We heard your curious cups were missing the brewing affairs from the crypto universe, which is why we’re back with our weekly cuppa filled with the latest headlines in this edition of the Future of Crypto Newsletter! If you're new and curious, read on to satisfy your taste buds and join other crypto nerds in receiving some fresh Weekly Crypto Cuppa, delivered right to your inbox every Saturday!☕

With Edition #12’s eventful stir, a diverse range of innovative product launches and funding rounds disrupted the digital landscape. The expanding DeFi segment came to light as the most active segment for the last week of the month.

Here’s the TL;DR:

Goldman Sachs offers its first bitcoin-backed loan.

Standard Chartered Bank joins Metaverse after buying land in The Sandbox.

Meta to open its first retail store to highlight metaverse-related products.

Damac Group to invest $100M in Metaverse digital cities.

Crypto lender Maple Finance expands support to Solana.

For the longer read, let’s get going –

The CBDC segment was bustling with regulatory undertakings by several countries around the globe.

In North America, the Governor of the Bank of Mexico confirmed plans to release a retail CBDC to achieve financial inclusion by 2025. In Asia, Bank Indonesia and the Bank for International Settlements (BIS) innovation Hub invited developers to participate in a CBDC hackathon where they looked for participants ready to accept technology challenges related to wholesale and retail CBDCs. Bangko Sentral ng Pilipinas (BSP) was in the news for its plans to launch a wholesale CBDC pilot project, coined CBDCPh, as part of its efforts to promote the stability of the country’s payment system. The Hong Kong Monetary Authority (HKMA) also issued a discussion paper inviting views on the critical issues around a retail CBDC. In Europe, the Central Bank of the Russian Federation hit the headlines as it is on the verge of releasing its solution for international settlements, the digital ruble, which will be launched on a pilot basis for making payments to other countries.

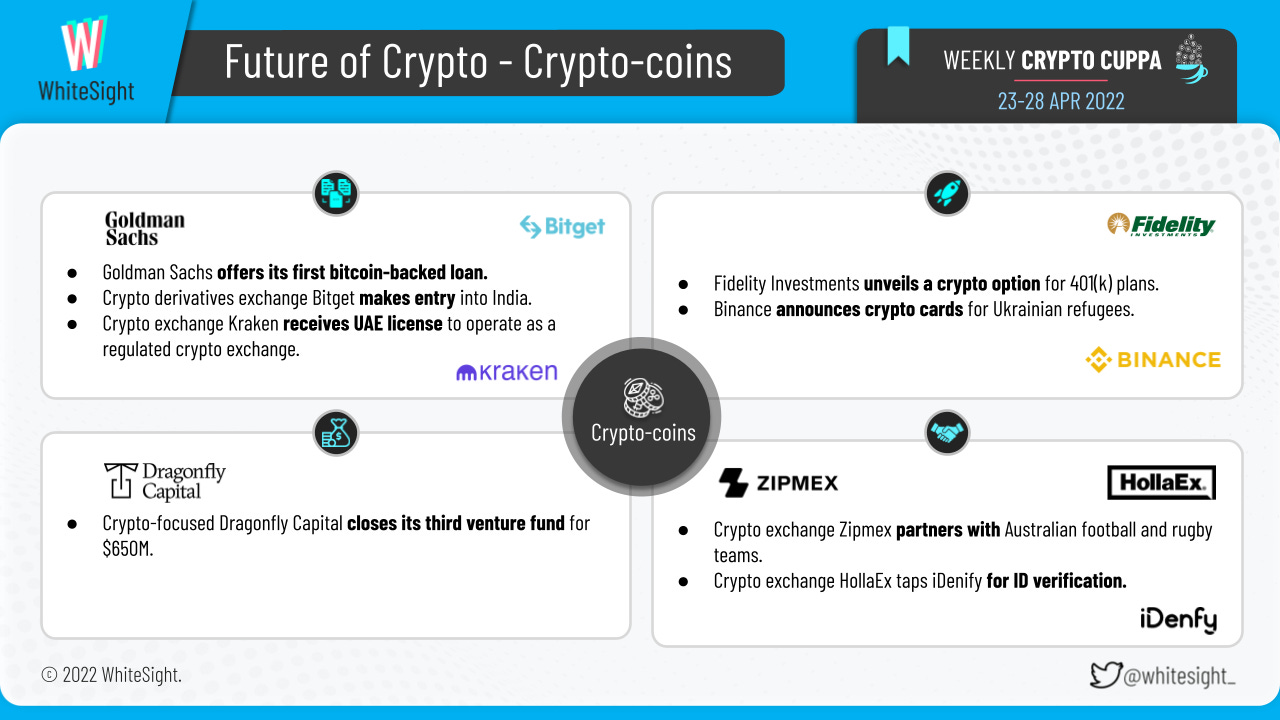

The Crypto-coins vertical witnessed several launches and market expansions, with companies worldwide embracing various cryptocurrencies within their current portfolios.

In a first, investment giant Goldman Sachs’ secured lending facility allowed a borrower to use bitcoin (BTC) as collateral for a cash loan. Crypto exchange Kraken received a Financial Services Permission (FSP) license from the Abu Dhabi Global Market (ADGM) to operate a regulated exchange platform in the United Arab Emirates. Similarly, crypto derivative exchange Bitget made its debut in the Indian market by teaming up with renowned free crypto taxation software Koinly.

As for the various launches, Fidelity Investments unveiled a crypto option for 401(k) plans where participants can choose to direct a portion of their savings into bitcoin, capped at 20%. Two former Jefferies Financial Group executives were in the news for their plan to launch a new cryptocurrency exchange named Crossover Markets Group, designed to meet the liquidity needs of institutional investors by late summer of 2022. While crypto exchange Binance teamed with European banking service provider Contis to roll out a crypto card for Ukrainian refugees, allowing them to make crypto payments in the European Economic Area, crypto-focused Dragonfly Capital closed its third venture fund for $650M, with plans to focus its investments across all stages of blockchain and crypto-native companies, protocols and tokens.

In other news, B Capital-backed crypto exchange Zipmex partnered with Australia’s A-League men's soccer league and National Rugby League to strengthen its foothold in the country and host educational workshops at the games to improve crypto literacy regularly. Lithuanian-based verification and fraud prevention company iDenfy joined forces with open-source cryptocurrency exchange platform HollaEx to provide document authentication and biometric verification support that will ensure safety for the latter’s customers. Furthermore, the Brazillian senate passed a bill aiming to create a regulatory framework for the country’s crypto industry.

The Stablecoin segment continues to gain traction as of late.

Stablecoin DeFi platform Blindex was in the news for its plans to introduce two new stablecoins, bGBP and bXAU, pegged to the British pound and the value of 1 oz of gold respectively, to the Bitcoin sidechain Rootstock (RSK) to inch the company closer to its goal of removing the inherent volatility of fiat money. The project incubation arm of Huobi Globa, Huobi Incubator, announced that it would co-host Celo x Huobi in web 3 & sustainability hackathon with mobile-first blockchain Celo to spur stablecoin development in the web 3 field and achieve long-term sustainability. While the UK government planned to extend regulatory authorization, governance, and reporting requirements under existing regulations to include some activities regarding fiat-linked stablecoins, Lyrebird was in the news for launching its algorithmic stablecoin protocol LRB on Neo N3 through Flamingo’s reverse liquidity pools and upcoming airdroplet events.

A number of funding rounds surrounding the NFT space created quite the buzz that turned heads last week, with significant players making their entrance into the emerging sphere.

Music NFT platform SoundMint raised $1.7M in a seed funding round led by Animoca Brands to build an NFT marketplace that will allow artists to create their own music NFTs, create a dashboard for NFT-holding fans, and release a token, buyback program, and ecosystem fund. NFT minting protocol CXIP Labs raised $6.5M in a seed round led by Courtside Ventures and Wave Financial to launch Holograph, a suite of products targeted at NFT creators and enterprises. Similarly, NFT platform Afterparty closed a $4M funding round as it introduced an NFT ticketing for artists that will cut out the secondary market and ticket scalping.

As for the launches, STXNFT announced its new brand Gamma.io which will provide a platform to serve as the home for collectors, creators, and investors to come together to explore, trade, and showcase extraordinary NFTs through the Bitcoin ecosystem. Furthermore, Hyderabad-based blockchain solutions startup TrayamBhu Tech Solutions (TRST01) announced the launch of carbon offset NFT token Bhu built on the Polygon blockchain, where the company intends to employ blockchain technology to address significant pain issues in the carbon offset industry.

On the other hand, Nike partnered with RTFKT to unveil a pair of digital Nike Dunk sneakers with various skins within their Mnlth collectible series called CryptoKicks. NFT marketplace OpenSea announced the acquisition of NFT aggregator company Gem to better serve its users by integrating the best of features, including one which allows users to buy NFTs across several NFT marketplaces in a single transaction and with any ERC-20 token rather than only Ethereum. Global Titans Fight Series also announced the world’s first-ever NFT sports event, which will provide access to an exclusive pay-per-view live stream – including the night of boxing on the helipad of the iconic Burj Al Arab boasting an explosive line-up featuring star champions Floyd Mayweather, Anderson Silva and many more – for NFT ticket holders.

The DeFi segment was astir with an assorted mix of project launches and funding rounds.

A group of former Goldman Sachs traders raised $20M in a Series A funding round led by Founders Fund and Pantera Capital to build a decentralized investment bank called Ondo Finance. While London-based Ethereum wallet Argent raised $40M in a Series B round led by Fabric Ventures and Metaplanet to accelerate its mission to build one app for all things DeFi and web 3, Tonic closed a $5M fund led by Electric Capital and Move to expand its team and create an open-source order book DEX on the NEAR Protocol. Decentralized FX trading platform Vertex Protocol also raised $8.5M in a seed funding round led by Alex Pack and Ed Roman and the venture arm of Dexterity Capital ahead of its planned launch in Summer 2022 to help them advise on tokenomics, market structure, and providing high-frequency trading resources.

As for various product launches, DeFi trading platform Hashflow launched a new feature to enable bridgeless cross-chain swaps by using a request-for-quote (RFQ) model where professional market makers set token prices and enable native-to-native swaps. Leading financial conglomerate Metax also announced its plans to enter into the DeFi space with the launch of its upcoming exchange MTX, which utilizes the PAMM documentary trading system at its core and combines it with decentralized technology. Payments-focused blockchain player Fuse also announced that DeFi analytics platform DEXTools extended full support to the Fuse Network blockchain to enhance traders' experience by tracking the major DEXs active on it.

Additionally, Stacks Ventures was in the news for incubating 11 projects designed to expand the use of CityCoins into wireless networking, web 3, gaming, NFTs, DAO, DeFi, and education. Crypto capital markets platform Maple Finance also expanded support to the Solana blockchain and has deployed a $45M fund to spur ecosystem growth in partnership with DeFi lending platform X-Margin, with the capital provided by USDC issuer Circle, digital asset manager CoinShares and several unnamed projects native to Solana.

An eventful array of activities made for the key highlights in the expanding metaverse industry.

Meta created a buzz for its plans to open its first retail store, to display metaverse-related products such as the Quest 2 virtual-reality headset, the Portal video calling gadget, and the Ray-Ban Stories smart eyewear. Standard Chartered Bank also jumped onto the metaverse bandwagon by buying land in The Sandbox metaverse world. Asian billionaire hotel groups hit the headlines after taking their first step into the metaverse by purchasing virtual properties in Decentraland and The Sandbox to launch hotels where visitors will be able to interact with an avatar that guides them through the building, while also having the chance to win real-world hotel surprises.

On various launches, Flipkart launched ‘Flipkart Labs’ to build and create technology-based solutions and test web 3 and metaverse use-cases with real-world applications. Japanese carmakers Nissan and Toyota also decided to venture into the metaverse by launching virtual showrooms to host vehicle launches and virtual workspaces to conduct employee meetings. Similarly, Metaverse company RFOX introduced the RFOX VALT metaverse’s minimum viable product (MVP) for selected participants, which features the open blockchain vision of the company through its support of multiple blockchains with WAX.

Furthermore, P2E blockchain game Fight of the Ages (FOTA), which allows players to join battles, interact with other players, and collaborate across distances, raised $8.3M in its angel fundraising. UAE’s Damac Properties was also in the news after its parent property Damac Group planned to invest $100M to build digital cities where the project will be run under a unit called D-Labs. While ARuVR entered into a strategic commercial partnership with metaverse company Virbela to launch and showcase the new XR Learning Platform alongside Virbela's Metaverse at the Learning Technologies exhibition, Crypto Blockchain Industries (CBI) signed an agreement to acquire a metaverse devoted to music, Xave, after which it will become part of the Alphaverse, interconnecting all experiences around music, enabling all Alphaverse users to enjoy the shows and proposals for creators and artists launched by Xave.

A plethora of launches remained at the forefront for the week in the DLT segment.

BlackRock launched its new iShares Blockchain and Tech ETF (IBLC), allowing investors to gain exposure to the blockchain sector without any direct investments in cryptocurrencies.

AXIA announced the mainnet launch of the AXIA blockchain that follows a participatory hyper-deflationary model, meaning any and all activity on the AXIA Blockchain and in the ecosystem ensures that AXIA Coin will become more scarce over time, which can benefit users and stakeholders in an ongoing manner.

Evmos launched its mainnet blockchain on the Cosmos network that allows users to deploy smart contracts and assets from Ethereum and use them in the Cosmos ecosystem.

Newrl also launched a tokenized-based equity solution that aims to enable the tokenization of equity to issue ESOPs, raise funds, and improve governance through smart contracts, making startup equity a more liquid asset class.

As for the other activities, Investment bank BNY Mellon signed a memorandum of understanding (MOU) with the Blockchain Association Singapore (BAS) to collaborate on advancing blockchain technology, driving institutional digital assets, and DeFi adoption. Fantom entered into a strategic partnership with blockchain data platform Pocket Network, which will provide network bandwidth to Fantom and enable Fantom blockchain network to perform relays daily. Publicly traded bitcoin mining company Riot Blockchain (RIOT) started the development of a large-scale 1 gigawatt (GW) expansion project in Navarro County, Texas, which will be expanded phase-wise and has an estimated cost of $333M.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include acknowledging the many Setting The Record Straight on Digital-first Banking Taxonomy and Unearthing The Bustle In Green Finance: Earth Day 2022.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️