We’re back with our weekly serving of a brewing cuppa filled with the latest affairs in this new edition of the Future of Crypto Newsletter! If you're new and curious, read on to satisfy your taste buds and join other crypto nerds in receiving some fresh Weekly Crypto Cuppa, delivered right to your inbox every Saturday! ☕

Edition #13 brings with it the latest happenings surrounding the Cryptosphere to keep your cups of curiosity up-to-date. An array of innovative launches and market expansions remained at the forefront for the week, with the DLT segment winning the day as the most active segment.

Here’s the TL;DR:

Polkadot launches a cross-chain messaging system to solve blockchain’s bridge problem.

Wikipedia organization decides to stop accepting crypto donations.

Telegram allows users to send crypto payments to other users.

Starbucks to sell NFTs that enable exclusive experiences and perks for customers.

OliveX Fitness Metaverse to let users earn crypto and NFTs while they burn calories.

For the longer read, let’s get going –

The CBDC segment was astir with activities as more and more countries buckle down to introduce their respective CBDC initiatives.

In Asia, the Indian government announced its plans to explore several commercial use purposes for its CBDC, which is to be issued by 2023. China made the news as four of its provinces are testing the digital yuan for use in tax payments, stamp duty, and social security premiums. The Hong Kong Monetary Authority (HKMA) released a discussion paper titled “e-HKD: A policy and design perspective,” which laid out the central banker’s thoughts on retail CBDC, including the potential benefits and challenges, design and legal considerations, and invited public opinion. The Philippines announced its plans to launch its wholesale CBDC pilot project CBDCph in the fourth quarter of 2022, having already signed up several large-scale banks, with plans to look for more. In Oceania, The Reserve Bank of New Zealand (RBNZ) published the results of its public consultation on the future of cash and CBDC, finding strong support for cash despite its declining use.

Furthermore, the Argentinian government has taken the first steps to launch its own CBDC with a new decree identifying the number 207/2022. The same will offer new faculties to the Argentinian mint to be involved in the investigation, development, and issuance of digital currencies.

As crypto-coins continue to enter the mainstream, varied players from sectors far and wide are trying to evaluate the integration of these digitized tokens into their existing frameworks.

Several regulatory steps grabbed attention for the week:

India named the country's Computer Emergency Response Team (CERT) as the national agency for cyber security, including the crypto business, which will require them to keep KYC information and records of financial transactions for five years. The move clarifies which agency has the authority over suspicious or illicit activities in the sector.

Similarly, Uzbekistan published a set of regulatory frameworks for the country's crypto industry, allowing residents to buy or sell crypto only on the local exchanges. Crypto businesses must verify the identity of users through a KYC process and store data about all the transactions for five years.

Argentina’s Banco Galicia added crypto trading to its investment platform targeting young clients who want streamlined access to crypto via traditional banking avenues.

Wikipedia decided to stop accepting donations in cryptocurrency form, for reasons ranging from crypto’s environmental impact to reputational damage to the open-source encyclopedia project.

Authorities in Belgium imposed mandatory registration for crypto exchange providers and custody wallet services, the failure of which invites fines and prohibition of carrying out their respective activities.

Panama's National Assembly approved a bill to regulate the use and commercialization of crypto-assets enabling Panamanians to use crypto-assets as means of payment for any civil or commercial operation not prohibited by law in the country.

As for the different market expansions, Telegram rolled out numerous new features, one of which allows users to send crypto as payment using the organization’s native TON coin by adding Telegram’s wallet bot to their attachment menu. Additionally, Spanish cryptocurrency exchange Bit2me launched its operations in Brazil by introducing an office in the country that will deal with compliance issues to make the exchange a safe option for Brazilians.

In other news, ahead of the Crypto.com Miami Grand Prix, crypto exchange OKX partnered with McLaren Racing in a multi-year deal worth hundreds of millions for various branding purposes. On the other hand, crypto platform Fei Protocol launched a $10M bounty to spur hackers to return nearly $80M of digital assets stolen over the weekend.

The stablecoins segment has been witnessing a series of head-turning events.

While Retrograde partnered with FRAX tokens to bring deep liquidity to the Terra blockchain, Cardano's algorithmic stablecoin Djed went live in the public testnet, allowing everyone to understand the dynamics of the protocol without incurring any risks.

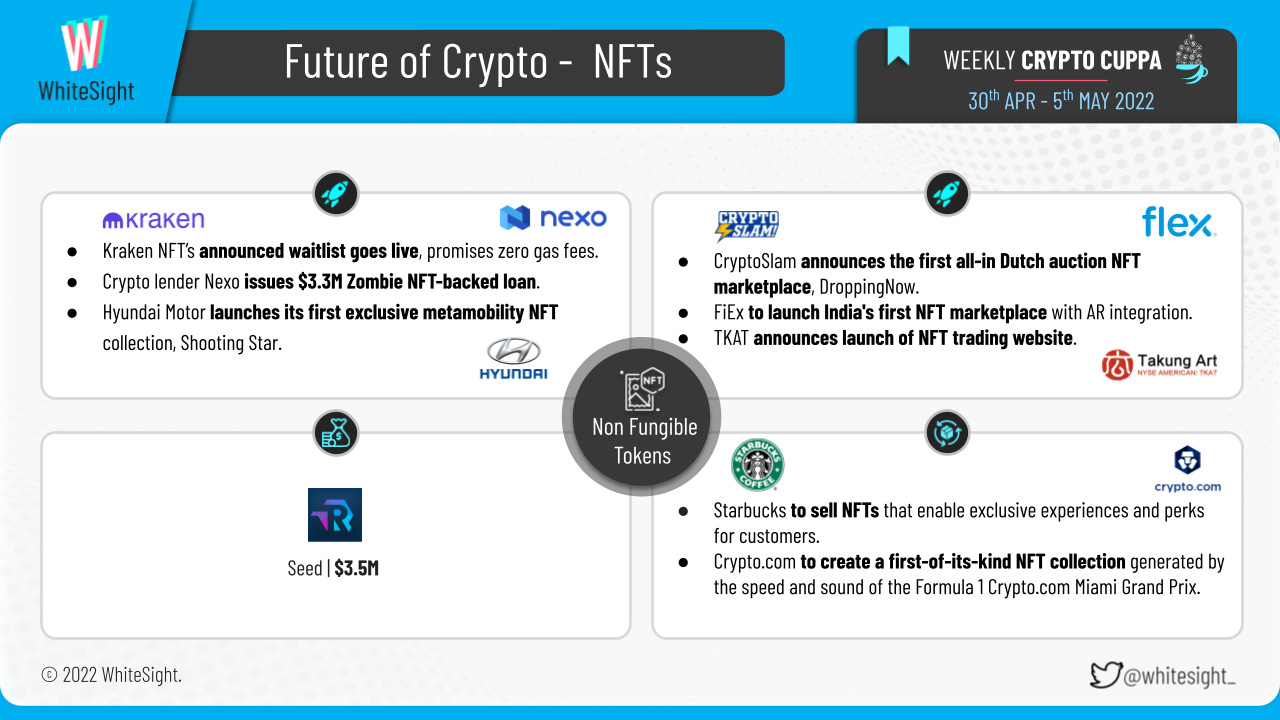

A plethora of innovative launches made most of the headlines in the NFTs segment last week.

Cryptocurrency exchange Kraken’s waitlist went live for its upcoming NFT marketplace, Kraken NFT.

Crypto-lender Nexo issued 1200 Ether in one of the largest loans backed by NFTs using two rare CryptoPunk Zombies as collateral.

VanEck announced the launch of its 1000 VanEck community NFTs designed to highlight the real-world utility of NFT projects by granting holders exclusive and early access to events, research, and more.

Hyundai Motor Company was in the news for its plans to offer its first exclusive metamobility NFT collection, ‘Shooting Star’.

CryptoSlam announces an all-in Dutch auction NFT marketplace DroppingNow which allows sellers to gain liquidity while earning tokenized rewards for selling their NFTs.

Singapore-based digital asset entity FiEx announced the launch of India's first NFT marketplace with augmented reality (AR) integration and new-age digital asset exchange that allows users to discover, mint, purchase, showcase their NFTs and also bring them to the real world using AR technology.

Fine arts online trading platform operator TKAT announced the launch of its own NFTs website Nftoeo.com which allows art collectors and investors to buy, sell and discover exclusive digital art items.

In other news, Starbucks revealed plans to use blockchain-based technology to create a digital community enabling customers to purchase unique NFTs from Starbucks and use them to get special access to Starbucks-related experiences and perks. Crypto.com hit the headlines for its plans to create a collection of NFTs generated in real-time by the speed, sound, and data of the Formula 1 Crypto.com Miami Grand Prix. NFT programming layer Revise raised $3.5M in its seed round led by AlphaWave Global and 8i, which will be used for hiring and expansion. What’s more – DeFi company The Commission announced a paid partnership between The Glimpse Group and its wholly-owned subsidiary company QReal for the development of multiple 3D AR-based NFTs for The Commission Token by leveraging QReal’s expertise in AR development and 3D modeling to design over two dozen gilded 3D models to be minted as NFTs.

Many industry players are recognizing the potential for growth in the DeFi space, and are making the best of the opportunities presented through varied activities.

BillHunters Group was in the news for their plan to launch a new contract trading product where aggressive customers can choose their own high-yielding products and deals by integrating mainstream NFT trading platforms such as MakerDao and Compound. Similarly, digital banking platform Revolut hit the headlines for eyeing expansion into decentralized cryptocurrency wallets. The firm is further looking at the mortgage sector as a part of its plan to become a financial super-app.

In terms of market expansions, Sienna Network launched its private crypto lending platform SiennaLend where crypto users can use the platform to earn interest on their crypto and borrow crypto from the platform — all privately. The DeFi Kings announced the launch of its new utility-based rewards token, a deviation from the traditional volume-based token rewards, where 13% of each transaction will be rewarded back to holders in their preferred cryptocurrency from a rich list of options that include Ripple (XRP), BUSD, Ethereum (ETH), ADA, and Bitcoin (BTC).

In other news, Element Finance raised a $32M Series A round at a $320M valuation led by Polychain Capital to hire more people across all areas. Digital asset data provider Amberdata raised $30M in Series B funding led by Knollwood Investment Company to grow Amberdata's engagement with prospective clients across the US and internationally. Additionally, Aeterna announced the launch of its native token, $Aeterna, which will assist the project's progress toward a DeFi automated ecosystem structure.

The metaverse vertical witnessed an assorted mix of diverse activities as more and more ecosystem participants buckled up to make their debuts.

FLOV Market launched a mixed reality metaverse marketplace wherein the project's first phase will include releasing a collection of one thousand exclusive NFTs, and the second phase will consist of virtual and real-world meets.

On the partnerships front, Niantic partnered with UK-based digital technology authority Digital Catapult to develop a real-world metaverse that will explore how AR technology can define the real-world metaverse, becoming the next platform for social interactions, and enriching human experiences and bringing people closer together. Similarly, Threedium was in the news for its plans to extend its existing working relationship with RarerThings. The strategic partnership focuses on providing existing Threedium clients with strategic web 3 advice and offering RarerThings clients access to Threedium’s products.

As for the other news, Meta made the bulletin as it is likely to bring four new virtual reality (VR) and mixed reality (MR) headsets as part of its Project Cambria that allows users to write and type emails within the VR environment. While OliveX Fitness Metaverse built a Metaverse game called Dustland Runn, which gives crypto and NFT incentives to people using the platform for jogging, running, or sprinting varying distances in the real world, Vision Network was in the news for its plans to be the first metaverse-based blockchain infrastructure provider.

The DLT segment accounted for quite a stir of events that grabbed the headlines for the week.

When it comes to the various launches, blockchain platform Polkadot launched a new cross-chain communications protocol to promote Polkadot’s multichain ecosystem. Illinois-based firm Café Holdings announced the launch of blockchain technology designed specifically for the green coffee industry to bring equality and sustainability to millions of smallholder coffee farmers worldwide while maintaining the highest environmental, social, and governance standards for buyers. Even Creduce announced the launch of the sustainability blockchain token KICHE intending to enable individuals and businesses to adopt a carbon-neutral investment using the KICHEE token smoothly.

As for the market expansions, Samsung Asset Management was in the news for its plans to list a blockchain exchange-traded fund (ETF) on the Hong Kong Exchange in the first half of this year, which tracks cryptocurrencies and blockchain tech companies. Similarly, Nukkleus debuted its new website and brand to show Nukkleus’s latest offerings and its ambition to bring together various payment solutions and build on its background in foreign exchange software.

As for the other events that made quite the buzz last week:

The World Gold Council (WGC) invested in aXedras supply chain, where the WGC CEO will join the board of the Swiss blockchain startup that provides supply solutions for the precious metals sector.

Argo Blockchain PLC announced that its subsidiary Argo Helios entered into additional loans under Argo's equipment financing agreement with NYDIG ABL LLC, which will loan Argo Helios an aggregate principal amount to recapitalize the purchase of digital asset mining equipment for Helios.

Stratis entered a long-term partnership with the charitable foundation of King Oyo to fund a new blockchain innovation center designed to build knowledge and blockchain development skills within the kingdom.

Crypto exchange Binance announced the launch of three key educational initiatives to fast-track educating Indian investors and students about the cryptocurrency and blockchain ecosystem.

Capital Union Bank partnered with blockchain data platform Chainalysis for their risk management software and expertise to ensure the safe and compliant rollout of cryptocurrency solutions, including trading and custody.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Crypto Cuppa, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include acknowledging the many Setting The Record Straight on Digital-first Banking Taxonomy and Unearthing The Bustle In Green Finance: Earth Day 2022.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️