We’re back with a new edition of the Future of Crypto Newsletter! If you're new and curious, read on to satisfy your curious taste buds and join other crypto nerds in receiving some fresh Weekly Crypto Cuppa, delivered right to your inbox every Saturday! ☕️

Edition #7 brings intriguing headlines from around the Cryptosphere to keep your cup of curiosity filled. A plethora of innovative launches and funding rounds remained at the forefront for the week. The NFT and Metaverse verticals were bustling with activities, noticeably the most active segments of this edition.

Here’s the TL;DR:

Qualcomm launched a $100M Metaverse fund to back XR, AI, and AR tech companies.

Crypto.com unveiled as FIFA World Cup Qatar 2022 official sponsor.

FTX Ventures invested $100M in banking app Dave; formed partnership for crypto payments in the platform.

Decentraland launched metaverse fashion week for brands, including The Fabricant, to showcase new clothing collections.

a16z alum Katie Haun’s firm Haun Ventures raised $1.5B for two new crypto-focused funds.

For the longer read, let’s get going –

The CBDC segment has been gaining momentum lately as many countries around the globe are joining the CBDC race.

In the Arab Peninsula, Qatar’s central bank was in the news for its plans to digitalize most of its products, including studying and potentially developing and launching a CBDC and issuing digital bank licenses. In its recent publication, the Arab Regional Fintech Working Group, an advisory panel from the Arab Monetary Fund, designated RippleNet as a natural alternative to SWIFT.

In other news, The Bank for International Settlements and the central banks of Australia, Malaysia, Singapore, and South Africa developed two prototypes for a shared platform that could enable international settlements using digital currencies issued by multiple central banks. Bank of England also made it to the headlines for revealing that it won’t be rolling out UK’s CBDC Britcoin until 2025 at the earliest.

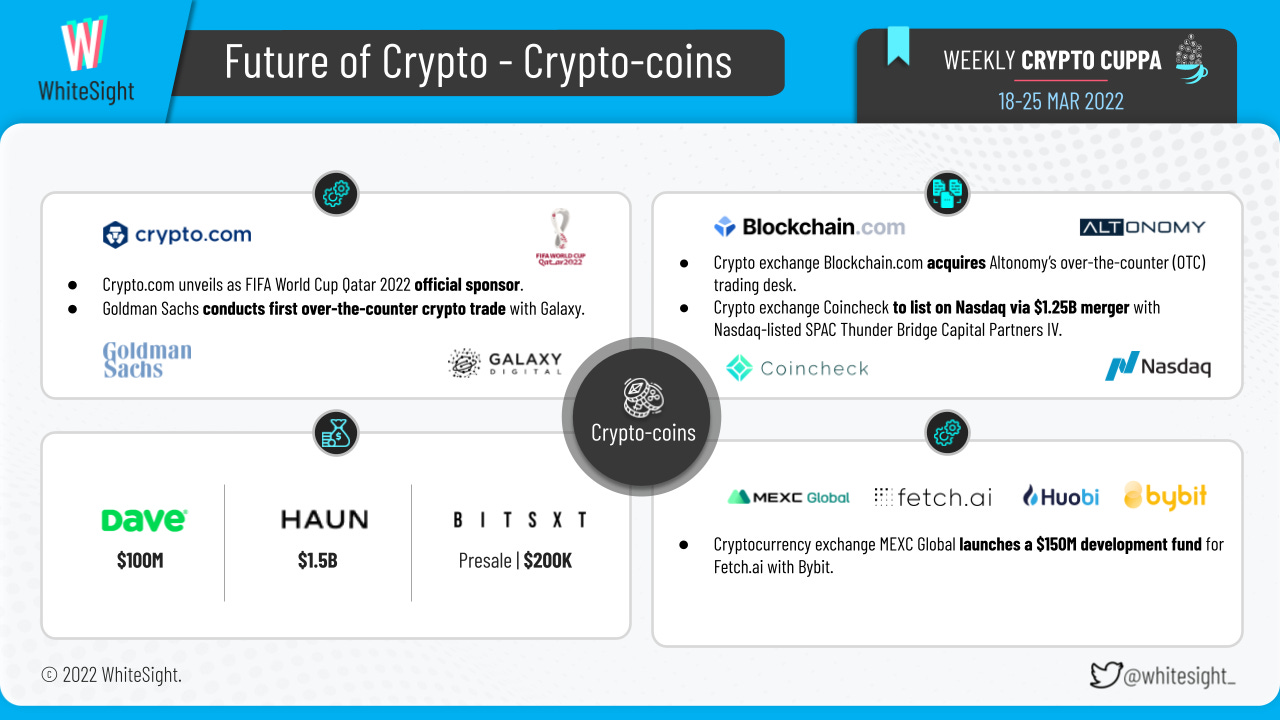

As crypto-coins continue to enter the mainstream, varied players from sectors far and wide are trying to support and embrace their potential.

Banking app Dave raised $100M investment from FTX Ventures and partnered with FTX US to explore ways to introduce digital asset payments onto Dave’s platform.

Crypto exchange BitsXT became the second project from the Bitgert Startup Studio to get its presale on the Brise chain, raising over $200K.

a16z alum Katie Haun raised $1.5B for two new crypto-focused funds for her new firm, Haun Ventures.

Crypto exchange Coincheck also grabbed headlines for agreeing to be listed on Nasdaq by merging with Nasdaq-listed SPAC Thunder Bridge Capital Partners IV in a $1.25B deal.

Crypto exchange Blockchain.com acquired Altonomy’s over-the-counter (OTC) trading desk in an undisclosed deal, expanding Blockchain.com’s presence in crypto OTC trading.

Regarding various market growth and expansions, FIFA announced cryptocurrency platform Crypto.com to be the Official Sponsor of the FIFA World Cup Qatar 2022. Wall Street giant Goldman Sachs completed the first-ever over-the-counter (OTC) cryptocurrency-related trade with the digital-asset financial company Galaxy Digital. Transak, a single integration for applications to accept fiat-to-Crypto payments, also made the news for featuring Apple Pay as a recognized payment option within the company’s fiat onramp.

Additionally, cryptocurrency exchange MEXC Global launched a $150M development fund for Fetch.ai, a blockchain-based machine-learning platform, with Bybit to encourage more developers and projects to work on the Fetch.ai ecosystem. In Malaysia, the Deputy Minister of Communications put forth a proposal recognizing Bitcoin as a legal tender in the country.

An assorted mix of events made up for most of the headlines in the stablecoin segment.

Australia and New Zealand Banking Group carried out an Australian dollar stablecoin payment in a landmark transaction to become the first Australian lender to mint a digital asset linked to the country's currency.

Cardano stablecoin issuer COTI hit the headlines for its plans to launch a $10M fund to expand the COTI ecosystem by onboarding developers.

Video game development company Wemade was also in the news for announcing a strategic investment in the Klaytn-based stablecoin project, KROME.

CoinShares partnered with FTX to launch the world’s first physically-backed Solana exchange-traded product (ETP), designed to transparently share the rewards of staking with investors.

The NFT space was abuzz with eventful happenings, highlighting several product launches, partnerships, and expansion activities.

Benzinga launched an NFT Madness 2022 Tournament with 64 NFT collections competing for the crown of Benzinga’s fan-voted Best NFT Collection. Metatron launched NFTMinthouse.com, an NFT full-service provider and pre-mint marketplace that allows anyone to monetize digital art and create NFTs.

On the partnerships front, AE Studio partnered with South China Morning Post to launch the first-of-its-kind NFT collection called 'ARTIFACTs by SCMP.' A local Vancouver-based couple’s NFT collection to become the first Canadian collection featured in an original children’s series as part of a partnership with TIME Studios. Huobi Global's NFT marketplace Huobi NFT partnered with NEXTYPE to launch a global-exclusive Hanazawa Kana NFT series.

On the fundings front, Yuga Labs raised $450M in funding at a $4B valuation to build a media empire around NFTs, starting with games and its metaverse project. NFT appraisal protocol Upshot raised $22M in a Series A2 funding round led by Polychain Capital to hire more staff and finance new DeFi algorithms and related developer tools.

Additionally, Abu Dhabi Global Market (ADGM), the emirate’s free zone, published a consultation paper with draft guidelines covering NFT trading, among other asset classes. The world’s first NFT superyacht sold for $12M on the Ethereum blockchain, with the yacht also being provided to the NFT owner in the physical form. While NFT marketplace Rarible grabbed headlines for its plans to add support for the Solana network, global esports entertainment company Allied Esports was also in the news for planning to join the burgeoning NFT market with the sale of its first collection, EPICBEAST.

Several product launches and expansions were the key highlights for the DeFi space for the week.

Parallel Finance launched DeFi ‘super app’ for the Polkadot crypto ecosystem to become a one-stop shop for all corners of DeFi.

Crypto startup LOFI-DEFI launched an NFT-based social media platform for creators and investors to earn passive income with the LOFI token.

DeFi protocol Integral announced the launch of Integral SIZE, a DEX that can seamlessly deliver large order volume to DeFi, eliminating drawbacks like price impact and impermanent loss.

Izumi Finance, a protocol providing liquidity as a service on Uniswap V3, joined forces with the HOURAI project to support the upcoming launch of its NFTs through Izumi’s DeFi derivatives.

On the fundings front, DeFi protocol Struct Finance secured a $3.9M seed round to develop the tools that will allow the ecosystem to customize, compose, and invest in decentralized structured products. Crypto structured protocol Ribbon Finance raised $8.8M under a new partnership with venture capital firm Paradigm to build new risk products native to DeFi and continue scaling the protocol.

In other news, DeFi Technologies announced its wholly-owned subsidiary, Valour, created a special purpose vehicle (SPV) to support the distribution of a digital asset-backed product program. Community protocol TraDAO became the first DeFi project to pave the way for an installment strategy in bond sales, allowing users to utilize tiny amounts of cash to purchase more bonds and then profit from auto-compounding staking.

Many players from different industries and sectors expanding into the metaverse have created quite a stir around the sphere.

Metaverse company Nextech AR teamed up with MIT to hack the metaverse using ARitize Maps at the ‘Reality Hack’ XR Hackathon. Hanai World partnered with Web3 company Vatom to build physical and digital metaverse crossover experiences. Klatyn blockchain also hit the headlines for its partnership with gaming titans such as Wemade, Netmarble, Neowiz, etc., to drive the creation of an exciting metaverse on the Klaytn blockchain.

On the fundings front, chip giant Qualcomm launched a $100M metaverse fund that will go towards a grant program for developers building extended reality-focused gaming, health, wellness, media, and entertainment experiences. Metaverse project Ultiverse also raised $4.5M at a $50M valuation in a seed round co-led by Binance Labs and Singapore’s DeFiance Capital to develop products, attract top talent and further increase the community's growth.

Furthermore, Decentraland launched Metaverse Fashion Week, a digital fashion week, where brands including The Fabricant will showcase new clothing collections in the metaverse. Nvidia debuted its new H100 AI processor chip that powers AI, autonomous vehicles, and metaverse tools. Chinese firm JX Luxventure also made the bulletin for its plans to enter the metaverse by offering NFT based projects.

An assorted mix of launches and market expansions made most of the news in the DLT vertical.

While MetaBlaze became the first Blockchain-gaming metaverse generating lifetime passive yields, Coinbase Wallet extended support to Solana blockchain by providing an added layer of security.

On the various launches, Volvo owner Geely launched a blockchain joint venture with Concordium in a bid for the latter to become a primary blockchain technology service provider in China. Web 3 infrastructure company Mysten Labs launched the Layer-1 blockchain platform Sui to facilitate instant settlement and deliver high throughput, low latency, and low cost needed to power applications for billions of users.

In other news, insurance company Lemonade partnered with prominent blockchain companies to form the Lemonade Crypto Climate Coalition DAO to protect farmers from climate change by offering blockchain-based insurance. While FanCraze made the list for raising about $100M in a Series A round led by venture capital firms B Capital Group and Insight Partners, the NFL granted teams limited permission to seek blockchain sponsorships while still banning cryptocurrency promotions and fan tokens.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include taking a closer look at Open Banking Innovation in Saudi Arabia in partnership with Mod5r and entering the immersive universe of Gamification—Into The Metaverse.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter and don't be shy to show some ❤️