We heard your curious cups were awaiting some weekly crypto buzz, which is why we’re back with a new edition of the Future of Crypto Newsletter! If you're new and intrigued, read on to satisfy your curious taste buds and join other crypto nerds in receiving some fresh Weekly Crypto Cuppa, delivered right to your inbox every Saturday! ☕️

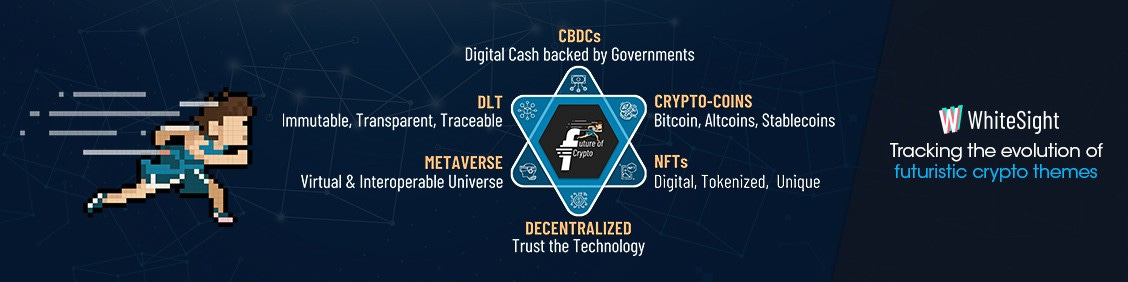

Despite the current turbulence that the crypto industry is facing, a range of intriguing headlines, including partnerships and product launches, made for quite the stir in Edition #14 of the Future of Crypto newsletter. The avant-garde Crypto-coins segment came out as the most dynamic theme of the week.

Here’s the TL;DR:

Cryptocurrency TerraUSD falls below its fixed value, triggering a selloff.

Google Cloud establishes a new team for web 3 infrastructure.

Instagram to start testing NFT sharing.

NFT Plazas launches an automated metaverse advertising system.

Opera crypto browser adds support for Binance blockchain and dApps.

For the longer read, let’s get going –

Governmental bodies worldwide are recognizing the potential of CBDCs in fostering financial inclusion and boosting economic development, which is why regulation seemed to be on the rise for last week’s affairs in the emerging space.

In Africa, the Central Bank of Nigeria became the latest governmental body to allow bill payments using digital currency when it approved the use of the upgraded version of its CBDC, eNaira. Speaking of Nigeria, the government of Tanzia hit the headlines for its plans to roll out a CBDC, where it is looking to learn from other countries with greater expertise in the area, such as Nigeria. China also enabled its citizens to pay their fares in digital yuan on trams and trains in two more cities – Xiamen and Guangzhou. Additionally, the International Monetary Fund turned its attention to the Bahamas’ CBDC, the Sand Dollar, recommending that the country accelerate its education campaigns and continue strengthening internal capacity and oversight. Even the Bank of Israel received feedback for its published paper on the draft model for a potential digital shekel CBDC. Many supported moving forward with research but were keen to use blockchain as a foundation.

In other news, CBDC infrastructure provider EMTECH joined forces with HaitiPay to demo its first CBDC + Proof of Concept and showcase the impact it can have on the Haitian economy. Jamaica’s Jam-Dex CBDC also made the news as it is set to become publically available, intending to offer a more secure, convenient alternative to cash.

An array of diverse activities marked most of the happenings in the Crypto-coins landscape last week.

On the funding front, crypto exchange KuCoin raised $150M in pre-Series B funding at a valuation of $10B to expand its product offerings to increase its presence in the web 3 market. Crypto forensics startup Chainalysis secured $170M in a Series F round at an $8.6B valuation led by GIC. South Korea’s Xangle also closed a $17M Series B investment round. African crypto startup Jambo similarly raised $30M with hopes of becoming the super app of Africa. India-based CoinDCX’s launch of its CoinDCX Ventures investment arm to invest in early-stage crypto and blockchain startups globally also made for a key highlight in the crypto-coins segment.

As for the other activities, Google’s cloud group announced forming a new team specifically for building blockchain infrastructure in a show of strong commitment to stepping into web 3. Luxury fashion house Gucci made the bulletin for its plans to begin a pilot project where it will accept crypto payments at five selected stores across the US in a move that marks the extension of its web 3 and physical communities. SBI Motor Japan also announced that it would accept Bitcoin and Ripple as payments for used cars on its e-commerce website.

Many players are also driving blockchain innovation through their collaborative efforts. Blockchain Association Singapore and Crypto.com signed a Memorandum of Understanding to advance both parties’ work in the NFT ecosystem and foster wider collaboration in the space. Crypto exchange Bibox partnered with Nuvei to streamline user access to over 145 cryptocurrencies. Conversely, Argentina banks called a halt to all crypto operations in a move to prevent money laundering, cyber attacks, and cross-border terrorism. NVIDIA also made the news for being fined $5.5M by the Securities and Exchange Commission for failing to adequately inform investors about the demand cryptocurrency miners had placed on its graphics cards.

The Stablecoins vertical witnessed quite the rollercoaster of events for the week, with the spotlight being shed on the risk and growth of the expanding industry. In a recent turn of events, cryptocurrency TerraUSD fell below the fixed value, a drop that caused ripples in Ether and Bitcoin. The US Federal Reserve also published its semi-annual Financial Stability Report, citing the run risk of stablecoins and other related risk factors. On the other hand, cryptocurrency exchange Bitso announced its Bitso+ feature that allows clients to gain up to 15% annually on USD stablecoins.

Last week, the NFT space was vibrant with eventful happenings, witnessing several partnerships across different platforms.

Manchester City and Puma announced their first collaborative digital art drop, 93:20, created by Musketon. The piece artistically displays a unique clockwork environment with cogs and Manchester City artwork within Sergio Aguero’s goal-scoring PUMA boot. Similarly, Sony Group Corporation partnered with Theta Labs to launch 3D NFT assets that will be crafted for the Sony Spatial Reality Display. Decentralized platform GuardianLink announced the launch of its Chelsea Memorabilia NFTs collection – ranging from collectibles dated back to 1905 when the club was formed to the recent club milestones in the modern era on its web 3 marketplace Jump.trade. Music icon Madonna’s partnership with Beeple to release an exclusive three NFTs collection called Mother of Creation also grabbed attention.

When it comes to the various products, Opensea announced in a series of blog posts that they are rolling out features to improve authenticity in the digital marketplace, using image recognition tech to scan NFTs on the platform and compare them with authentic collections. Popular art museum The Vatican announced a collaboration with metaverse developer Sensorium Corporation to create an official NFT exhibition that will be available in VR and on desktops. Cloud company Akamai unveiled an NFT artwork dynamically fueled by the internet. The NFT will visually evolve in real-time as internet traffic changes and cyberattacks launch based on data drawn from the Akamai Intelligent Edge Platform.

In other news, Meta CEO Mark Zuckerberg confirmed that the social network is testing NFTs on Instagram, with similar functionality coming soon to Facebook. What’s more – NFT platform Arianee raised a $21M Series A in a round led by Tiger Global, where the structure of the investment was in both equity and $ARIA20 token. NFT platform Freeverse.io raised $10.52M in a Series A funding round co-led by Earlybird and Target Global to continue the development of its product and core technology.

A range of head-turning partnerships made for an eventful buzz in the DeFi sphere.

Online gaming platform FACEIT announced a multi-million dollar partnership with Cake DeFi to provide the latter with authentic brand exposure to all FACEIT users globally through multifaceted gaming experiences that offer a chance to win crypto. Crypto staking app Giddy partnered with FinTech leader Plaid, making it easier for users to share their financial data securely and seamlessly to move funds in and out of their Giddy account. While Flurry Finance and KyberSwap joined forces to make deposits easier for novice DeFi users eliminating issues like Slippage, gas fees, and complex conversion processes, Friktion Labs partnered with CeFi platform Paradigm to bring institutional liquidity to DeFi options and perpetual markets by unlocking efficient price discovery and execution for Friktion auctions.

As for the other affairs, the EU’s executive arm revealed it will test an embedded form of DeFi’s supervision, which is now mainly unregulated, through a pilot. Liquidity app Jet Protocol announced the first step in building a truly decentralized and censorship-resistant protocol to provide infrastructure to access on-chain financial debt instruments by leveraging Solana’s speed and low fees. Bancor also announced the launch of its new automated DeFi liquidity solution protocol Bancor 3, which empowers token projects and their holders to drive healthy on-chain liquidity in their native tokens. Moreover, the social trading platform FNDZ was in the news for its plans to release a platform staking feature that will give holders of FNDZ‘s native token, FNDZ, the opportunity to earn a portion of fee-based revenues generated by the copy trading platform.

With the notion of metaverse fast becoming a favorable concept for the business ecosystem, firms across industries are eager to expand into this sector.

For instance, metaverse yacht company Cyber Yachts was awarded patent-pending status by the United States Patent and Trademark Office (USPTO) as a part of its plans to launch its slate of metaverse and in-real-life (IRL) events. UAE flag carrier Emirates was also in the news for its plans to embrace advanced digital solutions such as blockchain, metaverse, and cryptocurrency to connect with customers faster and more flexibly. Real Madrid partnered with Astosch Technology to build a digital recreation of the Santiago Bernabeu stadium, offering fans the ability to walk the corridors of the famous arena – including a 3D recreation of the trophy cabinet – and the surrounding area.

As for the various launches, NFT news website NFT Plazas announced the launch of its innovative new booking system, which allows users to upload and pay for customized billboard advertisements in the metaverse using an automated book-and-pay system. Dubai’s Virtual Assets Regulatory Authority (VARA) launched a virtual headquarter called VARA MetaHQ in the Sandbox, enabling the regulator to have first-hand experience of the industry it was set up to regulate. Similarly, digital asset platform Amber Group announced its entry into the metaverse with web 3 enablement platform Openverse, supported by real-time 3D rendering technology to create an experiential digital world for all users.

As for the other news:

Decentralized mobility marketplace Iomob partnered with sustainability-focused metaverse Next Earth to collaborate on developing a service to plan real-life journeys via the metaverse.

Through an upskilling program they launched, creative transformation firm WPP partnered with Epic Games to help the former’s client brands build digital experiences for the metaverse.

XR Central partnered with Taiwanese PC Giant GIGABYTE and IPL team LSG to create an exclusive digital-access-only fan zone.

Crypto startup Lighthouse Labs raised $7M in seed funding led by Accel, BlockTower, and Animoca Brands ahead of its metaverse search engine launch in 2022.

Metaverse co-creation platform StarryNift raised $10M in a pre-series A round led by Susquehanna International Group to power the launch of its metaverse, Starryverse, which has a marketplace, a spaceship expedition game, and other features.

A range of creative launches across various sectors made most of the headlines for the DLT vertical.

Blockchain bond platform LedgerEdge, built in collaboration with leading global banks, asset managers, and market makers, went live.

NEAR Foundation partnered with the local Kenyan blockchain community, Sankore, to launch a regional hub dedicated to ongoing blockchain innovation, education, and talent development throughout the African continent.

Elrond Network announced the completion of its integration with blockchain analytics platform AnChain.AI. This will provide applications using Elrond Network blockchain technology with the ability to quickly make sense of large data sets pertaining to on-chain transactions.

India’s securities regulator, SEBI, announced that the NSDL launched the Security and Covenant Monitoring System, a blockchain system to monitor the health of bond issuances.

EY organization also announced the production release of the third generation of EY Blockchain Analyzer: Reconciler, which offers various features, including importing enterprise records, reconciling off-chain enterprise records with on-chain transactions, and tracking wallet balances.

What’s more – Opera announced the integration of Binance Blockchain (BNB) in its crypto browser, wherein users will be able to buy BNB crypto token with fiat and send and receive it using the built-in Opera crypto wallet and access dApps. The state of Utah passed a Bill to create a Blockchain and Digital Task Force responsible for regulating blockchain initiatives and formulating policy recommendations on matters related to blockchain technology. While Andreessen Horowitz led a $40M round for Seattle startup Irreverent Labs, which is building a blockchain-based fighting game called MegaFightClub that pits chicken-esque fighters against each other, Brazilian esports organization Vivo Keyd announced a partnership with blockchain company Liqi for a one year deal that will see Liqi collaborate with the organization to launch NFT and Fan Token products. Additionally, NFT blockchain Flow announced the launch of a $725M blockchain ecosystem fund to promote innovation in games, apps, and digital assets in the web 3 sector. The fund can be accessed by developers globally who are into DeFi, blockchain gaming, and digital content.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Crypto Cuppa, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include acknowledging the many Setting The Record Straight on Digital-first Banking Taxonomy and Unearthing The Bustle In Green Finance: Earth Day 2022.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️