The cryptocurrency space is fast becoming an important and interesting part of our daily lives. As a medium of exchange that is enabling digital connectivity across borders, we believe the industry deserves its own cuppa of some hot, brewing tea – with weekly servings that are bound to keep you filled with the latest happenings of the sphere. To show our love for Crypto, we’re thereby launching the First Edition of our newsletter on V day, and we commit to forever continue with weekly editions across the six segments that are painting the Future of Crypto with their bustling activities. The anticipation that comes with this one is sure to make you hold onto the edge of your seats.

The CBDC segment has been subject to experimentation around the world as of late.

China made headlines for heating up the digital currency race, as it availed the digital yuan (e-CNY) to Olympians and visitors for purchases during the Winter Games using a digital yuan wallet app, or by storing the digital money on a physical card. Many other countries are similarly hopping on the CBDC bandwagon – with the Reserve Bank of New Zealand beginning work on a proof-of-concept CBDC, and the Reserve Bank of India planning to issue the digital rupee in the next financial year (FY23). The trust banking arm of Japan’s Mitsubishi UFJ is also in line with plans to use blockchain technology to set up Yen-pegged stablecoin that will act as a means of payment for enabling instant settlement. Even emerging markets, such as Myanmar and the crypto-opposing Reserve Bank of Zimbabwe are actively exploring the prospect of CBDCs to help improve their respective economies.

On the partnerships front, veteran Football club Manchester United has welcomed Blockchain firm Tezos as its official training kit and technology partner to add to the latter’s growing list of sports teams sponsorships. As part of this agreement, Manchester United will reportedly receive over $27 million per year, while Tezos will become the football club’s training kit sponsor.

The Crypto-coins vertical has been a witness to several product expansions, with companies worldwide embracing various cryptocurrencies within their current portfolios.

While KPMG Canada made its first treasury allocation of crypto assets by acquiring bitcoin (BTC) and ether (ETH) through Gemini Trust Company’s execution and custody services, asset management firm BlackRock Inc. made the news for its likely offering of enabling its clients to trade in cryptocurrencies. Indian crypto exchange platform CoinSwitch Kuber also took a step to help investors stay alert against market volatility by adding a new “Recurring Buy Plan” feature that allows them to invest systematically over making impulsive trading decisions. Another India-based crypto exchange platform that stole headlines with its phenomenal company milestone was CoinDCX, which crossed over 10 million users in just under four years since its launch.

In other news, crypto firm Binance signed a Memorandum of Understanding with South Korea’s K-Pop Talent Agency YG Entertainment to proliferate their influence over the blockchain industry. ssv.network, an effort that observes ethereum’s shift to a staking-based consensus mechanism, recently amassed $10 million to fund the development of decentralized staking infrastructures, and “mitigate” the biggest vulnerabilities in centralized staking. The Shiba Inu token also observed quite the leaps and bounds in its price gains as it became the most traded coin in ethereum whale wallets, replacing the Curve DAO Token (CRV) off its perch.

A number of launches and partnerships surrounding the NFT space created quite the buzz that captured our attention the past week, with significant players making their entrance into the emerging field.

Popular game developer Krafton is set to make its NFT and Web3 debut by joining forces with Asia’s largest web portal, Naver Z. On similar lines is Zynga’s plan to launch its first NFT games, a move that will include more blockchain-based alliances, partnerships, and potential acquisitions. Not only that, but Salesforce was also in the news for its plans to release an NFT Cloud that will serve as a service for artists to create content and release it on a marketplace.

The hype around NFTs is reaching every possible nook and cranny, as even the United Nations is gearing up to hold its first-ever female-focused NFT collection exhibition by the name of Boss Beauties at its headquarters in New York. Capital Block, the dedicated NFT sports and entertainment agency, became the official agency of Polish football club Legia Warsaw as part of their latest partnership. Combine the enthusiasm for both crypto and cannabis, and you’ll receive an NFT-powered cannabis brand – as launched by the Crypto Cannabis Club in partnership with e-commerce platform CampNova.

However, innovations and expansions just don’t stop here. Decentralized NFT platform Dixel Club is exploring the notion of “Draw-to-earn”, a concept that intends to remove the lack of community input when it comes to the final design by allowing users to become the sole decision-making factor in the process. Moonpay was another such firm that introduced a new NFT checkout tool that will allow investors to buy collectibles online using fiat currency.

A plethora of funding rounds was the key highlight for the DeFi space, as investors ready themselves for the decentralized phase – with cross-chain DeFi investment ecosystem Aperture raising $5.3m in seed and strategic round sale to abstract away the complexities around cross-chain yield strategies; Silicon Valley FinTech Alchemy acquiring $200m in Series C investment that takes the firm’s valuation to $10.2bn; and new entity for bitcoin Trust Machines raising $150m to build an ecosystem of next-level applications that will open up bitcoin as a settlement layer and platform for Web3.

The capabilities of DeFi are expanding across varying geographies as the year progresses. A Mexican FinTech is taking DeFi borrowing beyond crypto and into the broader financial market by extending $40m in credit lines to small business customers. Australian FinTech startup BAXE, in partnership with French technology company IDEMIA and Sydney-based startup Haventec, plans to assist users in authenticating high-value transactions and activating locked accounts by introducing the world’s first DeFi ecosystem with facial authentication. Brazilian asset manager QR also made its mark on Brazilian stock exchange B3’s list with its first local DeFi ETF under the ticker QDFI11.

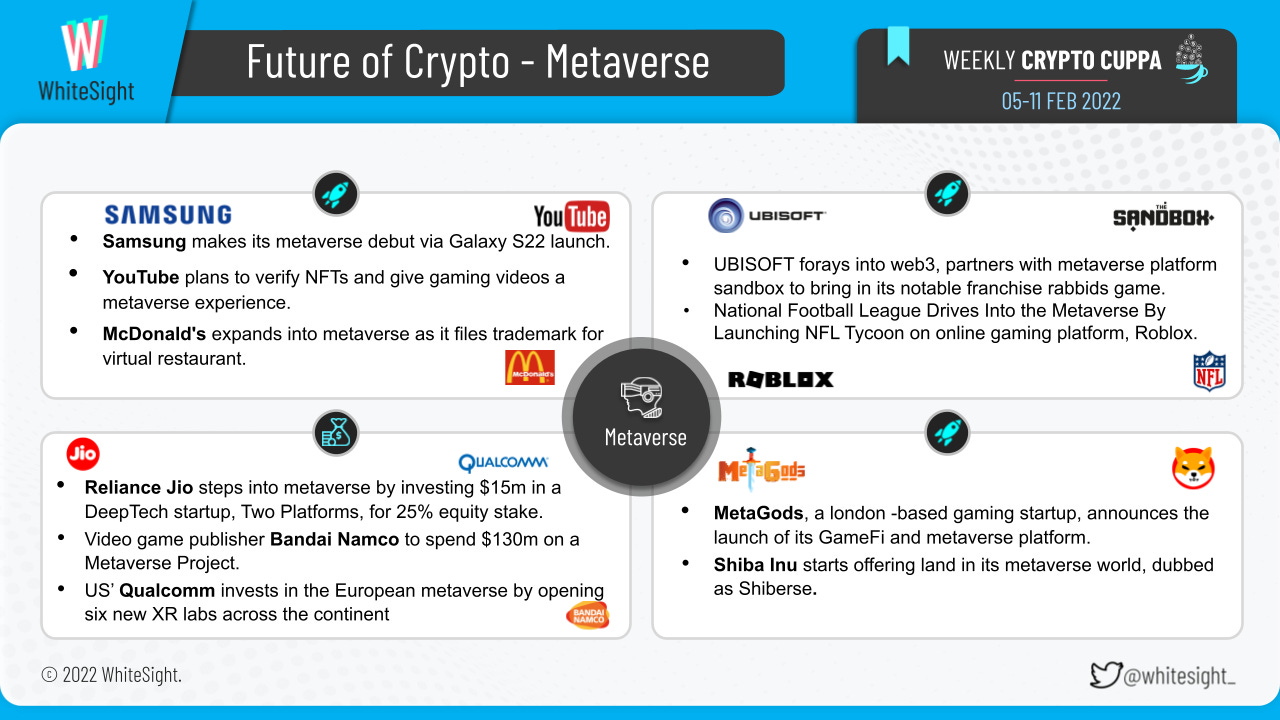

A variety of product and market expansions, along with a series of fundings played their part in furthering the trending Metaverse game.

A diverse set of industries and sectors are ready to test the waters of this nascent sphere, with popular names such as YouTube, McDonald’s, Samsung, and Reliance Jio treading the waves of the Metaverse craze. While YouTube stated that it will be creating metaverse experiences that will bring more interactions to games, McDonald’s filed trademark applications for virtual restaurants, cafes, and goods in preparation for a potential wave of virtual reality marketplaces. Samsung is also set to mark its metaverse debut through the launch of its Galaxy S22 smartphone on Decentraland. In an apparent attempt to conflate augmented reality and virtual reality, US mobile chip giant Qualcomm has invested in the European metaverse by opening six XR labs across the continent.

MetaGod is amongst the many gaming platforms that are working on developing metaverse platforms. The London-based startup announced the launch of its GameFi and metaverse platform that will consist of a complete ecosystem with a digitally rendered 3D virtual reality-based metaverse. Bandai Namco and Ubisoft are also foraying into new frontiers in the space as they make strategic investments to develop IP Metaverse projects.

Additionally, Shiba Inu started to offer the exclusive ability to purchase virtual real estate spaces ‘LANDS’ in Shiberse. The National Football League and Roblox also made the headlines for announcing a new metaverse experience, NFL Tycoon, that will help engage NFL with the next generation of football fans in the metaverse.

With the Web3 space experiencing continuous transformation, many projects saw a mix of eventful happenings.

Binance will be taking a $200m stake in Forbes to make it a leader in supplying information about digital assets. Secondary scaling solution Polygon raised $450m in a round led by Sequoia Capital India to consolidate its lead in the race to scale ethereum. Aleo Systems’ Series B $200m funding to help roll out its programmable Aleo blockchain network marks for the largest fundraising round in the zero-knowledge industry.

Many of these decentralized platforms have been in the limelight for their respective DeFi-related launches. TRON DAO and BitTorrent Chain, as part of the former’s long-term efforts to promote the mass adoption of blockchain technology and innovative cross-chain solutions, are launching the TRON Grand Hackathon 2022. DeFi project Aave dropped its Web3 social media platform called the Lens Protocol that intends to empower creators to own the links between themselves and their community.

As for the other activities, Worldplay has partnered with Crypto.com, the fast-growing cryptocurrency platform, to be a global validator and operator for the Crypto.org Chain. MakerDAO has also joined a long list of DeFi and Web3 projects in choosing Immunefi to host its record $10m bug bounty program.

We hope you enjoyed this edition of the Weekly Crypto Cuppa, and we'll be back with more next week! ☕