We heard your curious cups were awaiting some weekly crypto buzz, which is why we’re back with a new edition of the Future of Crypto Newsletter! If you're new and intrigued, read on to satisfy your curious taste buds and join other crypto nerds in receiving some fresh Weekly Crypto Cuppa, delivered right to your inbox every Saturday! ☕️

With Edition #8’s eventful stir, a diverse range of innovative product launches disrupted the digital landscape. The expanding Crypto-coins segment came to light as the most active segment of this edition.

Here’s the TL;DR:

Crypto exchange BTC Markets partners with Mastercard for payments.

MetaMask adds Apple Pay integration, increasing options for buying cryptos.

Coinbase to acquire Brazil's largest crypto exchange MercadoBitcoin.com's parent company, 2TM Group.

Decentraland to host first book launch in the metaverse.

Alibaba leads a $60M investment in AR glass maker Nreal.

For the longer read, let’s get going –

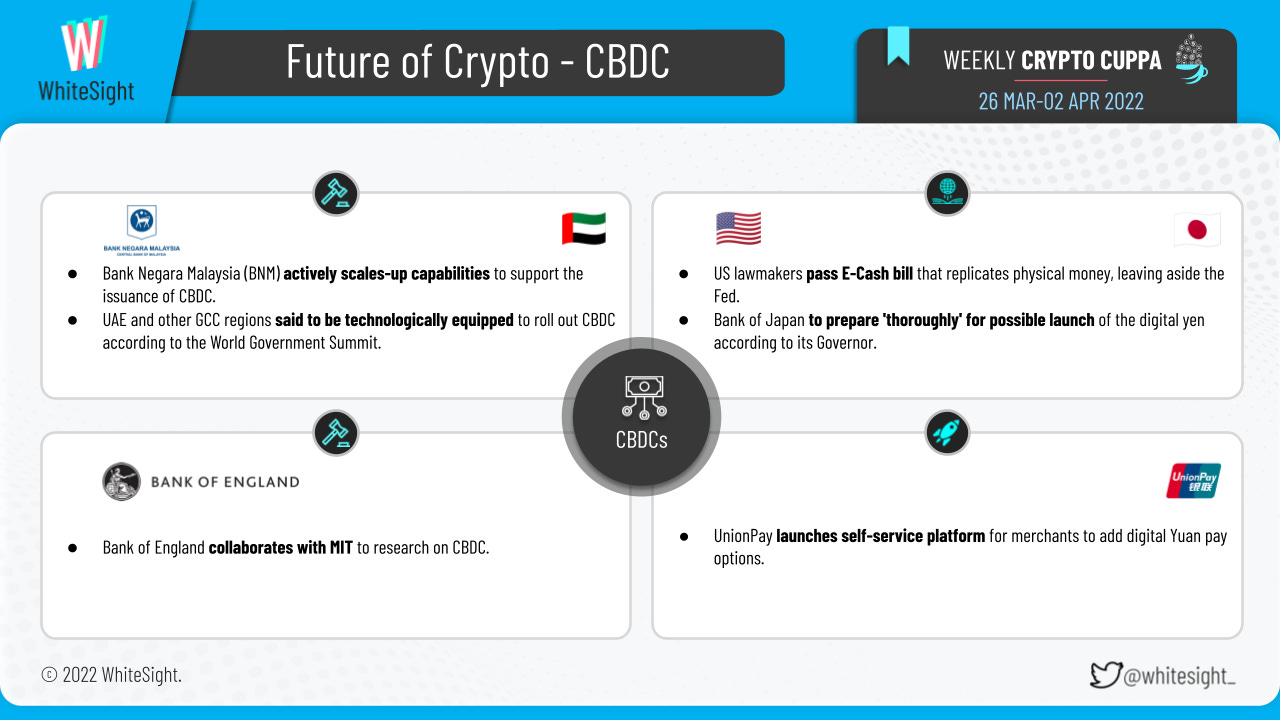

The CBDC segment was abuzz with activities as many more countries rolled up their sleeves to introduce their respective CBDC initiatives.

In Europe, the Bank of England decided to collaborate with MIT’s Media Lab’s Digital Currency Initiative in what would be a twelve-month-long research regarding the development of a CBDC. In America, US lawmakers introduced the “E-CASH” Act, a bill directed to the US Treasury Department instead of the Fed for developing a digital version of the USD that replicates physical cash. In Asia, the Bank of Japan grabbed headlines for its plans to prepare "thoroughly" to respond to changing circumstances that could require it to launch the digital yen in the future. Bank Negara Malaysia (BNM) was also in the news for actively scaling up its technical and policy capabilities to support its ability to issue a CBDC for prospective use cases that could offer high-level benefits to the nation.

According to experts at World Government Summit, the UAE and other Gulf Cooperation Council (GCC) regions were said to be technologically equipped to roll out CBDC, but the policies related to the dollar peg and its impact on the existing banking structure could delay the rollout. Additionally, Chinese financial behemoth UnionPay launched a self-service signup platform for merchants who want to use the digital CNY.

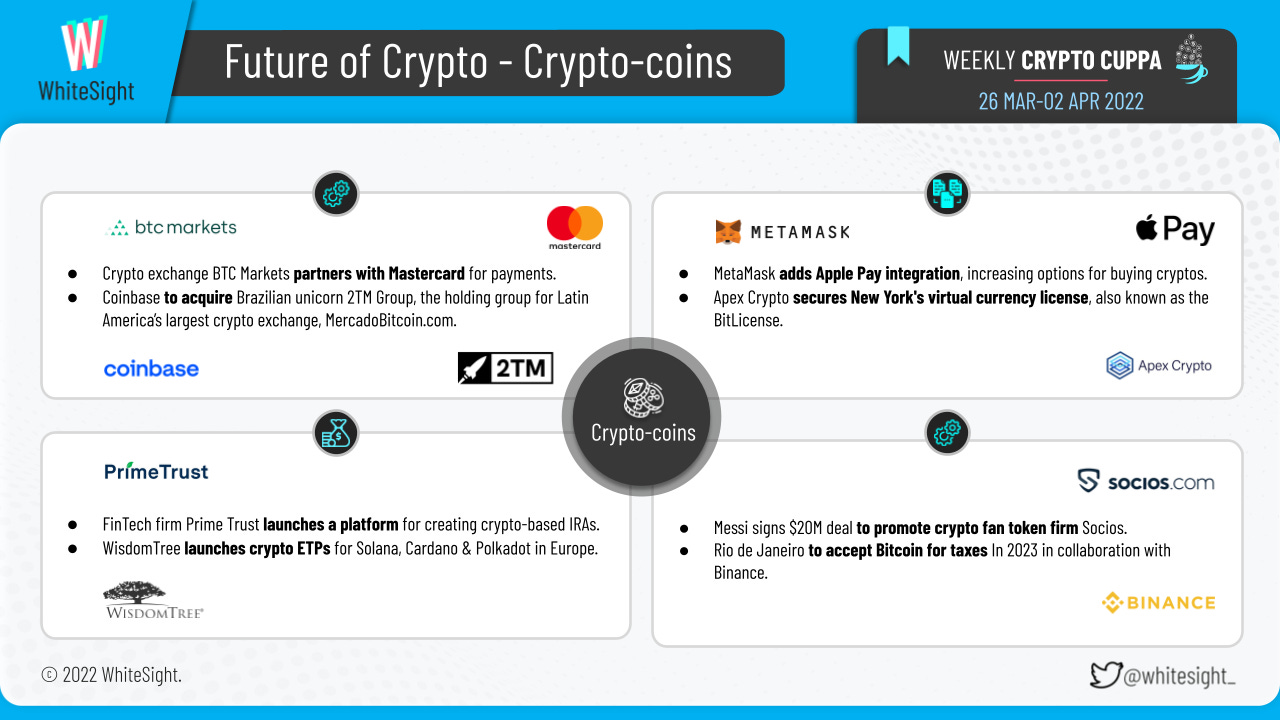

As crypto-coins continue to enter the mainstream, varied players from sectors far and wide are trying to evaluate the integration of these digitized tokens into their existing frameworks.

CrIn Brazil, the administration of Rio De Janeiro announced a move to formally integrate Bitcoin into the payments of taxes. Vietnam made the news for once again spearheading research in hopes of implementing a legal framework for governing digital assets. Furthermore, US President Biden released his 2023 budget proposal, seeking to modernize rules around digital assets estimated to generate an additional $11B in revenues by 2032.

As for the various market expansions, New York approved Apex Crypto’s application for its virtual currency license, the BitLicense, letting users in New York State trade cryptocurrencies on its platform. MetaMask also added Apple Pay integration, enabling Apple Pay or iPhone users to buy cryptocurrencies with debit or credit cards through the mobile app without transferring cryptocurrencies from cryptocurrency exchanges.

At the same time, investment firm WisdomTree launched another tranche of crypto exchange-traded products (ETP) in the European market, covering Solana's SOL, Cardano's ADA, and Polkadot's DOT listed on the Swiss stock exchange SIX and Börse Xetra. FinTech firm Prime Trust also launched a platform for creating crypto-based individual retirement accounts (IRAs) to expand the API provider’s web 3 footprint, of which sats-stacking Swan Bitcoin became one of the earliest clients.

What’s more – Lionel Messi signed an agreement worth more than $20M to promote digital fan token company Socios.com. Cryptocurrency exchanges Bybit and Crypto.com announced plans to set up operations in Dubai, as the Emirate steps up efforts to attract companies in the fast-growing industry. Crypto exchange operator Coinbase also made the bulletin for its plans to acquire Brazilian unicorn 2TM Group, the holding company for Latin America’s largest crypto exchange, MercadoBitcoin.com. Similarly, crypto exchange BTC Markets partnered with Mastercard to support crypto card payments.

The stablecoins segment has been witnessing a series of head-turning events. While Terra stole headlines for its plans to buy a whopping $10B worth of Bitcoin to back UST stablecoin reserves, the UK’s Finance Ministry had been in talks with crypto firms on stablecoins ahead of releasing new regulatory frameworks concerning cryptocurrencies and the use of blockchain technologies across its jurisdiction.

On the other hand, cryptocurrencies traded in the red early on April 1. The global crypto market cap is $2.05T, a 4.88% decrease over the last day. Bitcoin's price is currently trading at $44,881.50, a 1.42% decrease after the 10% weekly surge. Except for stablecoin Tether (up 1.7 %), all major cryptos – including Polkadot (-6.06%), Dogecoin (-5.89), Cardano (-5.16%), Binance (-4.89%), XRP (-4.37%) and Ethereum (-3.84%) – have slumped.

The NFT space was vibrant with eventful happenings last week, witnessing several launches across different platforms.

ypto gifting platform CryotoBuxx launched CryptoBuxx NFTs, a collection of asset-backed NFTs backed by specific amounts of cryptocurrency in downloadable digital gift certificates. While digital asset investment firms CrossTower launched a global NFT marketplace that allows creators and collectors to reach a wider audience, Ukraine launched a ‘museum of war’ NFT collection, with 54 collectibles and cash to help fund the fight against Russia. Indian automotive OEM Mahindra also hit the headlines as it forayed into the NFT space via Thar SUV-based NFT collectibles.

In other news, American luxury jewelry brand Tiffany & Co. announced its foray into the NFT space as it acquired Okapi NFT from NFT series Rocket Factory. Similarly, Mouawad partnered with Icecap for investment-grade diamonds to offer fractionalized ownership of the Miss Universe crown via NFTs. South Africa’s national heritage site Liliesleaf Farm and Museum auctioned an NFT of Nelson Mandela’s arrest warrant for $139K.

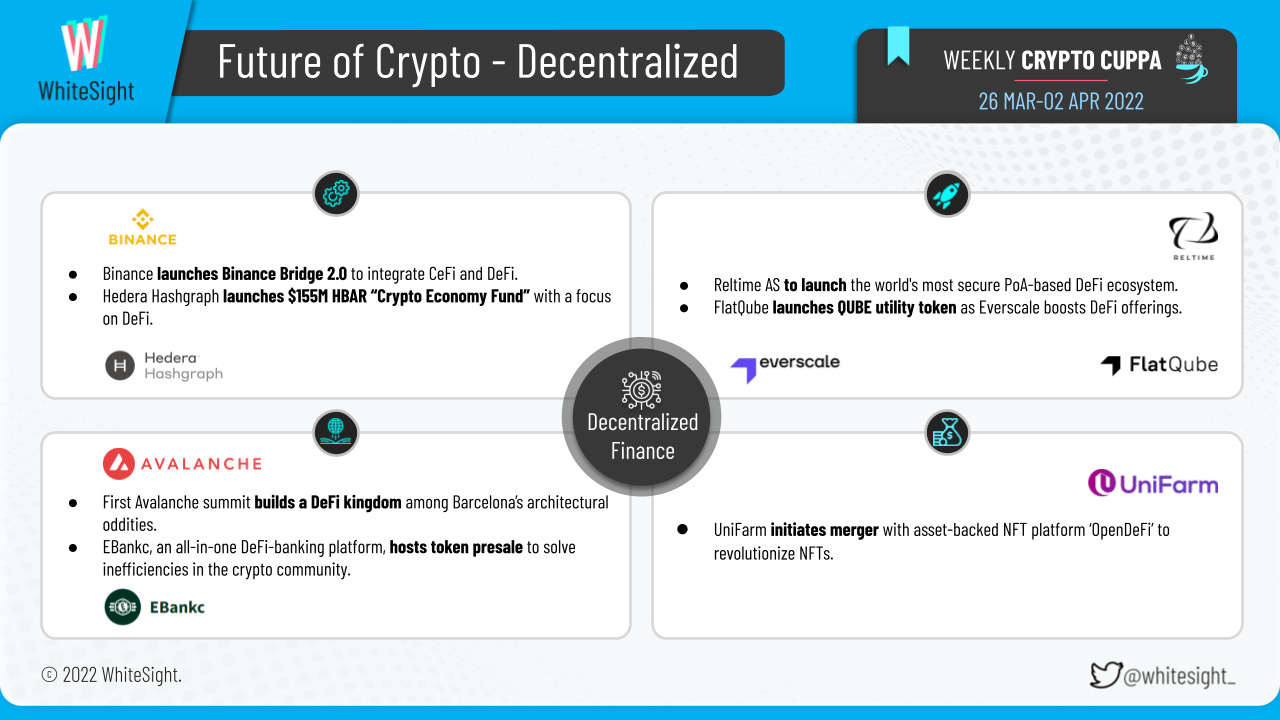

An assorted mix of launches and market expansions was the key highlight for the DeFi sphere.

Cryptocurrency exchange Binance rolled out Binance Bridge 2.0, enabling users to bridge assets from any blockchain, including tokens not listed on the Binance app, to the BNB Chain. Hedera DLT developers HBAR Foundation launched a $155M “Crypto Economy Fund” to attract DeFi projects in a shift toward retail traders. Reltime made the news for creating a unique Peer-to-Peer (P2P), DeFi ecosystem, where it will introduce the Reltime Oxygen (RTO) stable coin for all users as an internal transaction ecosystem currency, backed by deposits in euro. DEX platform FlatQube also made the list for launching the QUBE utility token, as Everscale scaled up DeFi offerings.

On the market expansions front, EBC Financial Group’s all-in-one DeFi-banking platform EBankc was in the news for hosting a token presale. Similarly, the first Avalanche Summit for developers, researchers, and makers built a DeFi kingdom among Barcelona’s architectural oddities.

In other news, global collaborative wealth creation platform UniFarm, with native token $UFARM, hit the headlines after announcing its plans to merge with NFT platform ‘OpenDeFi,’ with native token $ORO, to access a wider audience catering to both the NFT and crypto ecosystem.

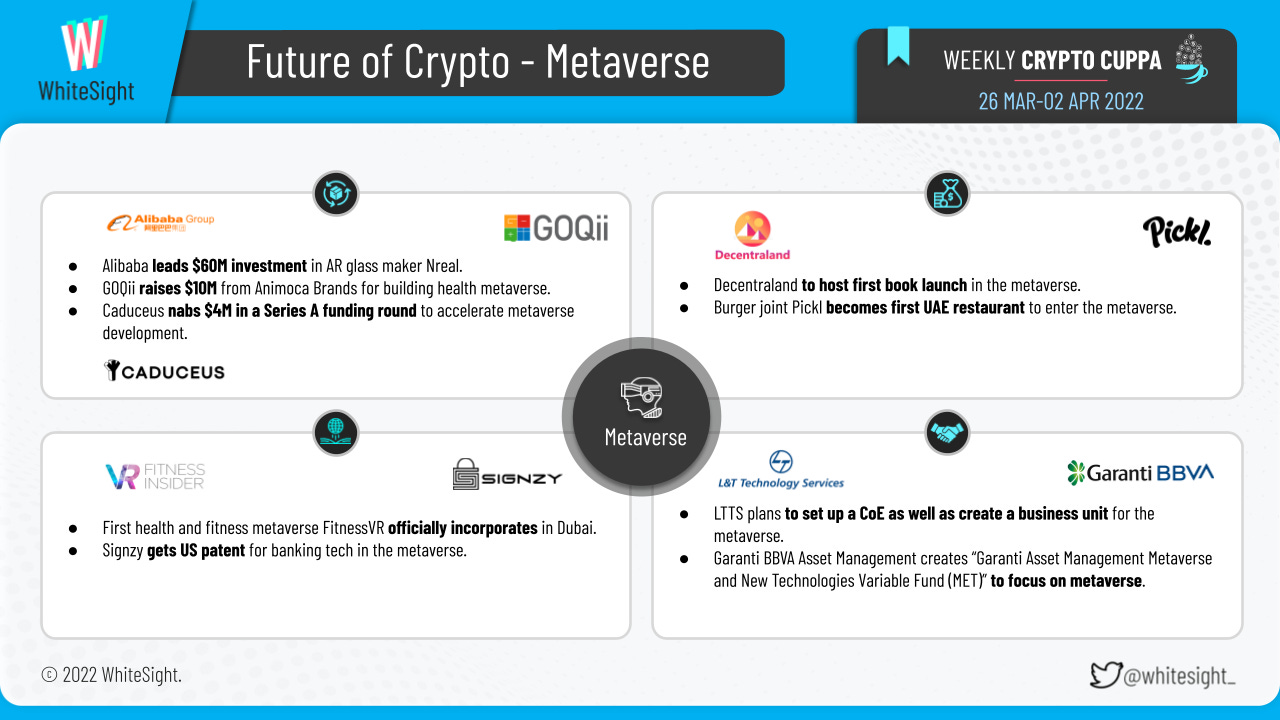

With the notion of metaverse fast becoming a favorable concept for the business ecosystem, firms across industries are eager to debut in this emerging segment.

Bengaluru-based Signzy Technologies received a US patent that will enable it to provide seamless banking and financial services in the metaverse. While the first health and fitness metaverse FitnessVR, powered by Scorpio Metaverse Engine, successfully opened in Dubai, Decentraland was in the news for hosting the first book launch event inside the metaverse that will be held with the official launch of Nina Xiang's new book Parallel Metaverses. Additionally, Burger joint Pickl became the first UAE restaurant to enter the metaverse, paving the way for the local F&B industry.

On the funding front, Caduceus Foundation raised $4M in a Series A round to accelerate the development of a suite of developer toolkits and hardware solutions that create a rich environment for metaverse development. In an extended C round, health tech firm GOQii raised $10M from Animoca Brands to develop offerings that leverage blockchain tokens and gamification in preventive healthcare. Similarly, Alibaba Group Holding Ltd. led a $60M investment in Chinese augmented reality glasses maker Nreal, joining rivals Tencent Holdings Ltd. and ByteDance Ltd. to stake a claim in the future of the metaverse.

In other news, L&T Technology Services (LTTS) grabbed headlines after announcing that they’re setting up a Centre of Excellence for Metaverse and creating a business unit for Meta that will be launched by July-August 2022. Furthermore, portfolio management company Garanti BBVA Asset Management recently created the Metaverse and New Technologies Variable Fund (MET), the first fund in Turkey to focus on metaverse.

A plethora of partnerships across various sectors made most of the headlines for the DLT vertical.

RiskStream Collaborative partnered with blockchain insurance consortium B3i Services to jointly run labs to explore the potential for homeowner parametric insurance and reinsurance. While KRAFTON’s subsidiary RisingWings partnered with blockchain-based esports service COMPETZ to enter the global blockchain game market and develop several new games for the service released within 2022, LTO Network became the world's premier blockchain network for eClinical applications through partnership with Triall and identity specialist Sphereon. Similarly, House of Gaming partnered with blockchain giant Polygon through Hefty Games, who’ll kickstart and fuel the Gaming & NFT ecosystem and blockchain gaming in India with exclusive P2E (Play to Earn) games and a plethora of unique utilities.

On the other hand, SK Square, the investment arm of South Korean conglomerate SK Group, was in the news for its plans to spend $1.6B in the next three years on semiconductors and blockchain. TechPay also made it to the headlines for offering the world’s first blockchain with real-time transactions in the NFT world, with its coin’s blockchain features 300,000 TPS (transactions per second) and a mere 15-second transaction finality.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include entering the immersive universe of Gamification—Into The Metaverse, and exploring the many Female-focused Crypto Initiatives that are ‘DeFi’ning the way for women in the blockchain world.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️