Future of FinTech | Edition #5 – February 2022

The first week of February brings with its winds a plethora of news from across the globe for the FinTech industry. As the six pillars painting the future of this bustling sphere offer us another round of some stirring tea, we take a look at the key events that stole the headlines for last week. The Digital Finance sphere seems to have come out on the top (once again), followed by a close second with the groundbreaking DeFi sector. The Open, Embedded, Platform, and Green Finance segments added to the much-needed recharge to get us all started with the new month’s happenings.

The Open Finance space opens the week with an assortment of partnerships, along with the seasoning of product expansions, fundings, and regulations.

While TESOBE—the company behind the Open Bank Project—partnered with RegTech and blockchain analytic provider Coinfirm to strengthen the bond of open banking practices and the crypto economy through advanced blockchain compliance solutions, Nordigen started a collaboration with SaaS investment platform Tapline to monitor B2B accounts and gather insights on enterprise financial activities and credit scoring.

Whitelabel software company Subaio chose the European open banking platform Aiia to smoothen up creditworthiness assessment by combining the access to financial data from Aiia with Subaio’s existing recurring payments detection, building a new white-label offering. US startup Trovata also scored a distribution agreement with Capital One to enable a cash management experience for its commercial clients with better visibility and insights into multi-bank account balances.

In other news, the Bangko Sentral ng Pilipinas (BSP) revealed its Open Finance Roadmap 2021-2024 that aims to strengthen customer preference for digital payments and promote more innovative and responsive digital financial services. With the rise in embracing data sharing in finance, Moneyhub announced its progression from Open Banking and Open Finance to Open Data to join the move. Additionally, Indonesian FinTech Ayoconnect raised $15m in Series B funding to scale its Open Finance API platform and increase its capacity so it can absorb accelerating demand.

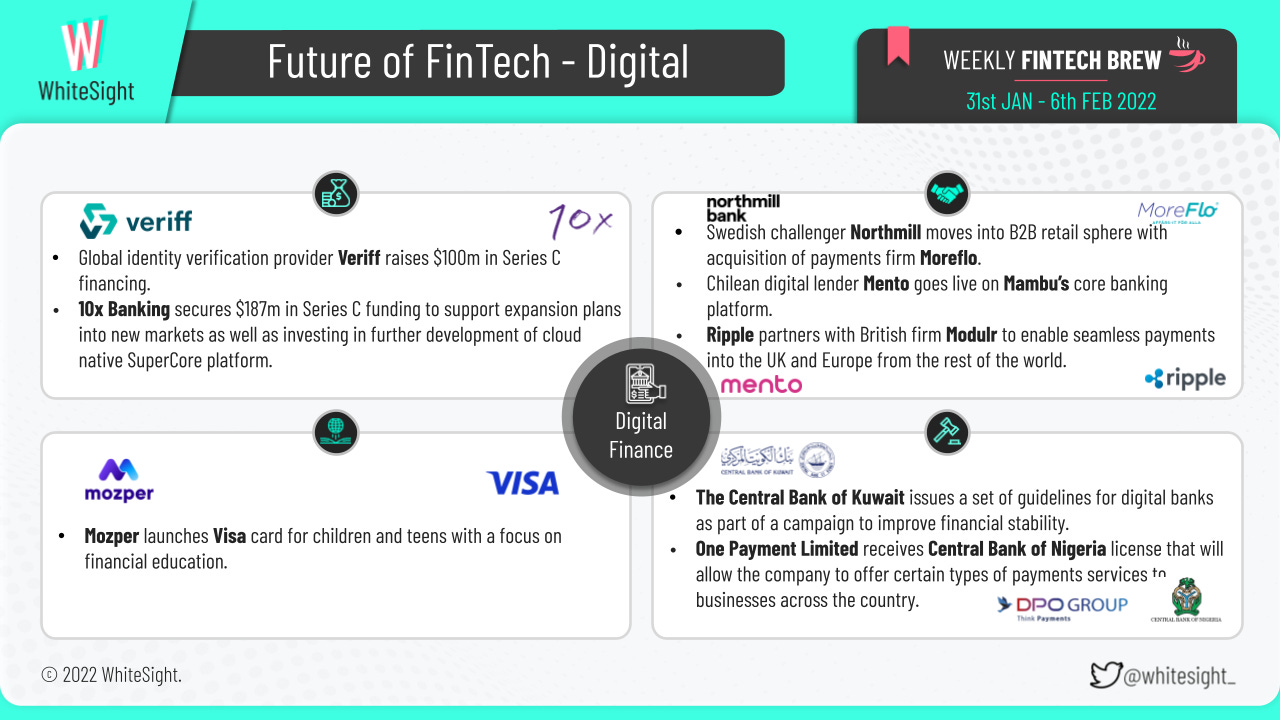

With another week of being crowned for being the most happening vertical of the FinTech space, the Digital Finance segment didn’t fall short on providing a medley of affairs to keep our curiosity and attention intact.

Blockchain and crypto giant Ripple joined forces with British firm Modulr last week, a partnership to improve and make the payments more seamless in the UK and Europe. Chilean digital lender Mento also went live with Mambu’s core banking platform to take on a more data-driven approach to loan vetting and origination for the underserved portion of society – focusing more on individual cases, history, and other personal information to complement or even stand in place of historical salary figures. On similar lines, Komerční banka – part of the Société Générale Group – completed the first phase of its core banking system replacement in its mission to become the digital banking leader in the Czech Republic by going live on Temenos’ modern open platform architecture.

Swedish challenger Northmill Bank made its move into the B2B retail sphere by acquiring native payments firm Moreflo to support its lofty ambition of wanting to erase the border between in-store and online shopping. India-based FinTech unicorn Pine Labs made similar moves by advancing negotiations to acquire API infrastructure company Setu, as the latter has been leaning more towards account aggregation and building with the Open Credit Enablement Network (OCEN).

Many challenger banks were observed to be adopting diversified initiatives last week, with neobank Bunq launching a new feature allowing its users to invest their cash through a partnership with Birdee. In partnership with payments giant Visa, Mozper launched a card in Brazil for Latin American children and teens to help them make smart and responsible financial decisions and thereby, throw light on the importance of financial education for the younger generation. UK challenger Monzo similarly made headlines for onboarding thousands of US customers in the past 18 months, to continue supporting the notion of financial inclusion while extending support to customers in vulnerable circumstances. Conversely, Benker became Europe’s first blockchain-based bank to fundamentally alter the way electronic banking is conducted and to assist artists in using new technologies such as non-fungible token currencies (NFTs).

However, it wasn’t only these regions that were a witness to advancement in digitization – many emerging markets were also at the forefront of their moves. The Central Bank of Nigeria granted One Payment Limited (a DPO Group subsidiary) a license that will allow the company to offer certain types of payment services to businesses across the country. The Central Bank of Kuwait issued a set of guidelines for digital banks as part of a campaign to improve financial stability, encourage innovation, and help the country respond to its economic needs.

Several firms also came through with successful fundraises to fuel their global growth – such as 10x Banking’s $187m Series C funding to develop its secure, reliable, scalable, and modular core banking platform SuperCore, and global identity verification provider Veriff's $100m in Series C financing to expand its global customer base and deliver trusted online identity verifications.

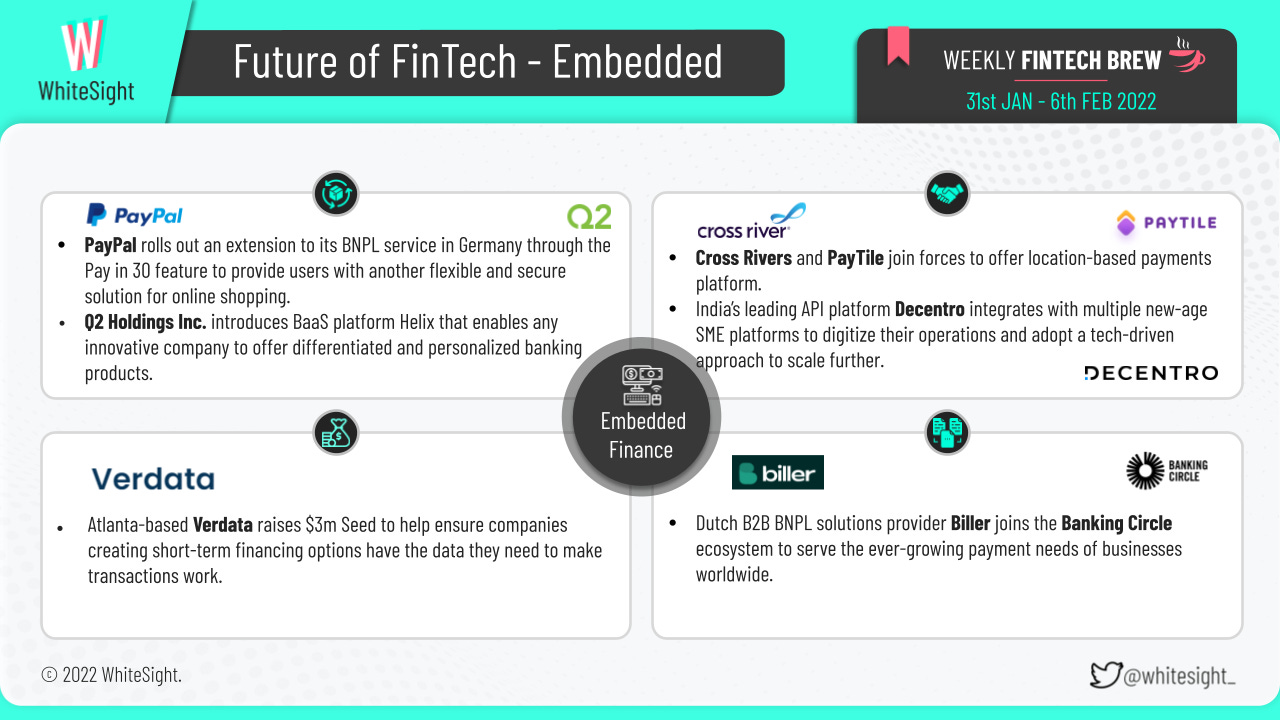

Embedded API banking modules seemed to have been on a rise for the last week, with many players from the field teaming up with various firms to empower seamless transactions. Decentro, one of India’s leading API platforms, recently integrated with multiple new-age SME platforms to enable thousands of MSMEs with simplified financial products and offerings to digitize their operations through a tech-driven approach. Core infrastructure and embedded financial solutions provider Cross River Bank made headlines for its partnership with peer-to-peer payment platform PayTile to provide a location-based payments platform. Block (formerly Square) was also in the news for having successfully closed its acquisition of BNPL firm Afterpay, an addition that will help deliver better products and services for sellers and consumers. AI-driven BNPL company Biller likewise joined the Banking Circle ecosystem so as to build a global, industry-leading provider of B2B payment solutions with full value-chain coverage and scalability.

On the other hand, digital transformation solutions provider Q2 introduced Helix, an evolution of the firm’s Banking-as-a-Service (BaaS) platform. PayPal also rolled out an extension to its BNPL services in Germany through the Pay in 30 option, which will let users simply pay in full for online transactions through a flexible and secure system 30 days after completion.

As more and more BNPL options catch on in e-commerce, Atlanta-based Verdata is ready to help ensure companies creating those short-term financing options have the data they need to make those transactions work, having raised $3m in a seed round lately. UK FinTech Railsbank is also in the process of raising $100m in new funding to near unicorn status and correspondingly join the UK FinTech unicorn club.

Despite being a vertical that is gaining momentum, the security of DeFi services remains a matter of debate considering the many attempts to exploit the transparency that comes with blockchain. Wormhole, a communication bridge between Solana and other DeFi blockchain networks, recently reported the stealing of $320m in cryptocurrency by hackers. The vulnerability, however, was patched by Wormhole management – reassuring users that the funds were safe.

Nevertheless, a series of funding rounds, acquisitions, product roll-outs, and regulations still made up for last week’s whiz surrounding the DeFi space.

Crypto paytech BCB Group landed the UK blockchain industry’s largest Series A funding worth $60m in a bid to expand its payments and market infrastructure across more regions.

Nigerian crypto startup Nestcoin grabbed attention with its $6.5m raise in pre-seed funding round, with the intent to drive the fast adoption of cryptocurrency in the African continent.

London-based BaaS startup Fiat Republic also secured $3.5m in a seed round from Speedinvest, Seedcamp, and Credo to accelerate acquiring regulated status in the UK and the EU.

Amber Group made its entrance in Japan via the acquisition of crypto asset exchange platform DeCurret, while Liquid Group and all of its operating subsidiaries—including Quoine Corporation and Quoine Pte. in Singapore are being acquired by FTX Trading Ltd. to provide products and liquidity to retail and institutional investors in the Japanese and global markets.

a16z-backed TrueFi was also in the limelight pertaining to the launch of its DeFi lending market for asset managers, potentially opening the door to wider mainstream adoption of DeFi solutions. Online payment solution AstroPay jumped the crypto bandwagon with its own option of buying and selling cryptocurrencies on its app and web app.

As regulation remains at the forefront for the sector, many countries were in the news the past week for their respective updates to decentralization. While on one hand, the United Kingdom’s tax agency updated its rules on how to tax revenue from DeFi lending and staking in proof-of-stake networks, on the other hand, was India’s announcement of the Central Bank Digital Currency (CBDC) to be issued by the Reserve Bank of India (RBI) – that will be recognized as a currency, while other private digital currencies and assets would be taxable.

A diverse set of activities were abuzz in the Platform Finance theme for the first week of the month. London-based Revolut made its move into InsurTech through the launch of a pet insurance product, one that reinforces its existing insurance offering and furthers its super app ambitions. On similar lines was Upgrade’s launch of ‘Upgrade Shopping’ feature in its super app, a service that offers cashback rewards at more than 20,000 local and national merchants in a bid to help consumers improve their financial existence.

Many super apps from emerging markets also made the news for their respective initiatives – such as Careem, the super app for the greater Middle East and Pakistan, partnering with National Command and Operations Center (NCOC) to map 600 government vaccination centers on its super app; and the M-Pesa super app announcing a partnership with the National Social Security Fund (NSSF) to enable customers the access to NSSF services through the Mini App on the platform.

Speaking of partnerships, Latin American super app Rappi also made headlines for its expanded partnership with payments firm dLocal to allow customers in Brazil to make purchases with local credit card payments. FinTech startup Rewire also joined forces with leading InsurTech Qover to create a holistic migration package that caters to the unique cross-border financial needs of migrants, along with protecting the customers through accident insurance.

With e-commerce rapidly reaching new heights within Platform Finance, many startups are gaining significant funds to expand around this emerging sector. Acho, a super app built for data workers, recently took in $2.2m in seed funding to build out features, services, infrastructure, and increase the team size to meet the 50% customer growth the company is experiencing each month. Wayflyer also hit unicorn status with its latest $150m Series B round, making it Ireland’s 6th unicorn. The firm will continue to help ambitious eCommerce businesses unlock their true potential, solving some of the critical challenges that have long stifled growth.

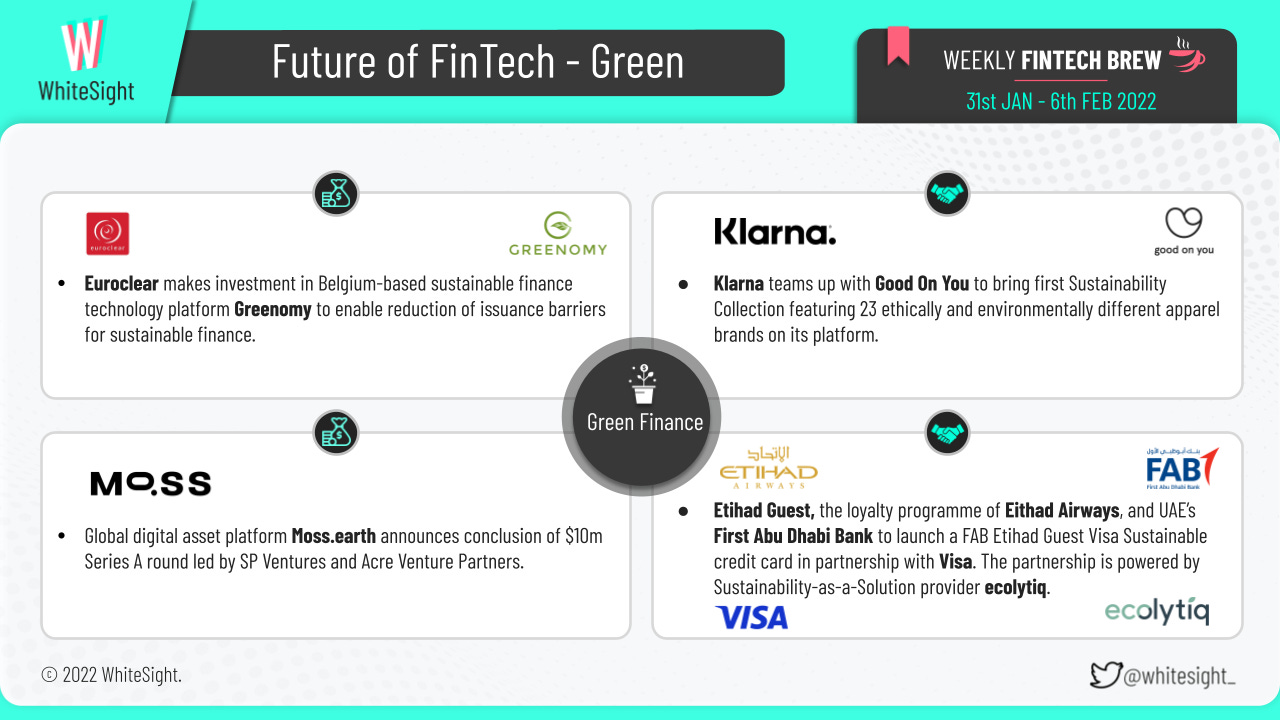

The Green Finance segment had an eventful mix of partnerships and fundings going on for it last week – BNPL giant Klarna added another feather to its cap of offerings with its first Sustainability Collection featuring 23 different mindful clothing brands in partnership with Good on You. In a move to reward members for making sustainable choices while also offsetting emissions for their spending, Etihad Guest and UAE’s First Abu Dhabi Bank in partnership with Visa launched a sustainability-focused credit card. The partnership is powered by ecolytiq, which is a provider of digital infrastructure for green finance.

Several green finance platforms also bagged in a few investments, with global digital asset platform Moss.earth concluding a $10m Series A round to develop significant web3 products and services; and Euroclear making an investment in sustainable finance technology platform Greenomy to be able to bring non-financial reporting to its network, enabling a reduction of issuance barriers for sustainable finance.

On the regulatory front, the European Union’s securities watchdog launched a review of the bloc’s fast-growing but largely unregulated market for environmental, social, and governance (ESG) ratings on companies, in an attempt to develop a picture of the size, structure, resourcing, revenues and product offerings of the different ESG rating providers operating in the EU.

That's a wrap for this week, folks! Let us know how you liked this Weekly FinTech Brew and what we can do to make it better. See you next week 👋