Bringing your favorite accompaniment to your weekend tea, we’re back with the latest edition of the Future of Crypto newsletter! Let your mind wander into the immersive universe of the Cryptosphere and join other Crypto Nerds in getting a Weekly Crypto Cuppa delivered right to your mailbox every Friday! ☕️

Edition #22 has got you covered on the week’s hot-off-the-press affairs that will keep you on the edge of your seat through their see-sawing transitions.

Here’s the TL;DR

If you’re a crypto wallet or an exchange, chances are that this might not be the best time for you. While Meta is finally shutting Novi crypto payments wallet in September, ending the Libra saga, Nexo is planning to acquire crisis-ridden crypto exchange Vauld.

While BGC gets another badge as it executes a CME crypto option block trade in Asia, Lickd strikes a deal with Vegas City to give music to the metaverse.

Although the market is at a standstill, it didn’t stop crypto tax startup KoinX from closing a seed round of $1.5M to build a unified crypto tax platform for web 3 transactions.

The NFT segment too celebrated a series of events, as Coca-Cola launched a pride series NFT collection on Polygon. Wirex and Blink Digital also joined the launch party, with the former releasing a crypto-backed credit and the latter launching a virtual hospital on Decentraland.

The activities don’t stop there for the NFT segment, as Binance and FC Porto partnered to release a collection of mystery boxes. Meanwhile, UAE teams up with Chainalysis to provide blockchain training to government entities.

For the longer read, let’s get going —

New names have been making a debut in the CBDC segment to understand the economic framework and implications of using it.

In North America, Mexican senator Indira Kempis proposed a bill to accept Bitcoin (BTC) as legal tender in Mexico and claims the second-largest market that accepts BTC as legal currency. In South America, the Central Bank of Chile announced the opening of an online survey for its planned CBDC project, including the financial sector and academics, specialists in payments and technological services, and the general public. In Europe, The Central Bank of Russia (CBR) revealed its plans for the digital ruble to replace the financial messaging system SWIFT, stating that when the platform is fully ready, Russia will no longer need SWIFT. Denmark’s National Bank also published a report analyzing the popular motivations for a CBDC amongst developed nations.

In other news, Montran Corporation and eCurrency Mint announced the successful integration of Montran’s Real Time Gross Settlement (RTGS) with eCurrency’s CBDC platform, resulting in the CBDC getting seamlessly interfaced with central bank currency management payment operations. The Visa Economic Empowerment Institute (VEEI) highlighted several aspects of the central bank-issued digital assets. These include the current motivations of central bankers in exploring CBDCs, policy implications of CBDCs, and risks central banks are likely to face.

A flurry of partnerships gave new life to the ailing Crypto-coins segment last week.

Binance announced its partnership with TikTok celebrity Khaby Lame as brand ambassador to debunk the misconceptions about cryptocurrencies and the blockchain industry and increase awareness of web 3.

CoinMENA announced its joining of Visa’s Fintech Fast Track program, speeding up the process of integrating with Visa, which will allow CoinMENA to leverage the reach, capabilities, and security of VisaNet and launch a host of Visa-exclusive services, including the CoinMENA VISA Card.

BGC Partners (HK) Securities LLC arranged an intermediated block trade of CME Group Bitcoin options contracts in Asia between Cumberland and Goldman Sachs.

Centri Business Consulting, LLC and BitPay also announced a partnership allowing Centri’s clients and vendors to pay invoices with cryptocurrency. This new payment solution will enable Centri to promote crypto acceptance to its customer base, especially those who are crypto natives.

Cellebrite joined forces with Chainanalysis to launch a partnership that will enable customers to easily identify and assess criminal activity involving cryptocurrency during digital investigations to expedite their resolution.

Furthermore, Crypto lending firm Nexo grabbed the headlines for its plan to acquire fellow lender and crypto exchange Vauld. The move comes after Vauld halted deposits, withdrawals, and trading on its platforms yesterday, citing financial challenges.

When it comes to the various regulatory operations, cryptocurrency exchange Coinbase made the news for providing sophisticated tools to the US Immigration and Customs Enforcement (ICE) agency to help it track transactions across Bitcoin, Ether, and other cryptocurrencies. Crypto lender Voyager Digital suspended withdrawals, trading, and deposits to its platform days after issuing a default notice to embattled hedge fund Three Arrows Capital (3AC), stating that it is exploring strategic alternatives to preserve the value of its platform. Meta (FB) was also in the news for its plans to shut down Novi, its digital wallet payments pilot, ending the libra stablecoin experiment three years after the company unveiled its ambitious but ultimately doomed crypto payments gamble.

On the other hand, crypto tax startup KoinX announced the closing of its seed round with a $1.5M fundraising to automate taxes of crypto retail investors and scale-up operations across India.

That’s not all – The Bank of England’s Financial Policy Committee called for enhanced regulation of the crypto-asset market to mitigate against potential risks. This came after losing $2T of the crypto market cap over months. The European Union (EU) lawmakers passed new legislation for tracing transfers of crypto assets like Bitcoin in the same way as traditional money transfers to prevent money laundering, terrorist financing, and other crimes.

The competitive Stablecoins market seemed to be regaining its steady momentum the past week.

Circle's USDC hit the bulletins as it's on track to topple Tether USDT as the top stablecoin in 2022 with an 8.27% growth in market capitalization. Basel Committee on Banking Supervision published a revised consultation on the capital requirements for crypto asset risk exposure that imposes tests to ensure stablecoins are redeemable and their price doesn’t deviate too much from par. Additionally, there are requirements for managing reserve assets. Tether cut its commercial paper holdings by around 58% as part of an earlier commitment to reduce its exposure to riskier assets. In an interesting turn of events, citizens in Argentina purchased between two and three times as many stablecoins as they do on a typical weekend. The news comes amid an economic crisis in the country.

The NFT segment has been thriving thanks to the recent explosion of novel launches and partnerships.

Facebook revealed the testing of a new NFT collectibles page with a small group of US producers, allowing users to flaunt their NFT collections on their Facebook page as a part of the new feature.

Shaabiat Al Cartoon, a popular Emirati animated series, launched its cartoon as an NFT collection to educate the public about the emerging digital trends sweeping up the digital industry.

Beverage giant Coca-Cola launched its NFT collection of ‘Pride Series’ to share the message of love, which will be minted on the Polygon blockchain and feature around 136 NFTs.

Vincenzo Sospiri Racing, a multi-championship winning GT race team backed by Lamborghini, partnered with Go2NFT to spread its legs into the NFT world, which will be powered by proprietary blockchain technology.

BOSAGORA Foundation similarly launched NFTs based on its unique BizNet through crowdfunding platform Crowdy. The NFTs intend to celebrate the success of the fund managed by FMway, a partner of BOSAGORA.

As for the partnerships, IPX, the digital IP platform, announced a partnership with blockchain and NFT company Cripco to produce NFTs for IPX, starting with the iconic character ‘IPs.’ Binance NFT partnered with FC Porto to launch a collection of NFT mystery boxes. The mystery box is placed at the price of 3 Porto coupons, with four different levels of rarity for the customers to explore. Wagmi United partnered with Adidas to launch an NFT collection based on English League One club Crawley Town, where the holders of the NFTs will receive an array of Crawley Town Club perks.

On the funding front, MarketWolf secured $10M in a Series A funding round led by Jungle Ventures and Dream Capital. Serenade, an NFT company, raised $4.2M in a funding round led by celebrities such as Hugh Jackman and some executives of Warner Music Group.

Additionally, Chinese private companies have now implemented an initiative to track NFT trading, transitioning from decentralized to centralized trading.

Numerous exciting launch-related activities stole the limelight in the DeFi space last week.

Leading payments platform Wirex launched Wirex Credit to offer competitive interest rates and no origination fee for crypto-backed loans, where users can easily borrow up to $100,000 in stablecoins. Voltz launched Lido (stETH) and Rocket (rETH) pools, allowing traders to speculate on the upcoming ETH merge and leveraging trading strategies historically. Bitfinex also announced the launch of Convergence (CONV) on its trading platform with trading pairs US Dollars (USD) and Tether tokens (USDT).

What’s more –

Multichain Bridge integrated with RSK blockchain to facilitate the transfer of ETH, USDC, BUSD, and other assets between RSK, Ethereum, and BNB Chain.

Moonstake was in the news for supporting the staking of ORBS token on the Polygon network, enabling users to earn interest and earn multi-chain staking rewards with the best user experience through one single click.

The UK Government made the bulletin for seeking public input on the taxation of crypto-asset loans and staking in the context of DeFi.

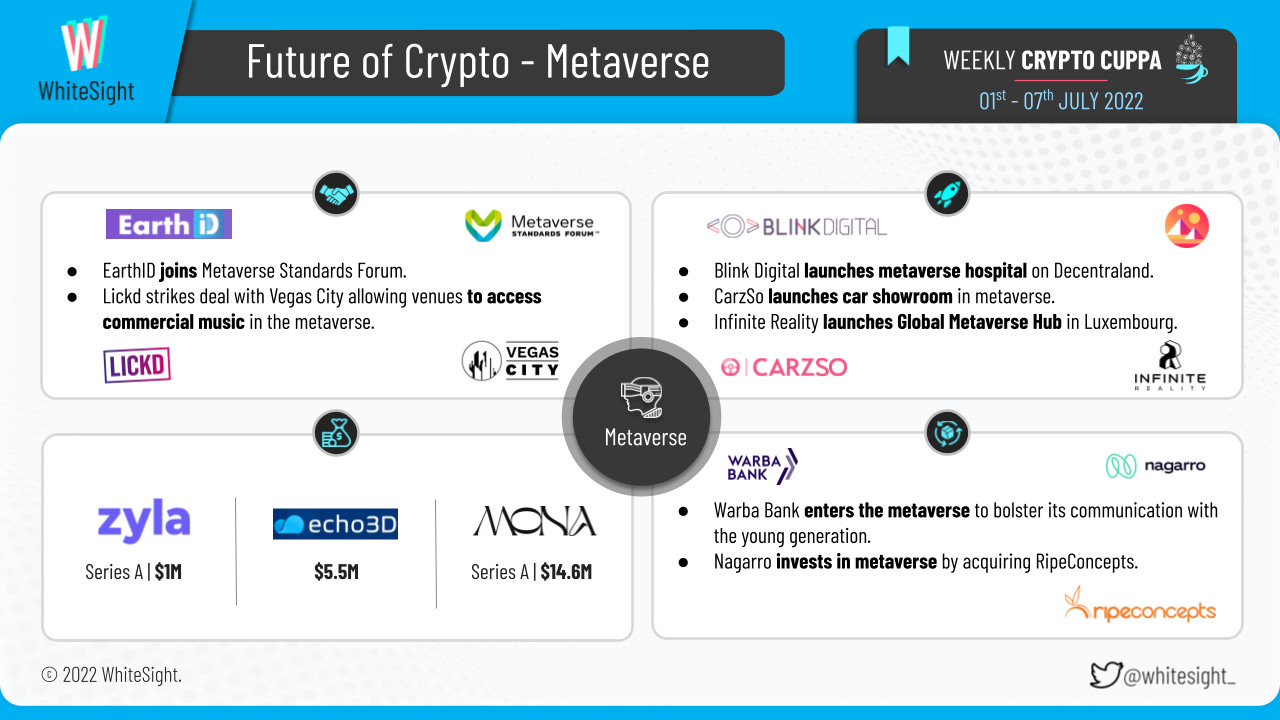

The common thing between the Multiverse and the Metaverse is that they both can surprise you for good and engage your curiosity for the best, and the week’s news serves as evidence for the same.

Starting with the various funding events,

Personalized care platform Zyla Health bagged $1M in pre-Series A funding round led by Venture Capital company Seeders.

Echo 3D, a cloud-based platform to store and stream 3D, AR, and VR, secured an investment of $5.5M led by Qualcomm Ventures.

Mona, a metaverse-based world-building platform, raised an investment of $14.6M in a Series A funding round.

Coming to the launch-related happenings, IT firm Nagarro ventured into the metaverse by acquiring RipeConcepts and thereby benefit from the growing popularity of the metaverse.

Furthermore, Blink Digital collaborated with Yashoda Hospital to introduce a metaverse hospital on Decentraland, enabling its users to interact with the doctors.

Used car startup CarzSo launched a showroom in the metaverse to enable users to buy pre-owned cars with the help of various tools provided by the company. Infinite Reality launched a global metaverse hub in Luxembourg aiming to deliver a metaverse experience where creators have the ultimate control over their own monetization potential.

Kuwait-based Islamic bank Warba Bank also made its metaverse debut to bolster its communication and support its younger clients.

Hopping on to the partnership scoop, global identity management and KYS platform EarthID joined the Metaverse Standard Forum (MSF) to leverage and facilitate interoperability and open standards in the metaverse. International Space University partnered with Metavisionaries to bring space science to the metaverse. Lickd also established an exclusive deal with Vegas City, a virtual district within the metaverse-based world Decentraland, to provide commercial music to Vegas City’s partners and ‘tenants,’ who can buy virtual land on the platform through blockchain-based purchases.

The week’s DLT comes with an assorted platter of partnerships, launches, and many news headlines about business expansions.

To begin with:

TikTok’s former head of gaming, Jason Fung, launched a blockchain infrastructure company called Meta0 that aims to provide integration to different metaverses for game developers.

Blockchain startup COSMETA’s plans to bring HR-based services to the metaverse also made for a key event in the space.

On the partnerships front, UAE teamed up with Chainalysis to provide blockchain training to government entities, which will help the government’s employees upskill themselves with knowledge about the blockchain. Multichain announced the integration of the Bitcoin-based contract protocol RootStock (RSK). The integration will enable RSK to bring Bitcoin to Multichain's ecosystem while also providing access to new markets and use-cases for its users. Blockchain GameFi Land of Conquest also received an investment from Huobi Ventures, who led the investment round, among other investment firms.

Finally, the Government of Colombia hit the headlines as it is set to utilize the XRPL blockchain for land registry, with Ripple’s partner Peersyst Technology announcing the launch of Colombia’s National Land Registry on top of the XRPL Blockchain.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Crypto Cuppa, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include exploring Revolut’s Journey In The Search Of A New World Order In Finance and Promoting Reliability In Diverse Ecosystems: Financial Institutions As Allies.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️