Costco x Affirm: Buy Now, Pay Bold 🛒

Future of Finance - Edition #165 (27th May - 2nd June‘ 25)

The fintech engine is humming louder this week. 🚀 New payment rails are snapping into place, AI’s jumping from labs to ledgers, and crypto’s finally showing up in a suit. The foundations? Moving. The pace? Unrelenting.

✔️ Banking infra goes global and modular

✔️ AI steps into transaction mode

✔️ Digital assets grow roots in regulated soil

No fluff. Just signal. Let’s decode the week. ⚡️📊

And nowhere is that signal louder than here.

While most are still debating whether crypto belongs in finance, the institutions are already past that phase.

They’re not just adopting blockchain, they’re shaping it.

Banks and asset managers are quietly building on Ethereum Layer 2s - not for headlines, but for control, scale, and future-proof rails.

As this post suggests, the shift isn’t speculative. It’s strategic.

👉 Hit the thread for the full breakdown on why Wall Street is going Ethereum-native.

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition 165 just dropped — piping hot with trend shots, collab pours, and a twist of bold moves. ☕

The Week's Hot 10!♨️🔟

AI Powers the Backend

⤷ Stripe introduced an AI foundation model as part of its global money movement expansion.

⤷ Griffin launched its Model Context Protocol (MCP) to let AI agents autonomously carry out tasks like opening accounts and initiating payments.

Europe’s Fintech Momentum

⤷ Revolut launched a POS device in Romania to boost payment speed and business cash flow.

⤷ Vodafone Germany partnered with Adyen and Tink to roll out Pay by Bank for easier bill payments.

Convenience Meets Money Flexibility

⤷ Costco teamed up with Affirm to offer BNPL options for large online purchases.

⤷ Nu México enabled cash deposits at 23,000+ OXXO locations to support cash-reliant customers.

Platforms Widen Their Scope

⤷ Plaid expanded its business banking coverage across 4,500+ U.S. institutions for better data access and connectivity.

⤷ Mambu launched Mambu Payments to offer end-to-end payment infrastructure on top of its composable banking stack.

Digital Assets Grow Up

⤷ Bybit secured a MiCAR license in Austria, enabling regulated crypto services across the EEA.

⤷ Block announced Bitcoin acceptance via Square using the Lightning Network, with rollout planned for late 2025.

Now, for the ‘byte’-sized fintech buzz –

Embedded Finance is getting hands-on—whether it's cash flow or early wages, it's showing up exactly where businesses need it.

HBX Group partnered with YouLend to offer a new financing solution called Cash Advance, aimed at helping small and medium-sized businesses in the travel and hospitality sectors manage cash flow and unlock growth opportunities.

Clair raised $23.2M in a Series B funding round. The funds will be used to expand Clair's embedded Earned Wage Access services, allowing employees to access wages instantly through existing payroll and workforce apps.

Open Finance isn’t just open, it’s operational, quietly powering smoother payments and compliance behind the scenes.

Tebex, a monetisation platform for game studios and private servers, partnered with TrueLayer to integrate Pay by Bank solutions into its checkout systems across the UK, Germany, France, Belgium, and Spain. This collaboration aims to provide gamers with a seamless payment experience while ensuring faster and more secure payouts for creators.

Tradu, a London-based multi-asset trading platform, teamed up with Salt Edge to enhance its security infrastructure and ensure seamless PSD2 compliance across its European operations. The partnership enables Tradu users to fund their accounts directly from their bank accounts in the UK and EU.

Digital Finance is having a borderless moment; doubling down on local rails and global reach in one bold move.

Dutch neobank bunq integrated Bizum into its platform, enabling users with Spanish IBANs to send and receive money through the bunq app. This move is part of bunq's strategy to strengthen its presence in Spain, where it has been operating since 2021, and to facilitate payments for businesses.

PayPal Payments Private Limited, the Indian subsidiary of PayPal Holdings, has received in-principle approval from the Reserve Bank of India (RBI) to operate as a cross-border payment aggregator for exports. This approval enables PayPal to facilitate secure cross-border transactions for Indian exporters.

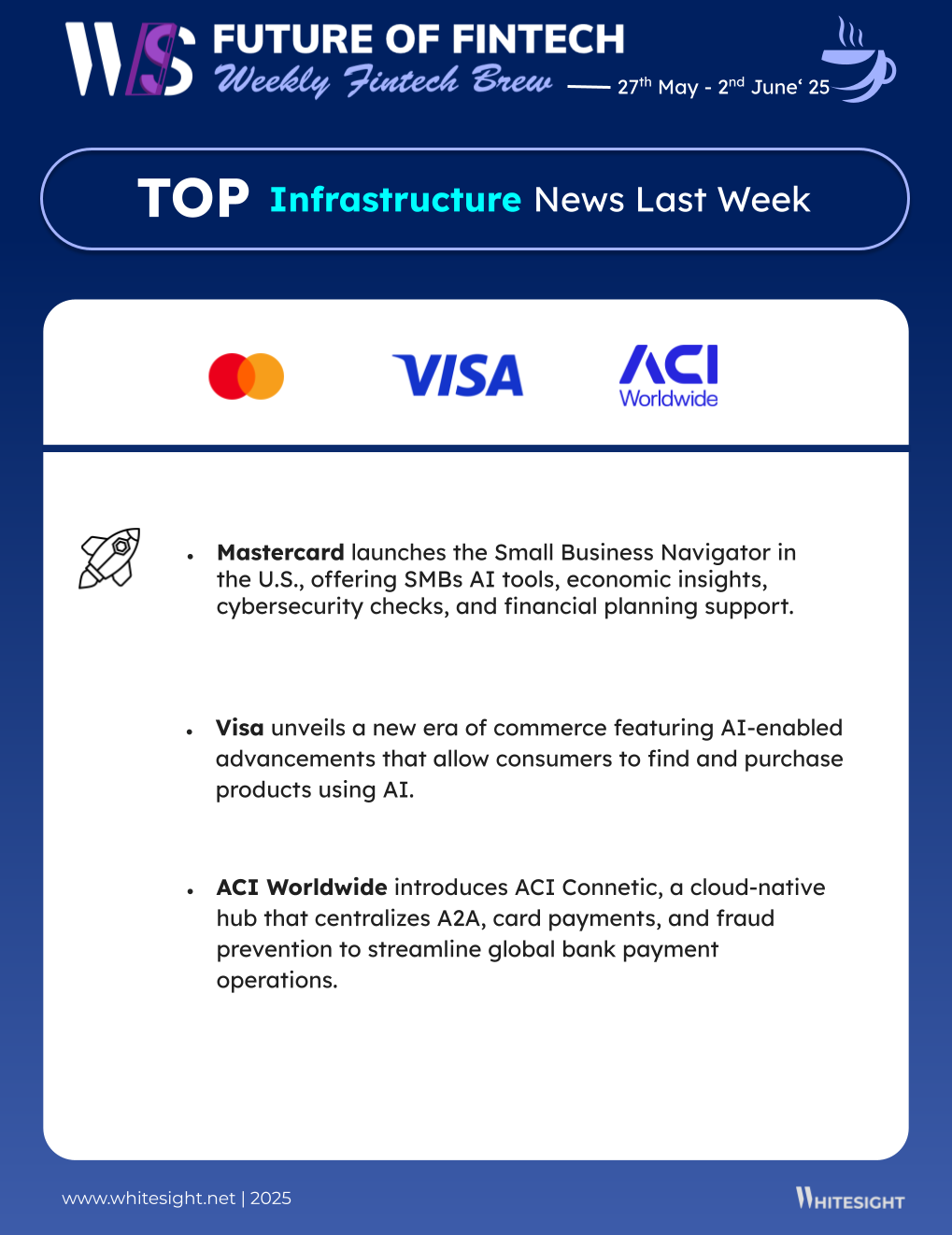

Fintech Infrastructure is going from backend to brainiac, where AI meets APIs and small biz gets big-time tools.

Mastercard introduced the Small Business Navigator program in the U.S., offering digital tools, data, and educational resources designed for SMBs. The program includes an AI-powered chatbot, insights from the Mastercard Economic Institute, cybersecurity assessments via RiskRecon, and financial planning support through Biz2Credit's Virtual CFO services.

Visa unveiled a new era of commerce featuring AI-enabled advancements that allow consumers to find and purchase products using AI. The initiative includes strategic partnerships and product innovations aimed at enhancing the shopping experience through AI-driven solutions.

Digital Assets are suiting up—licensed, streamlined, and finally playing by the rules (without losing the edge).

Openbank applied for licenses under the EU’s Markets in Crypto-Assets (MiCA) regulation to offer crypto services, including euro- and dollar-denominated stablecoins. This move aims to provide retail customers with access to digital assets through a regulated framework.

Worldpay partnered with BVNK to offer near-instant global payouts in stablecoins for clients in the U.S. and Europe. This collaboration allows businesses to make payments to contractors, creators, and sellers across more than 180 markets without directly managing digital assets.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Optimising Cross-Border Payments Globally: Shaping the Economy of Tomorrow Report- Visa

For Banks, the AI Reckoning Is Here Report- BCG

Are CBDCs The Global Push to Bank the Unbanked in 2025? Blog- MobiFin

Top trends and opportunities for financial services in 2025 Blog- Marqeta

How 2025 Is Redrawing the Map of Digital Asset Finance Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️

Nubank is unstoppable. What do you think about the Mercado-Nubank war for Mexico? Who do you think will win?