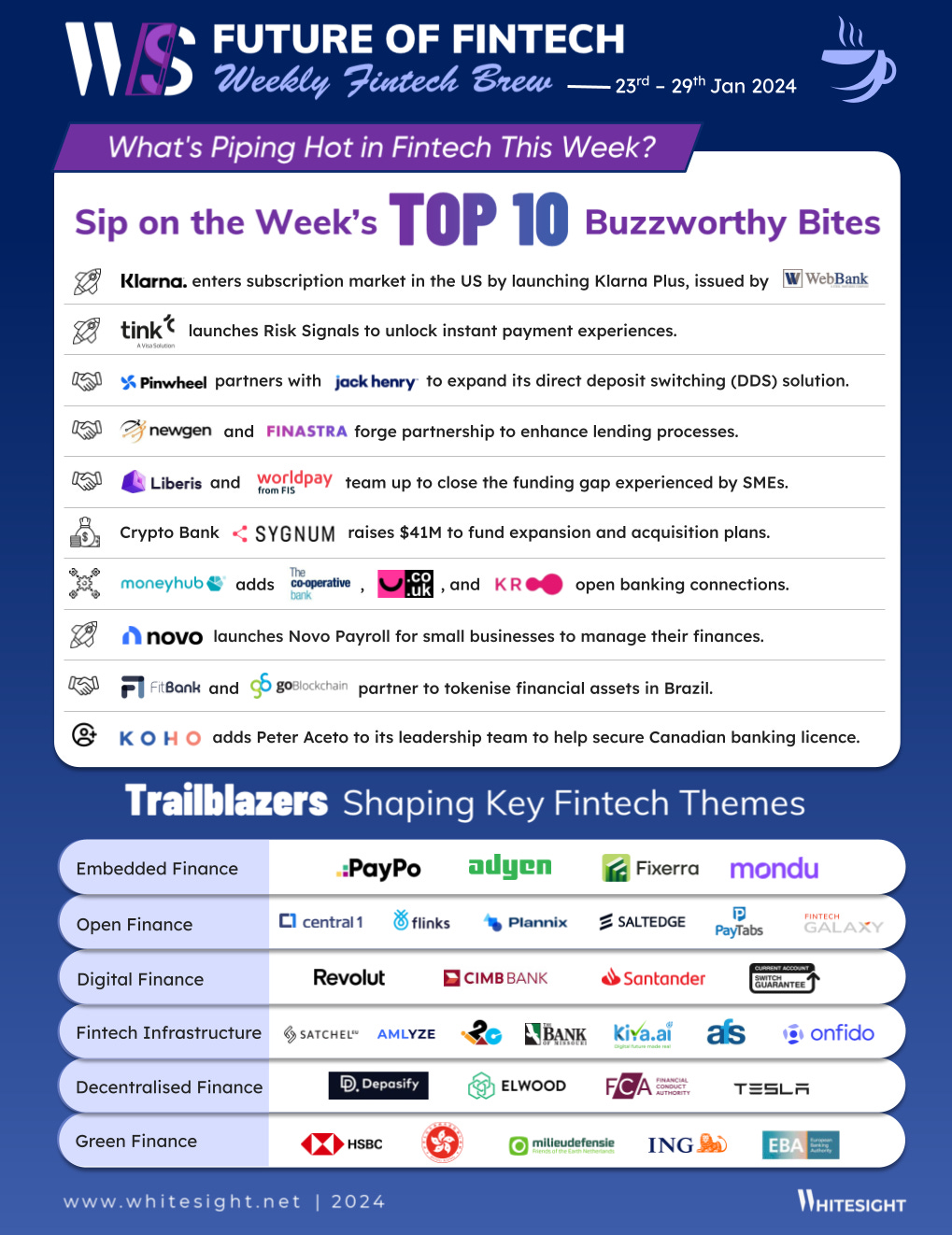

The Week's Hot 10! ♨️🔟

Venturing into new markets, Klarna announced its entry into the subscription service model with the launch of Klarna Plus in the US, issued by WebBank. Simultaneously, FitBank, a Banking as a Service platform, collaborated with goBlockchain to tokenise financial assets in Brazil.

With a specific emphasis on small businesses, embedded finance platform Liberis partnered with Worldpay to address the funding gap faced by SMEs. Additionally, digital banking platform Novo introduced Novo Payroll, enabling small businesses to streamline their finances from a unified platform.

Enhancing the payment and lending journey for users, open banking platform Tink introduced Risk Signals, a rules-based risk engine that optimises payment experiences across Europe while mitigating risks. Furthermore, Newgen Software, a low-code platform provider, collaborated with Finastra to elevate its loan origination solutions and seamlessly integrate lending solutions with Finastra's LaserPro.

Last week's highlight was all about 'expansion', as US-based fintech company Pinwheel joined forces with Jack Henry to broaden its direct deposit switching (DDS) solution. Meanwhile, Crypto Bank Sygnum secured $41M to fuel its expansion and acquisition strategies, aiming to strengthen its footprint in new geographic regions.

In other news, money management app Moneyhub added the Co-op Bank, Smile Bank, and Kroo Bank open banking connections in response to user demands. Meanwhile, Canadian fintech company Koho charted its course towards securing a banking licence in Canada, enlisting Peter Aceto in its leadership team for the upcoming phase.

Now, for the ‘byte’-sized fintech buzz –

Dive into the exhilarating universe of Embedded Finance, where fintech players unleash their full potential with collaborations to elevate the payments game!

PayPo, a Poland-based BNPL service, partnered with global payment platform Adyen to facilitate easy integration of PayPo deferred payments for e-shops working with Adyen. This collaboration aims to enhance the accessibility of deferred payment options for their customers.

Berlin-based B2B payment solutions provider Mondu raised $33M in debt financing. The company aims to expand into new European markets and develop additional payment solutions to meet the evolving needs of our business customers.

Dive into the dynamic domain of Open Finance, where partnerships between power players are becoming pivotal parts of the open phenomenon.

A2A payment infrastructure provider Token.io announced its participation in the SEPA Payment Account Access (SPAA) scheme to support the adoption of A2A payments in Europe. Through participation in the SPAA scheme, Token.io intends to contribute to the expansion of payment functionalities.

TelstraSuper, a profit-to-member superannuation fund, joined several other organisations in adopting open banking to check and validate member bank account details more securely and efficiently. Open banking will allow TelstraSuper members to complete more transactions online backed by a secure framework, removing the need for physical documents and bank visits.

Enter the zestful expanse of Digital Finance, where digital players worldwide are weaving and wielding wondrous milestones.

Santander Mexico announced that it is all set to launch its digital bank – 'Openbank' – this year. Openbank received its licence to operate in Mexico in July and is now in the final stages of preparation for the launch.

The UK's Current Account Switch Service (CASS) marked a significant achievement by facilitating more than 10.3 million account switches since its launch in September 2013. In the fourth quarter of 2023, switching figures increased by 15%, compared to the corresponding period in 2022.

Immerse yourself in a Fintech Infrastructure adventure, where global collaborators craft clever partnerships, creating a cascade of seamless banking services.

European digital bank Satchel partnered with AMLYZE, a Regtech company specialising in anti-money laundering and fraud prevention to enhance digital banking compliance standards. The collaboration with AMLYZE aligns with Satchel’s commitment to offering improved banking services while supporting regulatory compliance and client security.

i2c, a frontrunner in banking and payments solutions, entered into a five-year partnership with The Bank of Missouri (TBOM). The partnership is anchored to empower fintechs in the US to swiftly roll out a comprehensive range of digital banking products and services.

Plunge into the vibrant realm of DeFi, where global players make their mark on the fintech universe through regulatory milestones and noteworthy triumphs.

Tesla's Q4 2023 balance sheet reflected $184M in net digital assets. Despite artificial intelligence advancements in Q3 of the previous year, the electric vehicle innovator remained resolute in holding onto its bitcoin holdings, emphasising its commitment to cryptocurrency assets despite market fluctuations.

Goldman Sachs-backed Elwood, which offers digital asset services to institutional clients, received FCA crypto approval as a service provider. With the approval, the company will be able to provide an end-to-end digital asset platform in a regulated and transparent manner.

Embark on the Green Finance frontier, where industry giants strive to forge a more sustainable financial realm on their journey to meet Net Zero targets.

The European Banking Authority (EBA) launched a public consultation on draft Guidelines on the management of Environmental, Social and Governance (ESG) risks. The draft guidelines set out requirements for institutions for the identification, measurement, management, and monitoring of ESG risks, including thorough plans aimed at addressing the risks arising from the transition towards an EU climate-neutral economy.

HSBC launched its first Net Zero Transition Plan, outlining the global bank’s strategy to finance and support the transition to net zero and to meet the climate goals it has set over the past few years. HSBC's new plan outlines its strategy for realising climate ambitions, emphasising the use of financing and investments to support decarbonisation and sector transitions, and detailing its implementation approach.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it all the way here, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning! 🔗

Link Up! –

2024 banking trends: What does the future hold for the banking industry? - 10x Banking

The PayFac Economy and the Embedded Payments Revolution - PYMNTS Intelligence X Carat from Fiserv

2023 Roundup: Mortgage Makeover with Open Banking - WhiteSight

From Brewing to Boom: Embedded Finance takes-off in Europe - WhiteSight

Starling’s Challenger Bank Playbook - WhiteSight

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

Fintech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️