China, US and Revolut - Scaling Like There’s No Tomorrow 💥

Future of Fintech - Edition #174 (29th July - 04 Aug‘ 25)

Fintech’s getting surgical this week! 🧬 Smart tools are replacing legacy layers, and players are thinking globally while acting tactically. This week’s moves feel tight, targeted, and trend-setting:

✔️ Infrastructure gets sharper with AI

✔️ Regulation and crypto start shaking hands

✔️ Strategy meets scale in global pushes

Ready to chase the signals? Let’s get into it. ⚡

🚨 Featured Story of the Week:

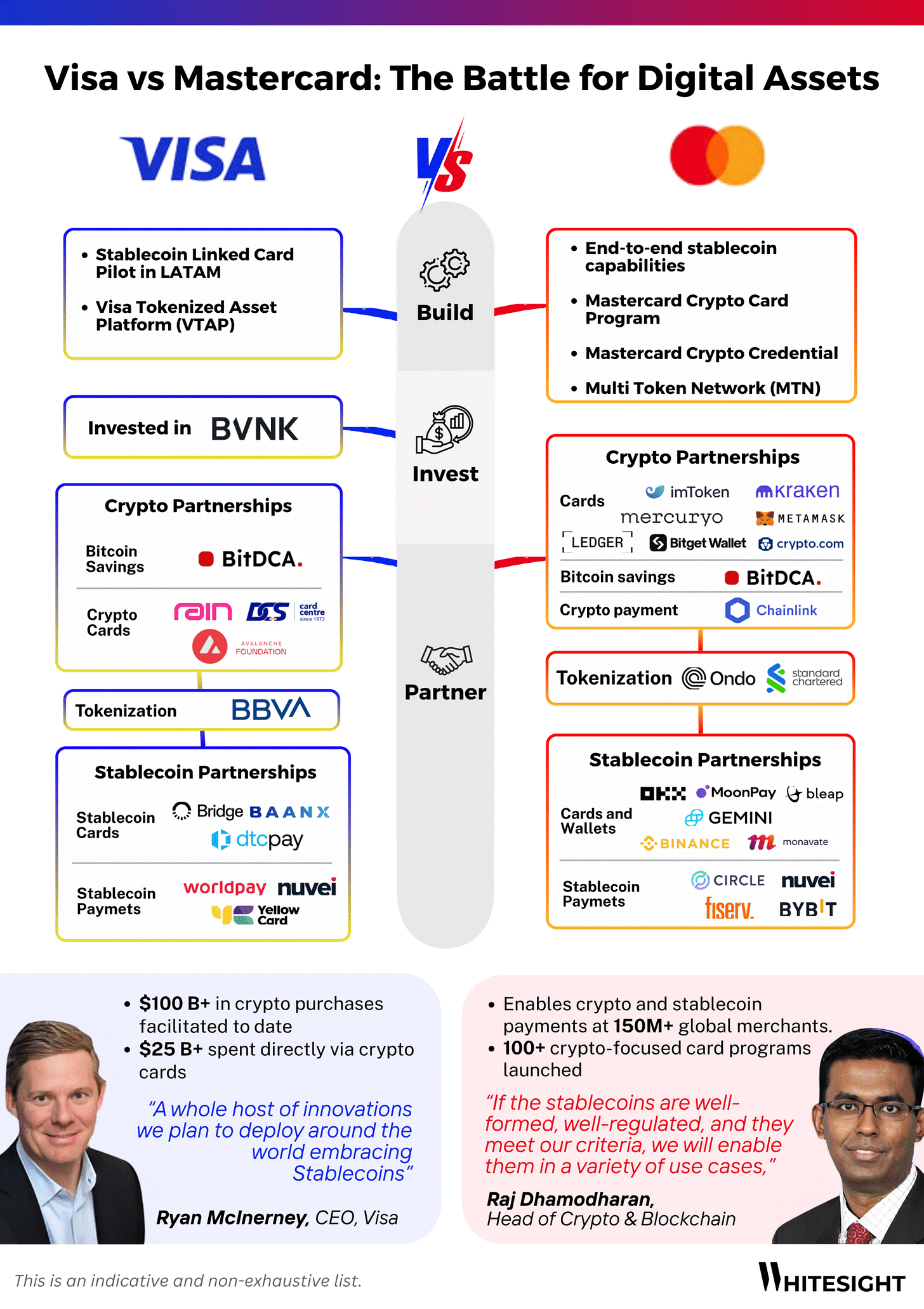

Swipe, Settle, Spend - Visa and Mastercard Gear Up for the Digital Asset Era 🪙

The card network giants are no longer sitting on the crypto sidelines. From stablecoins to tokenized assets, they're rewriting their rulebooks to stay ahead in a world of digital value. This week’s featured infographic from WhiteSight dives into the evolving digital asset playbooks of Visa and Mastercard - and what they signal for the future of finance.

💥 What’s unfolding in this battle of the networks?

🌐 Global settlement is going blockchain-first, with stablecoins powering real-time treasury flows

🪄 Tokenization is turning assets into programmable money, and both networks are setting the rails

🔐 Security, compliance, and interoperability are at the heart of their digital asset infrastructure moves

🤝 Partnerships with crypto-native and TradFi players are shaping new use cases across borders

As the lines blur between traditional payments and digital assets, the battle for future dominance is well underway - and the card giants are making bold moves to claim their stake.

👉 Check out the full story here.

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Sip on bite-sized updates every week—fresh, hot, and brewed to keep you in the loop in just minutes. Subscribe now! 📨

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Sizzled, stirred, and spiced just right - Edition #174 serves real-time rails, embedded flavours, and crypto cool on a silver fintech platter.

The Week's Hot 10!♨️🔟

AI Goes Operational

⤷ Mastercard launched conversational AI payment capabilities, using intelligent agents and tokenization to modernize card interactions.

⤷ Experian partnered with AI-powered verification platform Sikoia to automate income and employment checks, through AI-driven document extraction.

Card Networks Double Down on the UK

⤷ Mastercard launched A2A Protect, a fraud prevention and dispute resolution service for A2A payments, launching in the UK to fight APP fraud.

⤷ Checkout.com partnered with Visa to enable card issuing services - both physical and virtual - across the UK and Europe.

Features First, Finance Later

⤷ Klarna received an e-money license in the UK, allowing it to launch a digital wallet (Klarna Balance) and a cashback program (Klarna Cashback) later this year.

⤷ Nubank introduced enhancements to its travel eSIM, relaunched NuCoin rewards, and expanded mobile services, adding depth to its Ultravioleta offerings.

Scale by Acquisition

⤷ JPMorgan Chase is in negotiations with Apple to take over its Apple Card program from Goldman Sachs, boosting its credit card dominance.

⤷ Revolut may acquire a US bank to fast-track its expansion, while also eyeing China as a future market.

Crypto Steps Into Structure

⤷ The U.S. Securities and Exchange Commission launched Project Crypto to modernize securities regulations for on-chain trading infrastructure.

⤷ Bitstamp by Robinhood partnered with BBVA to enable regulated Bitcoin and Ethereum trading directly inside BBVA’s retail banking app in Spain.

Now, for the ‘byte’-sized fintech buzz –

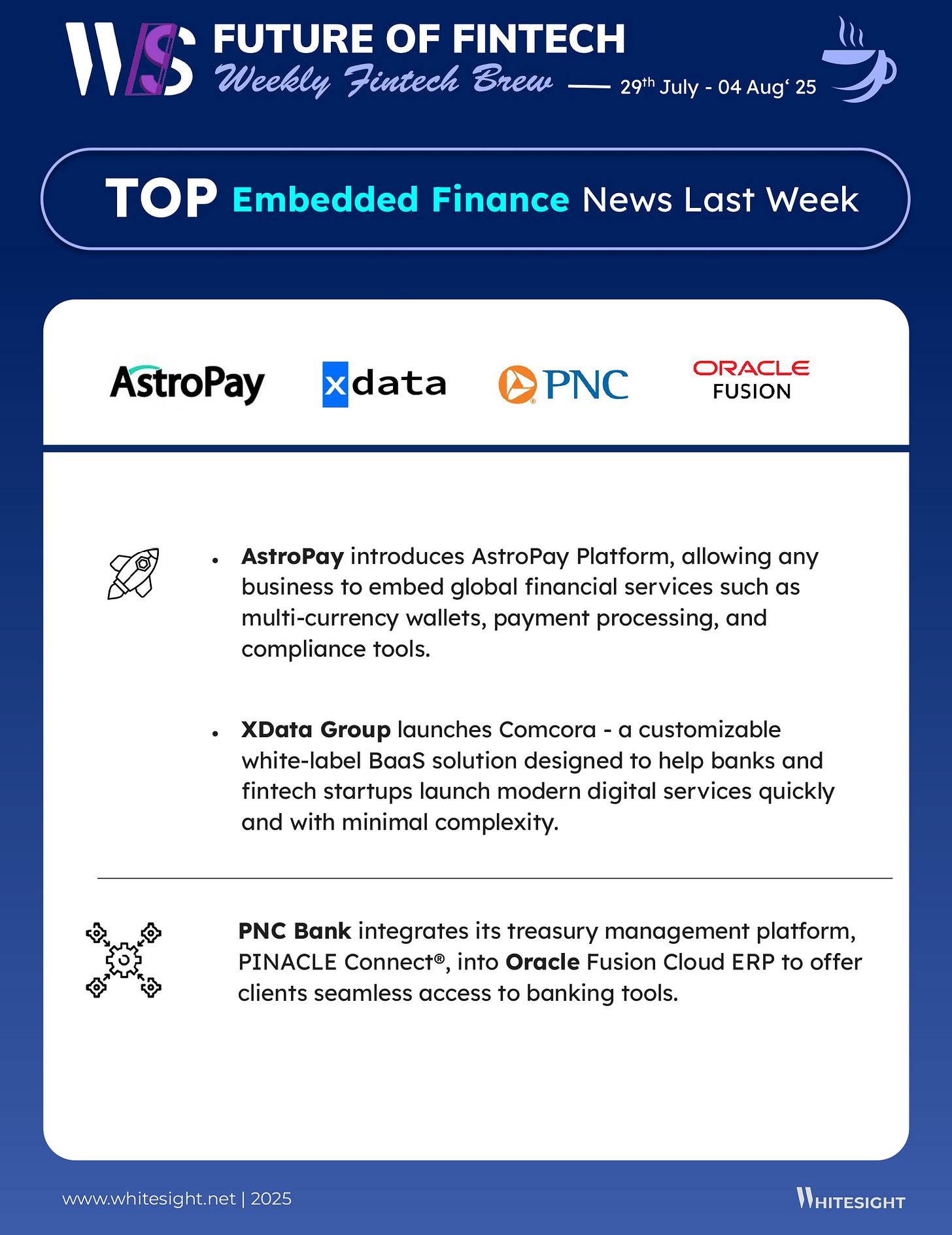

Embedded finance is slipping deeper into commerce workflows, helping merchants stitch payments into every channel and checkout moment.

Deliverect, a food tech SaaS company, partnered with FreedomPay to enable multiple payment providers across different channels and locations to manage payments with ease.

ContactNow partnered with PayTabs to launch its Buy Now, Pay Later (BNPL) services to enable more inclusive, flexible, and customer-focused payment solutions for merchants and consumers alike.

Open finance is shedding its plumbing persona; it's now the brains behind smoother flows and smarter money moves.

Ecommpay implemented its Advanced Open Banking platform for peer-to-peer lender The Money Platform, enabling on‑demand pay‑in and pay‑out capabilities, automated payment initiation, and more.

Worldline is in exclusive negotiations to divest its Mobility & e-Transactional Services (MeTS) business to Magellan Partners for approximately €410m, refocusing on its core payments operations and redeploying capital.

Digital finance is getting personal and playful, blending finance with fandom and everyday protection - right in your pocket.

Revolut becomes the title partner of the future Audi F1 Team from the 2026 FIA Formula One Championship season onward. The collaboration will combine the brands to challenge conversion and drive consistent development.

Mox Bank launched Mox Insure, its digital insurance division in Hong Kong, following regulatory approval, and introduced its first product - the “Personal Accident Cushion” underwritten by QBE - available entirely via its app.

Fintech infrastructure is breaking speed limits, with real-time rails and tokenized tools driving faster, smarter financial flows.

Nuvei extends its global clearing and settlement platform into the United States and Canada, bringing North American merchants onto its unified infrastructure, with transaction‑level intelligence, and real‑time settlement visibility.

Visa added Google Pay tokenization and push‑to‑wallet support to its fleet card offering, enabling dynamically configurable fleet data tags for issuers and operators and speeding digital provisioning from days to hours globally.

Digital assets are trading hype for habit, turning crypto into a seamless, swipeable part of how we pay and get rewarded.

JPMorgan Chase and Coinbase partnered to let credit card users fund accounts and convert rewards to USDC starting fall 2025.

PayPal launched “Pay with Crypto,” allowing U.S. merchants to accept over 100 cryptocurrencies and wallet types.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

UK account-to-account payment infrastructure Report- EY

Transforming Global Payments: The Role of Tokenized Money & Funds in Cross-Border Transactions - Visa

Inside UAE Banking: Growth & Digital Trends Blog - Paymentology

UK BNPL Regulation Is (Almost) Here Blog- Klarna

Mexico’s Digital Banking Surge: A Market in Motion Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️