10 Game-Changing Moves Redefining Finance – From Mastercard Alliances to SEC's Crypto Approval, What's the Buzz?

Future of Fintech - Edition #101 (9th-15th Jan)

Fintech Brew Alert! ☕

Get ready to ignite your Tuesday with a blend of bold fintech brews. Be in the know of the latest fintech headlines that are sure to energise your week, navigating through the tech territories of the US and the Middle East, where revolutions in finance are afoot. Don't merely witness; become a part of the fintech phenomenon. We've crafted a captivating blend just for you, ensuring your fintech fix is nothing short of extraordinary!

Fin-teresting Stories in Fintech 📰

Bank of America's $3.8 Billion Game-Changing Move!

In a bold move, Bank of America's CEO, Brian Moynihan, has unveiled an audacious $3.8B investment plan for technology initiatives in 2024, emphasising a steadfast commitment to innovation and digital transformation. Despite no expected increase in overall spending compared to previous years, the bank aims to sustain its technological edge, attributing its outstanding performance in recent years to these advancements.

Spearheading the digital revolution is Aditya Bhasin, the Chief Technology and Information Officer, leading a global team of over 60,000 employees. Bank of America's 2023 journey has been nothing short of extraordinary, marking a milestone year with record-breaking achievements. The expansion of its digital and physical presence, including the launch of 52 financial centres in growth markets like Omaha, reflects the bank's strategic prowess. In global wealth management, a staggering 40,000 new relationships were forged, and 150,000 banking accounts opened. The digital frontier witnessed a surge, with over 3 billion logins and digital sales constituting 49% of total sales in consumer banking. Merrill, Bank of America Private Bank, and Global Banking all reported impressive digital engagement statistics.

With impressive digital metrics across segments, the bank continues to evolve, managing $5.4T in client balances. CFO Alastair Borthwick highlights the exceptional value and convenience offered to clients, solidifying Bank of America's position as a leader in the ever-evolving fintech landscape.

Dive into the fintech extravaganza as we commemorate the 101st Edition with a surge of innovation and a dash of thrill!

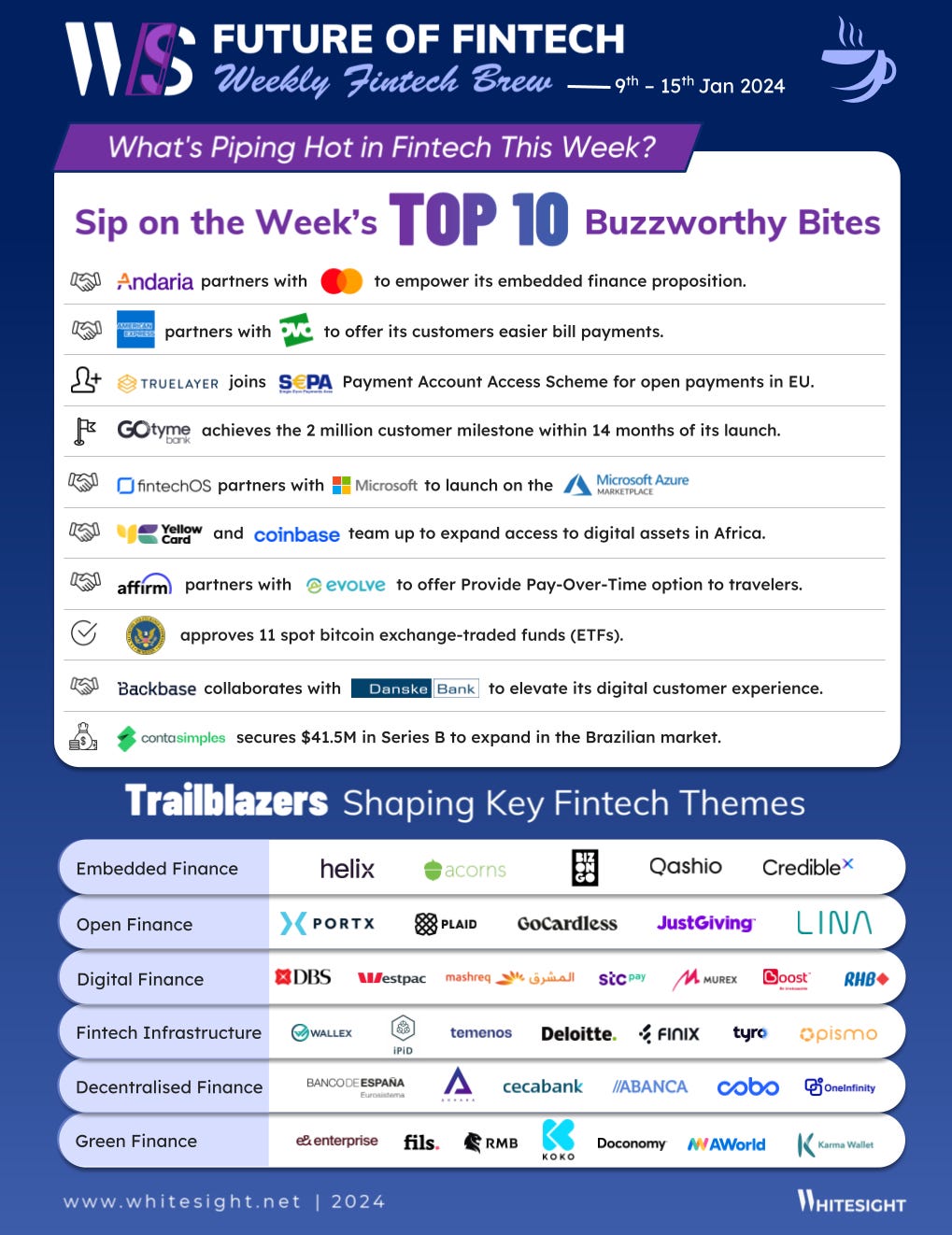

Here's the TL;DR

Partnering to prowess and propel, Andaria partnered with Mastercard to enhance its card and payment offering and empower its embedded finance proposition. Meanwhile, Backbase and Danske Bank forged an agreement to offer its customers a continuously improved digital customer experience.

Striving for excellence in user experience, American Express collaborated with OVO, enabling 4 million customers to breeze through bill payments directly from their bank accounts. Additionally, Affirm joined forces with vacation rental hospitality innovator Evolve, presenting a Pay-Over-Time option to enhance the travel experience for adventurers.

Heavyweights took the spotlight in fintech last week – FintechOS partnered with Microsoft to introduce FintechOS to the Microsoft Azure Marketplace, empowering them to accelerate their digital transformation journey. Meanwhile, Truelayer joined the SEPA Payment Account Access Scheme (SPAA) for open payments in the EU.

Venturing into fresh territories was the strategy at play as Yellow Card and Coinbase collaborated to broaden access to digital assets in Africa. Adding to the momentum, Conta Simples secured a robust $41.5M in a Series B funding round, earmarked for expanding its presence in the Brazilian market.

Staying in sync with the digits: The Securities and Exchange Commission approved 11 spot bitcoin ETFs which means that both retail and institutional investors can now diversify their portfolios with crypto exposure without worrying about the complicated issues of custody. Meanwhile, GoTyme Bank hit the milestone of 2 million customers in just 14 months.

For the longer read, let's get going –

Step into the scintillating sphere of Embedded Finance, where fintech frontrunners fervently forge a fusion of formidable forces to fulfil a myriad of user needs.

Helix by Q2, a cloud-native core purpose-built for embedded finance, expanded its partnership with saving and investing app Acorns with the launch of the Mighty Oak Debit Card. Acorns’ new Mighty Oak Debit Card allows money to grow by turning saving and investing into an everyday habit.

UAE-based Qashio and CredibleX - MENA’s embedded finance platform - launched 'Qashio Financing' to provide flexible and accessible financing to businesses of all sizes. The service delivers quick access to funds, competitive rates, and a streamlined, user-friendly process for Qashio’s SME customers, powered by CredibleX.

Dive into the vibrant domain of Open Finance, where fintech enthusiasts were seen uniting to grasp various optimal opportunities.

Latam-focused fintech Prometeo secured $13M Series A funding from PayPal, Samsung, and more. The company plans to use the funds to expand its region's multi-banking data and payment offerings.

Canadian credit union FirstOntario tapped API developer Flinks and paytech Everlink to power its open banking services ahead of the planned rollout of the country’s open banking framework in 2025. This collaboration empowers credit union members with enhanced financial data control, enabling FirstOntario to offer more personalised financial services.

Take a ride through the dynamic world of Digital Finance, where leading players are making waves in the financial scene through impactful collaborations and strategic strides.

Boost, the fintech arm of Axiata Group Bhd, together with its consortium partner, RHB Banking Group (RHB), received official approval from Malaysia’s central bank - Bank Negara - and the Finance Ministry to commence operations as a digital bank.

DBS and Westpac entered into AI and tech partnerships to bolster their technological capabilities. These initiatives aim to refine customer service and expand their digital offerings.

Embark on a Fintech Infrastructure adventure, where bold players endeavour to sculpt seamless financial experiences with a touch of modern tech flair.

Payments solution provider Finix launched Payouts, its standalone product line. Payouts enable businesses across all industries to efficiently send money at scale, regardless of whether they utilise the broader Finix payments platform.

Temenos and Deloitte partnered to provide technology solutions to help US financial institutions accelerate core banking and payments modernisation in the cloud. Temenos and Deloitte will help financial institutions rapidly enhance digital experiences, and seize new opportunities like Instant Payments and BaaS, all while minimising costs.

Plunge into the vibrant realm of DeFi, where central authorities of nations make impactful regulatory waves, aimed at elevating the DeFi landscape.

The Securities and Exchange Commission approved 11 spot bitcoin exchange-traded funds (ETFs). The approval means that both retail and institutional investors now can diversify their portfolios with crypto exposure without worrying about the complicated issues of custody.

Banco de España announced partners for its wholesale CBDC trials. Adhara, a treasury and transactions payment platform, and a consortium formed by private banks Cecabank and Abanca, will be its partners in the development of several upcoming wholesale central bank digital currency (CBDC) trials.

Step into the Green Finance arena, where players aim to establish green frameworks and transform green investments into an everyday norm!

BNP Paribas Asset Management released its Global Sustainability Strategy (GSS), updating its approach to applying sustainability considerations in its investments, and including goals to grow its ranges of sustainable and impactful investment solutions.

Oman unveiled a sustainable finance framework to help the Gulf country reduce its reliance on fossil fuels and attract ESG investors. Under the initiative, the Sultanate plans to issue financial instruments like green, social and sustainability bonds, as well as loans and sukuk (bonds that comply with Islamic law), whose proceeds will be used to fund and re-finance renewable energy projects.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more fintech insights, check out some of our other work at WhiteSight.

Our latest publications include –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

Fintech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️