We’re back at it again to make your weekend read a delightful one with a new edition of the Future of Crypto Newsletter! If you're new and intrigued, read on to satisfy your curious taste buds and join other crypto nerds in receiving some fresh Weekly Crypto Cuppa, delivered right to your inbox every Saturday! ☕️

Before diving into the steaming cuppa brimming with the piping hot affairs of the Cryptosphere, we bring you the Top 10 Crypto news across the six dynamic themes that are coloring the Future of Crypto:

Let's get down to business then 😎

The crypto industry is recovering, and it’s recovering fast! A range of intriguing headlines, including partnerships and product launches, made for quite the stir in Edition #16. The DLT segment took the crown as the most dynamic theme of the week.

Here’s the TL;DR:

China trials digital yuan CBDC student card to track purchases.

Sumitomo Mitsui Trust partners with Bitbank to establish a crypto firm targeting institutional clients.

OpenSea launches NFT marketplace Seaport.

Visual storytelling platform Disguise launches metaverse solutions division.

Crypto Valley Venture Capital launches African Blockchain Early-Stage Fund.

For the longer read, let’s get going —

The CBDC segment was bustling with regulatory and developmental undertakings from several countries around the globe.

In China, the latest application of the digital yuan CBDC was rolled out as the digital RMB smart student ID card, a SIM card supporting NFC for payments and identity, and GPS to enable the child’s location. In America, the US Congress introduced 50 digital asset bills and regulations involving crypto taxation, CBDC, crypto clarity on the regulatory treatment of digital assets and digital asset securities, supporting blockchain technology, and more. Multiple banking and finance industry bodies have responded to the US Federal Reserve consultation on a potential CBDC, including the American Bankers Association (ABA), Bank Policy Institute (BPI), and the Institute of International Finance (IIF), none of which were particularly supportive, with the IIF being the least resistant.

In other news, Brazil’s crypto exchange Mercado Bitcoin announced its partnership with the Stellar Development Foundation (SDF) to participate in the development of a CBDC by working on one of the nine projects promoted by Brazil’s LIFT. Mobile wallet SunCash also launched a new face pay feature that will let consumers in the Bahamas authorize in-store payments using the country’s Sand Dollar CBDC.

The Crypto-coins vertical has witnessed several product launches, with companies worldwide embracing various cryptocurrencies within their current portfolios.

When it comes to the various products, GameStop launched a beta for its very own Ethereum wallet that lets users store, send, and receive both cryptocurrency and NFTs through their web browsers. Andreessen Horowitz announced a new $4.5B fund for backing crypto and blockchain companies, one-third of which will be earmarked for seed deals exclusively. India's crypto marketplace and research portal Coingabbar.com also launched along with the GCI -20 crypto index with detailed information of 13000+ crypto assets on its website. Similarly, CoinDCX launched its crypto yield program ‘Earn’ where customers can earn interest on their crypto assets in 16 cryptocurrencies which will be deployed across multiple yields generating opportunities such as margin trading, lending, and staking to generate returns.

What’s more -

Asset manager Sumitomo Mitsui Trust was in the news for its plans to tap Tokyo-based crypto exchange Bitbank to set up a company offering digital asset services to institutional clients from 2022. Similarly, Stripe teamed up with crypto start-up OpenNode to allow its customers to accept Bitcoin payments through a new app, enabling customers to convert incoming payments and any amount of their balance into Bitcoin.

Coinbase grabbed the headlines after becoming the first crypto company to join the Fortune 500 list.

Cryptocurrency tax services firm ZenLedger raised $15M in Series B funding led by ParaFi Capital at a $27M valuation to expand its team.

Crypto exchange Binance made the bulletin for its plans to help Kazakhstan develop digital assets regulation that includes integrating banking infrastructure within the cryptocurrency market and helping with the country's blockchain strategy as the Central Asian nation looks to develop its crypto industry beyond Bitcoin mining.

The Stablecoin segment observed some relief as industries showed signs of hope with their respective moves.

Polygon launched an uncapped multimillion-dollar fund so Terra-built projects can move to its blockchain. Jarvis Network partnered with Techemynt to incentivize liquidity providers contributing to their Curve pools with swap fees and a portion of JRT (Jarvis governance token). FinTech startup Pebble was in the news for offering 5% APY on all cash deposits using non-algorithmic stablecoins.

Several innovative launches surrounding the NFT space created quite the buzz that turned heads last week, with significant players entering the emerging sphere.

NFT marketplace OpenSea unveiled a new web 3 marketplace protocol– SeaPort–which will allow NFT merchants to make direct trades with digital collectibles buyers, fully governed by smart contracts.

eBay launched a series of exclusive NFTs, including Genesis, which will feature 3D and animated interpretations of the iconic athletes featured on Sports Illustrated covers over the years through a strategic partnership with OneOf.

EQONEX Limited announced it had completed its first-ever direct to custody over-the-counter (OTC) NFT trade, a part of the company’s new offering that provides exclusive NFTs through a network of regulated partners and provides storage for the assets within Digivault.

Cryptocurrency exchange Elite Token announced the unveiling of NFTs based on the beta version of the cross-metaverse p2e gaming platform Runiverse.

The NFT space seemed Happy as Pharrell Williams launched a new NFT platform called the Gallery of Digital Assets or GODA to give contemporary artists a curated platform to approach the digital world.

As for the funding rounds, the digital art collective UnicornDAO raised $4.5M to empower women and LGBTQ-led NFT initiatives, with members from every corner of the NFT market coming together to participate in the round. Similarly, NFT marketplace FanTiger raised $5.5M in a seed round led by Multicoin Capital to grow its team across product and tech, extend industry partnerships, and onboard well-known and aspiring Indian artists. NFT social marketplace Bubblehouse also raised about $9M in a seed funding round led by Cassius Family to expand its marketplace and portfolio of partners across brands, art, athletics, hospitality, music, fashion, and influencer categories.

Additionally, Rarible Protocol grabbed the headlines after integrating with Immutable X's Layer 2 (L2) scaling solution to enable projects building upon the protocol to instantly trade high-quality gaming NFTs on Ethereum via Immutable X, without any gas fees or negative impact on the environment.

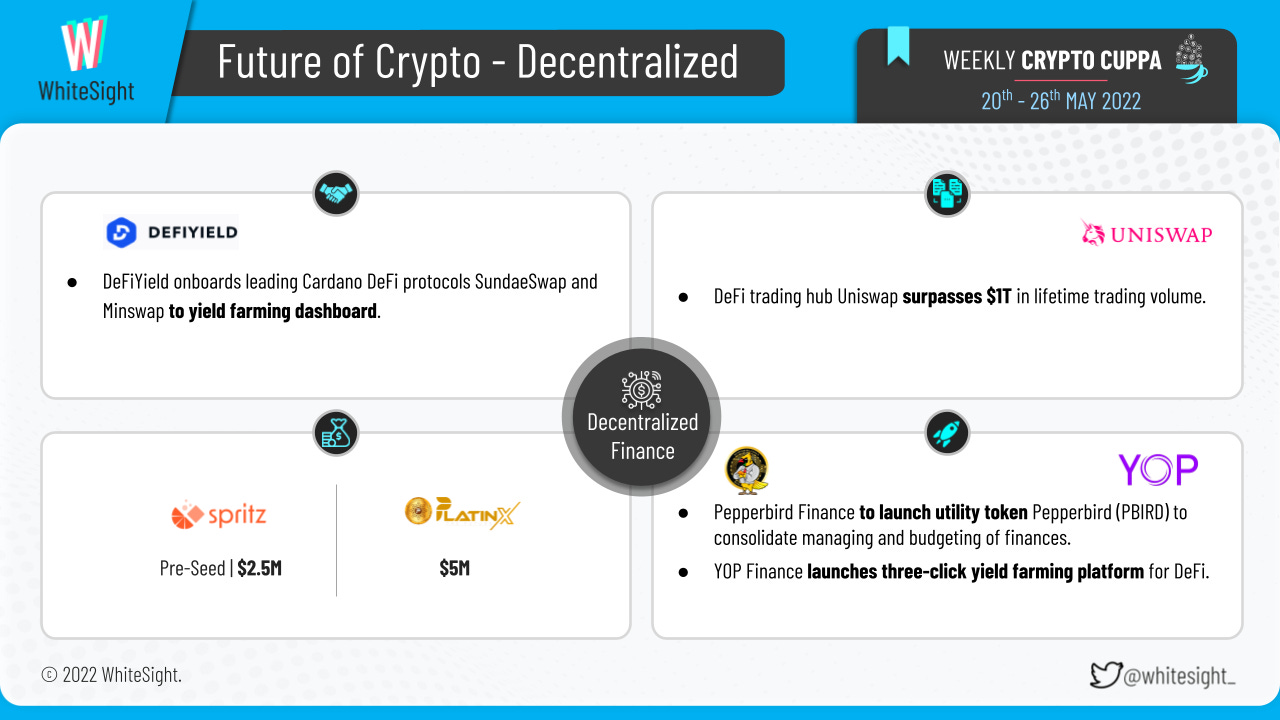

The DeFi segment had an assorted mix of project launches, funding rounds, and milestones that made for an eventful scoop.

DeFi asset management platform Pepperbird Finance scheduled the launch of its utility token Pepperbird (PBIRD) in May 2022, which has a comprehensive asset management system designed to consolidate the managing and budgeting of one’s finances in both the centralized and decentralized sphere. DeFi Technologies announced its subsidiary Valour received approval to begin trading Valour Enjin (ENJ) EUR and Valour Cosmos (ATOM) EUR on the Frankfurt Stock Exchange. Similarly, YOP Finance launched a platform that lets users earn passive income on their crypto across top blockchain platforms from a clean, simple, and easy-to-use application.

On the fundings front, Spritz Finance closed a pre-seed round of $2.5M from notable investors, including Polygon co-founder Sandeep Nailwal, former Coinbase CTO Balaji Srinivasan, and Aaron Harris, which will be used for hiring, expanding the platform’s crypto payments integrations, and making the product compatible across multiple blockchains. Crypto solutions platform Platinx also secured a $5M funding to help bolster their Algo Trading Software.

Moreover, DeFiYield announced the addition of Cardano-based DeFi protocols SundaeSwap and Minswap to its platform, allowing individuals to track DeFi investments on Cardano in addition to the existing chains and protocols already offered on the platform. DeFi trading venue Uniswap announced it had processed $1T in lifetime trading volume, half of which has come in the 4th quarter of 2021.

An eventful array of activities served to be the key highlights of the expanding metaverse industry.

Mobile customer service platform Helpshift launched its first free plan for in-app metaverse customer support with augmented reality experiences. Visual storytelling platform for extended reality (XR) solutions Disguise launched a Metaverse Solutions division for live, virtual production, and audiovisual location-based experiences. Similarly, music metaverse gaming platform Pixelynx unveiled its first mobile game, Elynxir, at Niantic Lightship Summit, which will be available to the public in August 2022.

Some other news that found itself in the reportage:

Lumos Labs raised $1.1 mn in a seed round led by Delta Blockchain Fund to launch a developer-centric metaverse platform where developers can learn, earn and explore developer-centric opportunities. Similarly, metaverse platform BUD closed $36.8M in a Series B round led by Sequoia Capital India to launch web 3 products and NFT projects.

New Chinese Fund and Enoki Film announced a collaboration with Football Metaverse Pte Ltd to launch a Football Metaverse project to bring about an interactive and immersive Football Metaverse Theme experience to the online football communities. On the same note, color authority company Pantone partnered with Spatial Labs (sLABS) to launch a wearable hardware product that looks to standardize colors in the metaverse.

Virtual real-estate marketplace Origin Metaverse announced its plans to integrate the AI-powered identity verification and AML screening system, Shufti Pro, into its services to help drive mass adoption of virtual real estate and physical real estate as NFTs securely. Additionally, Zee entertainment expressed its intent to enter the metaverse with NFTs from TV shows, movies, music, and original web series to increase customer retention on its platform.

The DLT vertical saw a range of product launches that made some attention-grabbing headlines last week.

DevOps solution JFrog launched open source project Project Pyrsia, which uses a blockchain platform and Sigstore Cosign and Notary V2 cryptographic signature software to secure software packages.

Blockmate Ventures announced the launch of its blockchain IoT platform Hivello which will be connected to the Helium network, joining which individuals and property owners can earn passive income by hosting a Hivello hotspot at their premise.

China’s state-backed Blockchain-based Service Network (BSN) was in the news for planning its first major international expansion with a product called the Spartan Network that will eventually be made up of half a dozen public blockchains that do not operate with cryptocurrencies.

Crypto Valley Venture Capital launched an Africa-focused fund to support blockchain startups on the continent by investing in 100 startups over the next four years.

Layer 1 blockchain Celestia launched its “Mamaki” testnet, making it one step closer to becoming the first fully functional modular blockchain that allows users to spin up their own blockchains at scale while maintaining the security standards of rival layer 1s, separating consensus from execution.

On the other hand, blockchain-based carbon-credit platform Flowcarbon announced it raised a total of $70M in venture capital funding led by a16z to tokenize carbon credits and build an on-chain market to drive funding directly to projects that reduce or remove carbon from the atmosphere. MetaKing Studios also secured $15M in seed-stage funding led by Makers Fund and Bitkraft Ventures to make the blockchain-based multiplayer online game Blocklords. While web gaming platform Kongregate teamed up with Immutable X for a $40M fund to give grants to developers who make blockchain games for Kongregate.com, Polygon Networks announced a partnership with Tokenology and MSP Recovery to deliver a new healthcare claims platform that will leverage blockchain technology to solve healthcare’s biggest problems, including fraud, inefficiency in payments, and antiquated processes.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Crypto Cuppa, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include acknowledging the many Setting The Record Straight on Digital-first Banking Taxonomy and Unearthing The Bustle In Green Finance: Earth Day 2022.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️