Fintech's thriving in its License era📜

Future of Fintech - Edition #159 (1st - 7th April, 2025)

There’s a quiet reshuffling happening across fintech 🌐 — new data, smarter decisions, and rails that move more than just money.

✔️ Licenses become the new growth lever

✔️ Wallets stretch into lifestyle territory

✔️ Stablecoins inch closer to mainstream

Let’s explore where the signal’s pointing this week »

And speaking of deeper shifts…

Licensing has become the new scale strategy. From Stripe’s banking license push for merchant acquiring in the U.S. to Revolut’s PPI license coming through in India and Airwallex’s banking ambitions in the UK, mega-fintechs are leaping ahead into the regulated territory.

Why? Because owning licenses means:

Enhances Trust, Credibility & Consumer Protection: Deposit Insurance (e.g., FDIC, FSCS), Regulatory Legitimacy (e.g., Direct Supervision, Compliance Frameworks), Perception Shift (e.g., From "App" to "Bank")

Access to Core Financial & Regulatory Infrastructure: Direct Connectivity to Payment Rails (e.g., [ACH, UPI, PIX, SARIE]), Issuer Status for Cards (e.g., [BIN Sponsorship, Card Schemes]), Settlement Accounts with Central Banks (e.g., [Reserves, Faster Clearing])

Improved Unit Economics & Operating Margins: Disintermediation of Partner Banks (e.g., [BaaS Fee Elimination, Own Ledger]), Control Over Fee Structure (e.g., [Interchange, FX Spread, Float Revenue])

Strategic Autonomy and Long-Term Moat: Resilience to Platform Risk (e.g., [Bank Exits, BaaS Deplatforming]), Valuation Premium (e.g., [Regulatory Moat, Improved EBITDA])

In a world where technology and distribution are increasingly getting commoditized, regulatory licenses are emerging as the new moat for fintechs.

This isn’t a blip. It’s fintech’s next chapter, and the playbook’s going global 👇

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

📖 The Week’s Featured Story: Inside the Strategic Shifts Powering the Next Wave of Embedded and Digital Finance in Jan 2025

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Featured Story of the Week 📰

Inside the Strategic Shifts Powering the Next Wave of Embedded and Digital Finance in Jan 2025

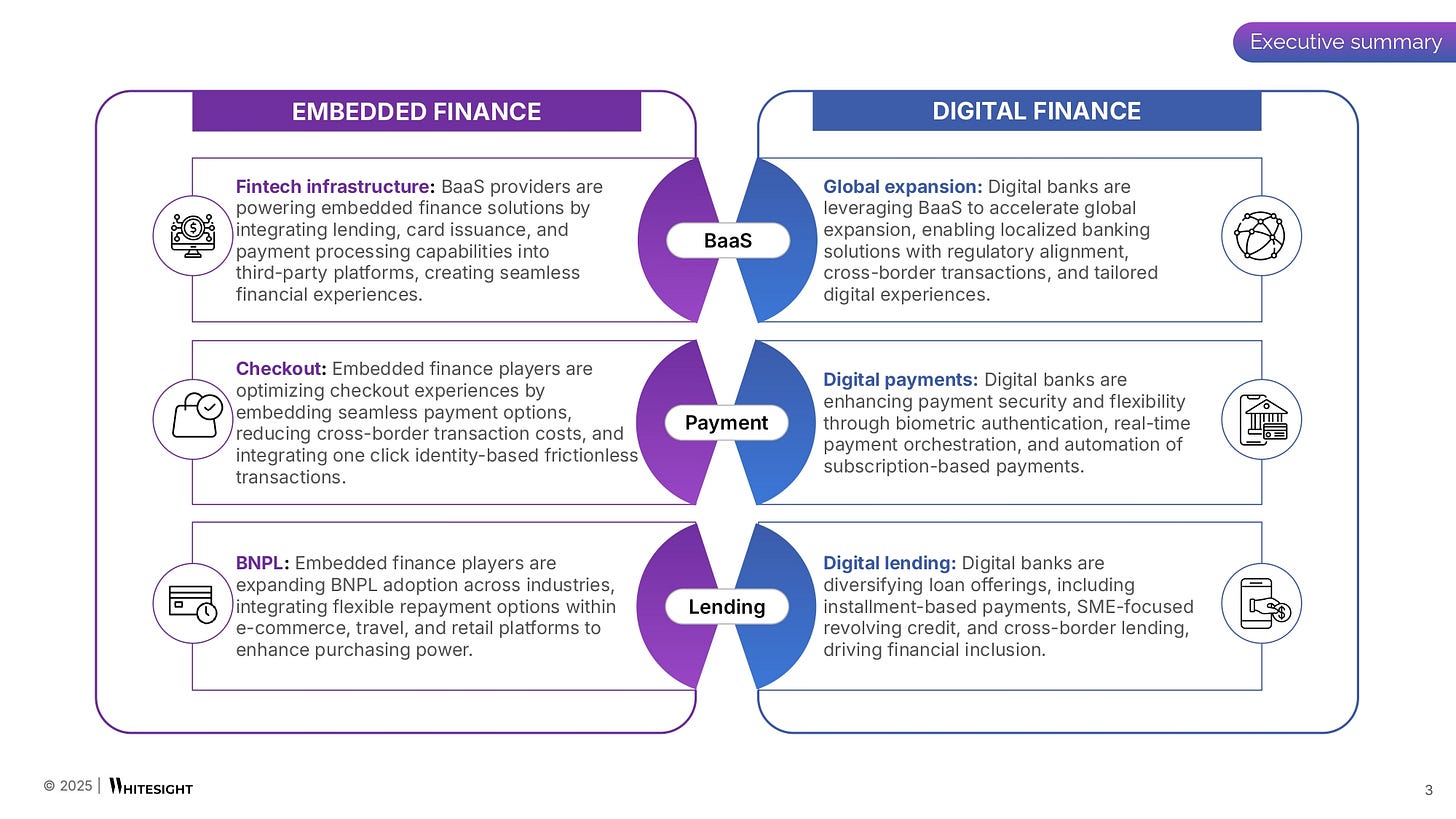

Embedded and Digital Finance developments in January 2025 revealed a powerful acceleration of integrated financial services, propelling businesses and consumers into an era of seamless transactions. Key trends observed were a surge in embedded payments, lending, and insurance, alongside the widespread adoption of Banking-as-a-Service (BaaS) platforms. Digital finance solutions, ranging from cross-border payment innovations to AI-driven credit solutions, were seen redefining customer experiences and expanding financial access globally.

🔑 Here’s a quick sneak peek through 3 key highlights:

Embedded Payments: Strategic alliances are revolutionizing consumer experiences by eliminating transaction friction across industries like travel, entertainment, and more. These partnerships are driving digital-first interactions and reducing dependency on cash.

BNPL & Embedded Lending: Companies far and wide are extending the reach of Buy Now, Pay Later (BNPL) solutions across retail and travel, enhancing flexibility and customer loyalty. The expansion into new sectors is making flexible lending options more accessible than ever before.

BaaS and Global Expansion: Digital banks leveraging BaaS platforms are opening doors to localized, compliant, and frictionless financial products for diverse markets, while strategic partnerships demonstrate how cross-border payments and financial products are seamlessly integrated into global businesses.

What strategic partnerships are paving the road for global scale in lending, payments, and insurance? How are digital banks leveraging BaaS to enhance global scalability? What’s driving the surge in BNPL adoption across multiple industries?

Unlock detailed insights into these transformative trends and more in our latest report. Download the full report now to stay ahead and tap into new growth opportunities:

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Brewed fresh from the fintech café - bold moves in every sip. ☕

The Week's Hot 10!♨️🔟

Positioning for Platform Dominance

⤷ Temu expanded its partnership with Adyen to support its launch in additional markets, enhancing its global payment capabilities.

⤷ Visa reportedly offered Apple approximately $100M to replace Mastercard as the payment network for the Apple Card.

Licenses Are the New Growth Lever

⤷ Stripe’s application for a U.S. merchant bank charter gets accepted in Georgia, pushing it closer to directly accessing card networks.

⤷ Revolut received full authorisation from the Reserve Bank Of India to issue prepaid wallets and cards via UPI.

Fintechs Turning Into Ecosystems

⤷ Chime launched Chime+, a premium membership with 3.75% APY and perks, alongside a redesigned app for saving, credit-building, and money management.

⤷ Monzo entered the home insurance market by offering contents insurance tailored for renters and homeowners.

Credit Get Intelligent

⤷ Singapore-based payments startup Airwallex reportedly wants to expand into lending. To that end, the company plans to acquire banking licenses in the U.S. and United Kingdom.

⤷ TransUnion acquired Monevo, a UK-based credit prequalification and distribution platform, to enhance personalized credit offerings to consumers through comparison websites and third parties.

Coins Take Shape

⤷ The Central Bank of the UAE announced plans to introduce the Digital Dirham, a central bank digital currency (CBDC), in the fourth quarter of 2025.

⤷ Itaú Unibanco is contemplating the launch of a stablecoin but is awaiting the outcome of the central bank's consultation on the topic.

Now, for the ‘byte’-sized fintech buzz –

Embedded Finance is tightening its grip on payments, wiring smoother rails straight into the customer journey.

ClearBank expanded banking services for Kraken's UK operations. It will provide Kraken’s UK-based clients with GBP clearing services, enabling seamless on- and off-ramps into the digital exchange ecosystem.

Eurostar teamed with Klarna to offer flexible payment options, including 'Pay in 3', allowing travellers to split the cost of their tickets. This initiative aims to make high-speed rail travel more accessible to customers in the UK and France.

Open Finance is going plug-and-play; quietly wiring the backend for faster, smarter money movement.

TrueLayer and Papa Johns partnered to introduce a Pay by Bank solution, allowing customers to pay directly from their bank accounts, aiming to enhance payment efficiency and reduce transaction costs by over 40%.

Backbase and Salt Edge formed a strategic partnership to help banks meet open banking compliance requirements and unlock new revenue opportunities through innovative solutions.

Digital Finance is stepping up as a personal finance coach, helping people save, swap, and stack with ease.

Nubank introduced Caixinha Turbo, a solution designed to help clients save money with security and immediate liquidity. Eligible customers can contribute any amount to it, with the tool assisting them in achieving their financial goals.

PayPal added Chainlink (LINK) and Solana (SOL) to its lineup of supported cryptocurrencies, allowing U.S. users to buy, sell, hold, and transfer these tokens through PayPal and Venmo.

Fintech Infrastructure is getting sleeker under the hood - enterprise-grade, modular, and built to scale.

Mastercard launched a program that allows banks to use its Virtual Card Number (VCN) technology, aiming to streamline and enhance efficiency in commercial payments.

SumUp partnered with FreedomPay to provide a robust payment system with offline capabilities, and enterprise-level functionality, aiming to support retail and hospitality merchants worldwide.

DeFi’s not just disrupting- it's docking into traditional finance, one stablecoin and dashboard at a time.

BNY Mellon launched the Digital Asset Data Insights product. This service aims to enhance transparency and data integrity for digital assets, with BlackRock's BUIDL on-chain money market fund being the first to utilize this offering.

Sumitomo Mitsui Financial Group (SMBC) plans to issue a stablecoin in collaboration with Ava Labs. The initiative aims to facilitate instant, 24/7 cross-border corporate transactions.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

What’s next for real-time payments Report - Mastercard

Building and Scaling a Payment Service Provider Report - Akurateco

All-in-One Platforms: The Key to Customer Retention in Vertical SaaS Blog - Marqeta

The Complete Embedded Finance Primer: Strategies, Examples, and Revenue Models Blog - Lars Markull via Embedded Finance Review

Starling’s Challenger Bank Playbook Report - WhiteSight

UAE: The Rise of a Crypto Powerhouse Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️