As we enter a new month with the wonderment about what’s next, we haven’t forgotten to deliver our weekly fresh serving bubbling with some exciting scoop of crypto affairs in the latest edition of the Future of Crypto newsletter! If you're new and curious, read on to find out what happened in the world of Crypto across six dynamic themes, and join other Crypto geeks in receiving some fresh Weekly Crypto Cuppa delivered right to your inbox every Friday!☕️

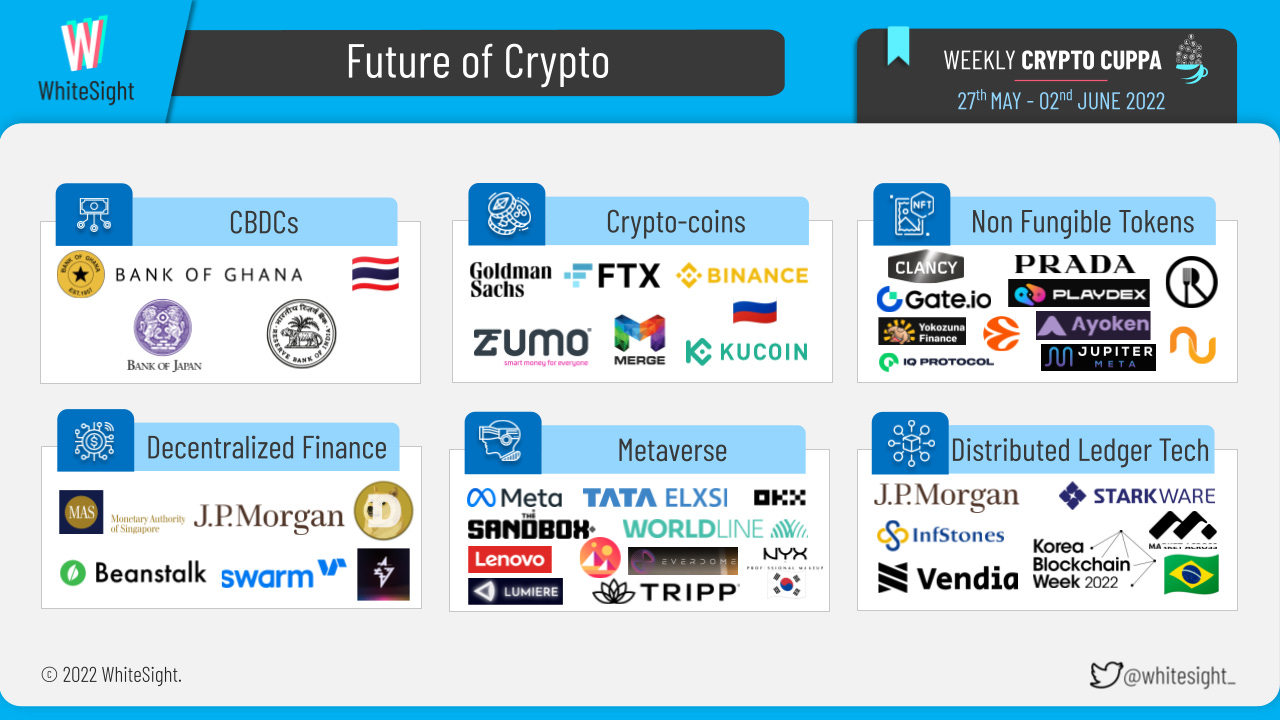

The crypto industry has witnessed a range of regulations and market expansions in Edition #17, with the DLT, Metaverse, and Crypto segments tied as the most dynamic segments for the opening week of the month.

Here’s the TL;DR:

Facebook parent Meta to use Broadcom chips to build metaverse hardware.

Tata Elxsi, Lenovo partner to offer XR solutions, metaverse as service.

JPMorgan uses blockchain for collateral settlement.

Brazil launches a blockchain network to better trace public expenditures.

Crypto film ‘The Infinite Machine’ adds metaverse component in pact with Decentraland, Lumiere.

Before taking a sip of this steaming cuppa brimming with the piping hot affairs of the Cryptosphere, here’s a little add-on of the Top 10 Crypto News Stories of the week:

Now, for the longer read, let’s get going —

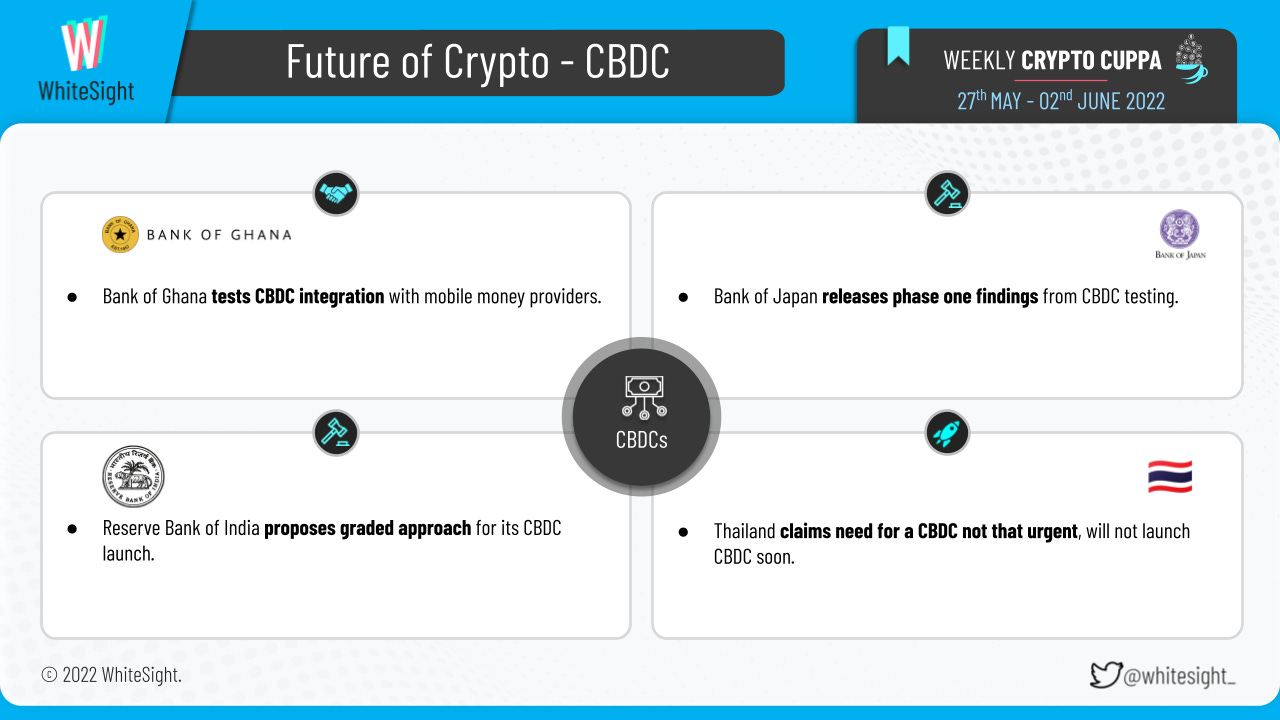

The CBDC segment has again observed a plethora of regulatory experimentations as more countries join the sector to better understand its dynamics.

In Asia, the Governor of the Bank of Thailand stated that the need for a CBDC is not urgent and that the institution will not hurry to introduce one, claiming that Thailand offers a variety of alternative payment alternatives. The Reserve Bank of India (RBI) proposed adopting a ‘graded approach’ for the launch of its CBDC to ensure conformity with the objectives of the monetary policy, financial stability, and efficient operations of currency and payment systems. Bank of Japan released the phase one findings from its CBDC testing. In Africa, the Central Bank of Ghana (BoG) announced it granted Vodafone Cash and CalBank customers the opportunity to test its online version of its digital currency (CBDC), the eCedi.

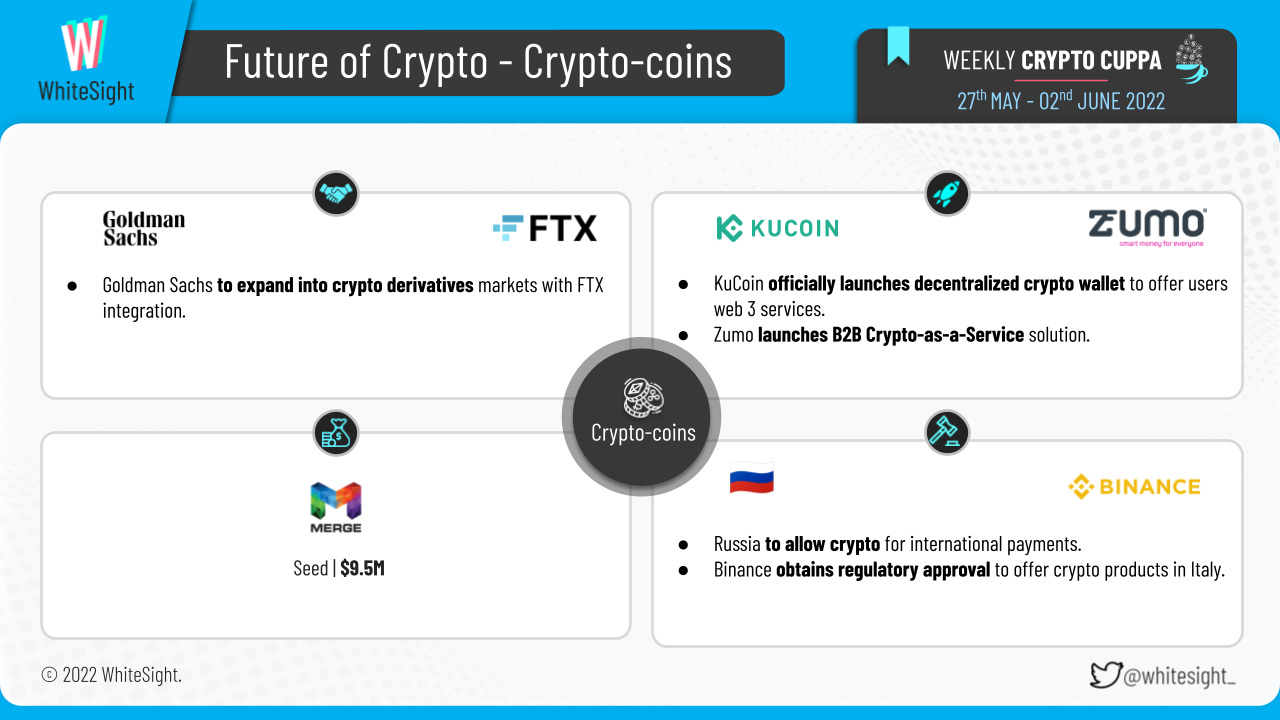

With a bit of skepticism still hovering over the Crypto-coins landscape, a diverse set of activities made for the buzz around the segment last week.

Cryptocurrency trading platform KuCoin launched its new decentralized product — KuCoin Wallet, with its website that went live for users to access the service on 1st June. Germany-based crypto wallet and payments platform Zumo launched a B2B ‘Crypto-as-a-Service’ solution that enables companies to offer crypto products and services to their customers.

On the regulatory front, Russia was in the news as it plans to allow cryptocurrencies to be used as means of international payments to counter Western sanctions. Crypto exchange Binance received regulatory approval from Italy’s financial regulator to operate as a cryptocurrency service provider in the country.

As for the various expansions, crypto management platform Kassio, which provides crypto investment solutions like earn, borrow, shop, or trade to its users, announced the launch of its operations in India. Similarly, Chinese crypto exchange Huobi announced it had purchased LATAM cryptocurrency exchange Bitex to reach out to LATAM countries like Chile, Argentina, Uruguay, and Paraguay.

In other news, Goldman Sachs was in talks with FTX over the regulatory and public listings and aims to expand into offering crypto derivatives by leveraging some of its own derivatives tools and services. London-based cryptocurrency payments firm Merge raised a $9.5M seed round led by Octopus Ventures, Coinbase Ventures, Alameda Research, and Hashed to ensure that cryptocurrency companies can make payments and work with traditional financial services more efficiently.

The Stablecoins segment is still under scrutiny, and regulations have poured in to limit its expansion.

While the Bank of England grabbed headlines for being given the powers of direction over administrators appointed to deal with collapsed stablecoins, in an amended version of existing rules designed for financial market infrastructures (FMIs), Britain’s finance ministry set out plans for adapting existing rules to deal for any major stablecoin collapses, such as with TerraUSD.

Moreover, Tether Operations Limited announced the launch of MXNT Tether tokens pegged to the Mexican Peso that will officially be launched on Polygon, Ethereum, and Tron networks.

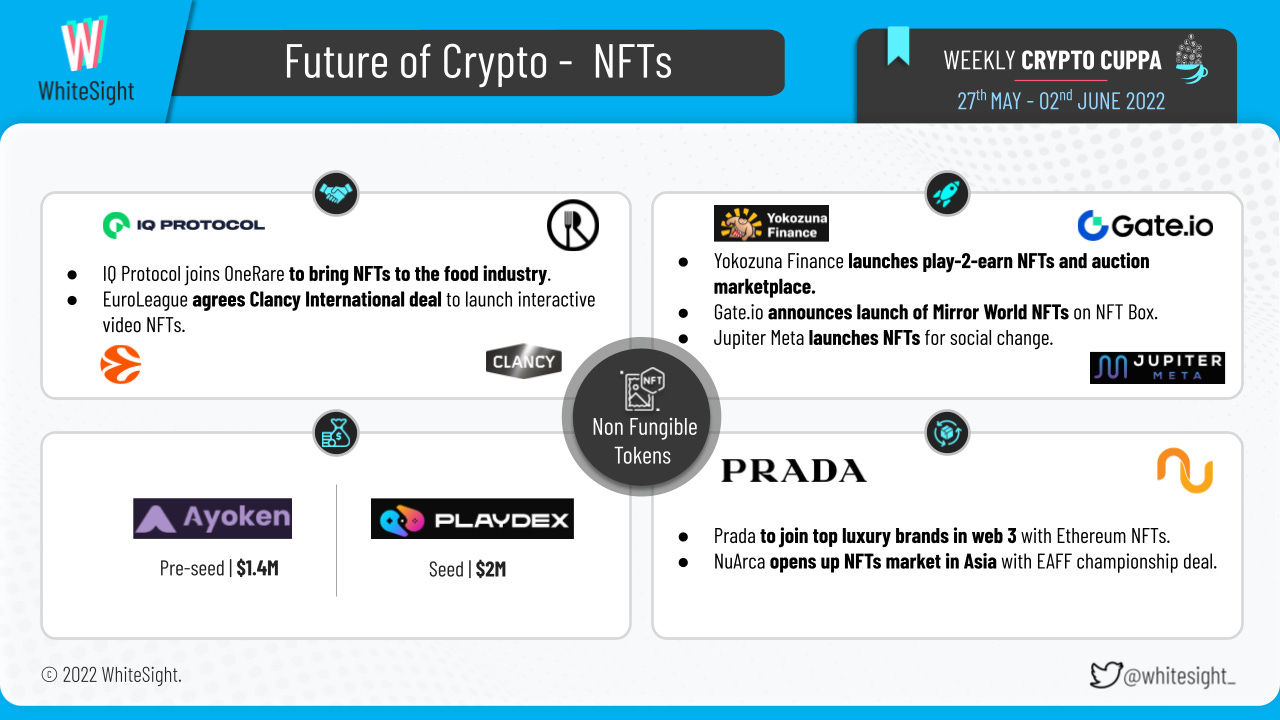

Several innovative launches surrounding the NFT space turned heads last week, with significant players introducing their own collections and initiatives in the expanding space.

Integrated web 3 entity Jupiter Meta launched art NFTs on its digital marketplace to inspire people to be catalysts for social change by channeling a percentage of the sales to social upliftment.

Crypto exchange Gate.io announced the upcoming listing of Mirror World NFTs on its NFT marketplace, which went live on June 1st, 2022.

AI/ML NFT platform SwopX launched the first fully integrated multi-chain NFT platform consisting of a marketplace with live analytics for price forecasting, trend insights, authentication, and fraud protection protocols, which also offers an innovative lending platform for collateralized borrowing against NFTs.

Yokozuna Finance also launched an innovative play-to-earn NFT model called NFT Auction Market, which offers participants the opportunity to use Functional NFTs to monetize their gameplay.

Some other happenings in the NFT domain include-

On the partnerships front, The OneRare Foodverse joined the IQ protocol to expand its utilities in the NFT market, where the latter’s rental capabilities will be implemented in the metaverse as a safe way for passive income. Even the EuroLeague elite basketball competition announced a new, multi-year partnership with Clancy International to launch interactive video NFT collections.

As for the expansions, Prada joined the NFT race after plans to launch 100 Ethereum NFTs to go along with its latest Timecapsule apparel release. Similarly, the East Asia Football Federation (EAFF) struck a deal with NuArca Labs, which will become the regional association's official NFT partner focusing on the upcoming 2022 EAFF E-1 Football Championship.

Regarding the numerous funding rounds, NFT marketplace Ayoken raised $1.4 million in pre-seed funding to enable users to grow their revenue streams through digital collectibles. Coins.ph co-founder co-launched NFT rental platform Playedex with $2m in seed funding, allowing players and guilds to rent gaming assets from NFT holders, connecting all stakeholders in the P2E sphere through one streamlined platform.

What’s more – a former OpenSea executive was indicted for fraud and money laundering in a case federal prosecutors in the Southern District of New York characterized as insider trading in NFTs.

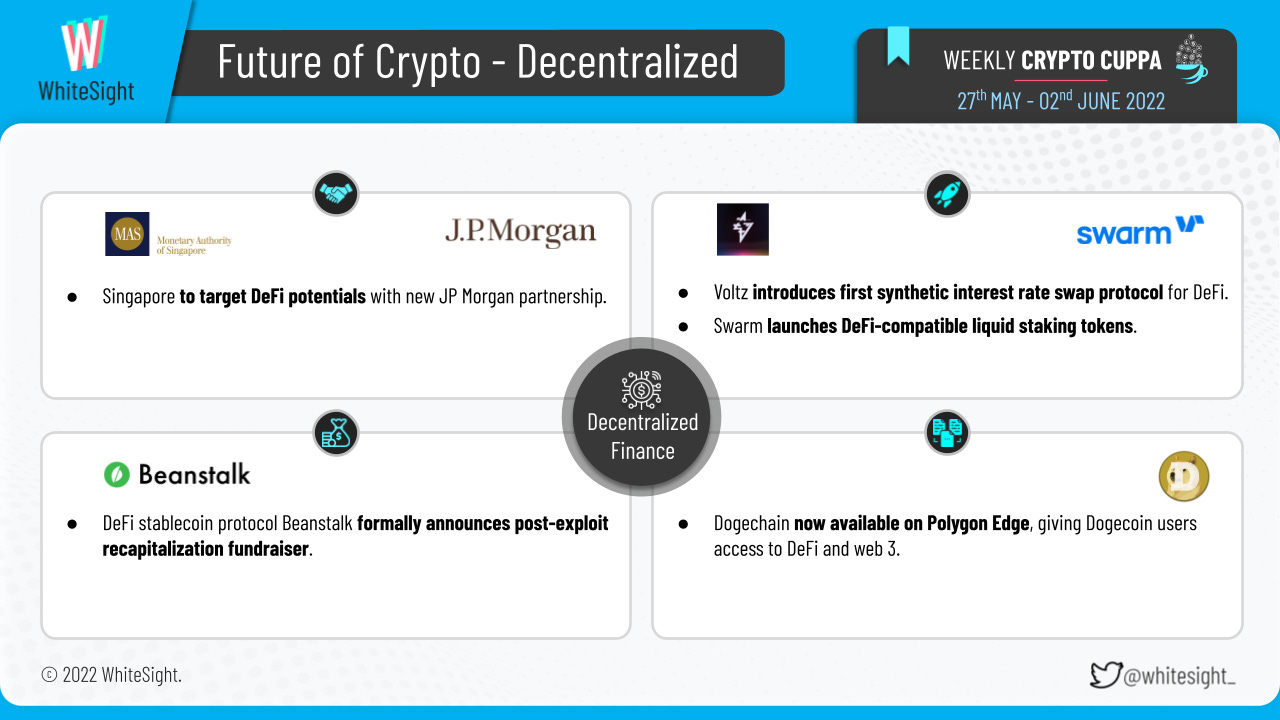

Last week, ecosystem players from diverse industries and geographies targeted the DeFi sphere to map out its potential.

When it comes to the various launches, Voltz Protocol launched a synthetic, capital-efficient interest rate swap automated market maker (AMM), which will now provide the means for DeFi to compete with the interest rate swap marketplace in TradFi. Similarly, the Berlin-based multi-asset DeFi platform Swarm was in the news for its plans to introduce institutional-grade liquid staking tokens capable of integrating into DeFi AMM pools to generate additional yield in a protected environment.

Furthermore, decentralized credit-based stablecoin protocol Beanstalk announced "The Barn Raise," a fundraiser to restore $77M of liquidity stolen from the protocol during recent governance exploit and further recapitalize pre-exploit participants. The Monetary Authority of Singapore (MAS) launched a digital asset pilot program to examine the potential of asset tokenization and decentralized finance tagged ‘Project Guardian’ in collaboration with institutions such as JPMorgan Chase & Co., Marketnode Pte, and DBS Bank Ltd. Dogechain also went live on Polygon Edge, implying that Dogechain would now have the intrinsic ability to deploy dApps, create NFTs or even build blockchain games.

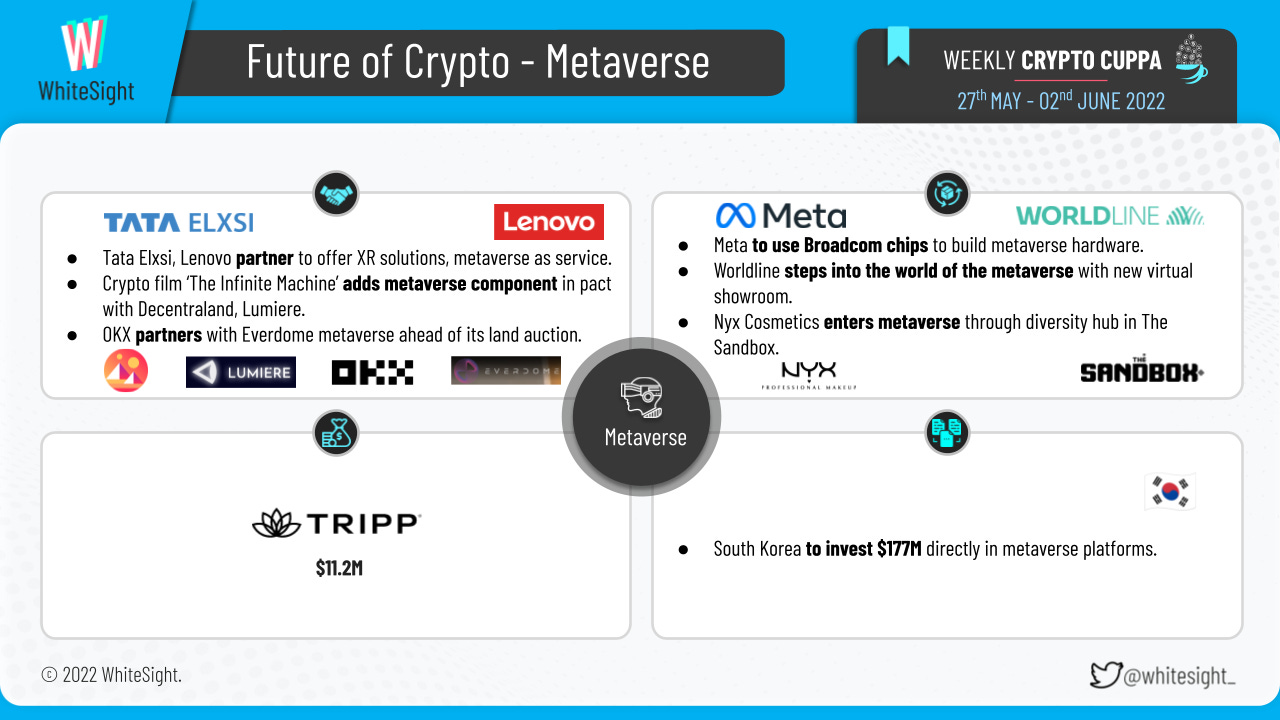

An eventful array of partnerships served to be the key highlights of the expanding metaverse industry.

Tata Elxsi and Lenovo announced a partnership to develop smart XR solutions for enterprise and engineering applications, aiming to offer end-to-end solutions and services for customers using Lenovo’s smart XR devices in both large and small offices and industrial settings.

Nyx Professional Makeup was revealed as a collaborator for the People of Crypto Lab’s (POC) metaverse diversity hub set to debut in The Sandbox, where the trio has announced plans to work together on the Valley of Belonging space.

OKX announced it acquired a substantial land holding in the hyper-realistic metaverse Everdome, where both will work to bring their partners and others into the metaverse to design unique cultural programming and innovative experiences that surprise and delight.

Similarly, Versus Entertainment brought on board Decentraland and Lumiere to develop metaverse and NFT angles for its ongoing film project “The Infinite Machine.”

On the other hand, Worldline stepped into the world of the metaverse with a new virtual showroom located in the Crypto Valley area of Decentraland, hoping to develop its presence in the domain. While Meta Platforms Inc hit the headlines for its plans of using Broadcom Inc’s custom chips to build its metaverse hardware, becoming the chipmaker’s next ASIC customer, the Government of South Korea announced it would invest in metaverse projects directly to kickstart national jobs and companies in this field. Digital solutions provider Kiya.ai also announced the launch of India’s first-ever Banking Metaverse – Kiyaverse. In the first phase, Kiyaverse will allow banks to extend their own Metaverse for clients, partners, and employees through services that will include Relationship Manager & Peer Avatars and Robo-advisors.

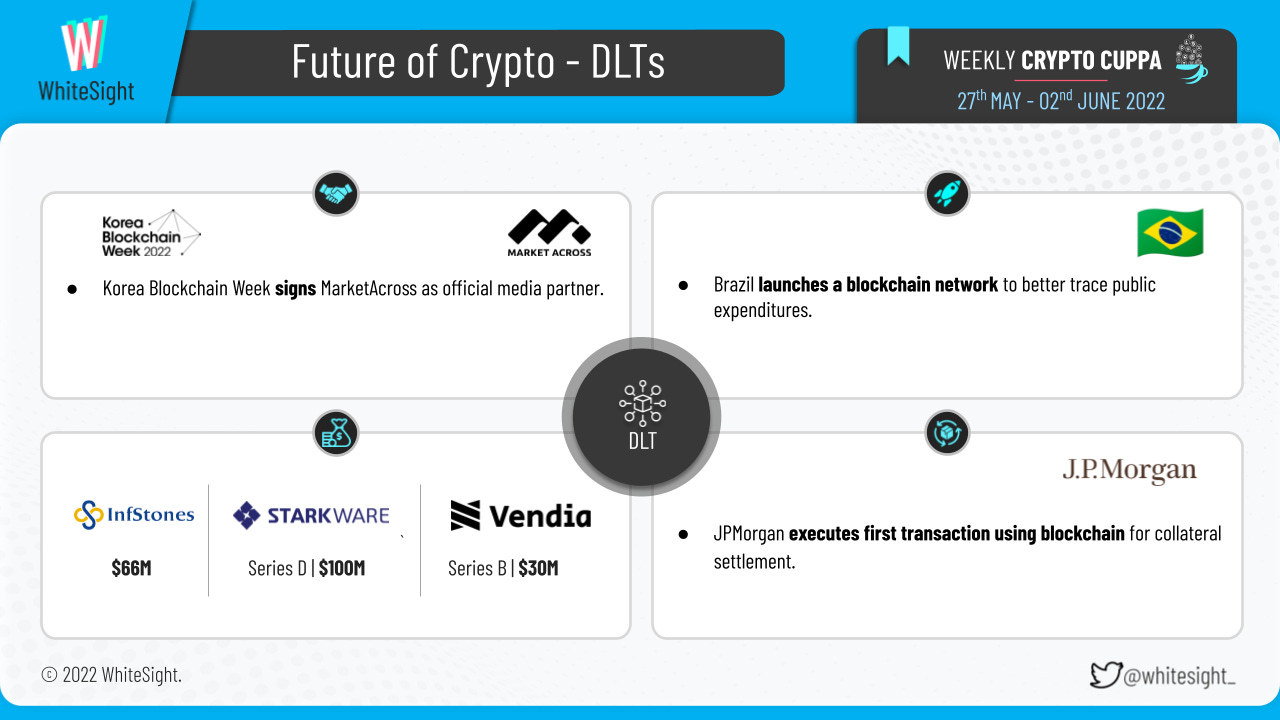

A plethora of funding rounds made most of the eventful affairs in the DLT segment.

Blockchain infrastructure provider InfStones raised $66M in a new funding round led by SoftBank Vision Fund 2 and GGV Capital, which will help InfStones grow its team, build out its blockchain infrastructure solutions, expand into new markets and pursue potential partnerships and acquisitions.

Blockchain technology builder StarkWare Industries raised $100M in a Series D funding round at an $8B valuation led by Greenoaks Capital and Coatue.

Blockchain-based enterprise data-sharing platform Vendia secured $30M in a Series B funding led by NewView Capital to scale the platform.

Moreover, JPMorgan Chase developed a collateral management blockchain solution for traditional finance. Last week it executed its first transaction by tokenizing BlackRock money market fund shares and using them as collateral. Brazil’s new government blockchain network went live under the cooperation agreement between the Court of Accounts of Uniam (TCU) and the Brazilian Development Bank (BNDES). Crypto exchange Binance also made it to the bulletins after closing a $500M investment fund to boost blockchain, web 3, and value-building technologies.

Additionally, Asia’s flagship blockchain event, Korea Blockchain Week (KBW), appointed blockchain PR and marketing firm MarketAcross as their official global media partner.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Crypto Cuppa, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include exploring how The Future of Financial Services Will Run on Open Rails and Unearthing The Bustle In Green Finance: Earth Day 2022.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️