Agentic Finance: Oracle’s Agentic Banking| PayPal’s agentic commerce| Anthropic Funding

Agentic AI Newsletter - #Edition 2 - 1st - 13th Feb 2026

The first two weeks of February saw AI agents deployed across both back-office finance and consumer-facing transactions.

Banks, payment networks, crypto rails, and AI platforms wired agents directly into infrastructure rails, checkout, wallets, and compliance stacks. This resulted in agents operating directly within core financial infrastructure, analyzing risk, making decisions, and executing transactions.

✔ Financial institutions deployed agents into core workflows, onboarding, AML investigations, accounting, CRM, and mortgage origination

✔ Crypto positioned itself as the native settlement layer for agents, with agent wallets, micro-payment standards, and programmable transaction controls

✔ Agentic payments went live across stablecoins and card networks, from programmable USDC rails to Mastercard pilots and checkout optimization at scale

Ready for the agentic signals that defined the first two weeks of February? 🔍⚡

🚨 Featured Story of the Week:

UiPath Acquires WorkFusion to Scale Agentic AI in Compliance

UiPath acquired WorkFusion, doubling down on agentic AI in financial crime and compliance workflows.

WorkFusion already deploys AI agents across AML, sanctions screening, and regulatory review. UiPath brings global enterprise distribution and automation infrastructure. Together, they are positioning compliance as the first scalable beachhead for agentic AI inside banking.

What changes now

AI agents can move into standardized compliance products, embedded directly into core banking workflows.

Financial crime investigations and regulatory review processes can shift from manual case handling to repeatable, agent-led execution models.

Enterprise automation platforms gain domain-specific intelligence, reducing reliance on bespoke AI implementations.

Why this matters for financial players

Compliance is rules-heavy, costly, and measurable, making it ideal for agent deployment.

Banks can reduce compliance costs while improving speed and auditability.

Agentic systems can operate within regulatory guardrails.

AI shifts from workflow assistant to operational co-worker in regulated environments.

The broader signal indicates consolidation around domain intelligence is accelerating. From Cube’s acquisition of Kodex AI to Themis buying Pasabi, the race is on to embed specialized AI directly into financial infrastructure.

If agentic AI needs a proving ground in finance, compliance may be it.

Thanks for reading Future of FinTech - Agentic AI Newsletter! Subscribe for free to receive new posts and support our work.

Thanks for reading Future of FinTech Newsletter! Subscribe for free to receive new posts and support our work.

🚀 Startup Spotlight: Sarvam AI

This edition, we’re spotlighting Sarvam AI, an India-built full-stack “sovereign AI” platform designed for enterprise and government use cases, with models tuned for India’s languages and local context.

The pitch is simple: Sarvam provides India-first language, voice, and document intelligence APIs and pairs them with forward-deployed engineers to ship production-ready agents inside real workflows.

Got something cool brewing in agentic finance? We’d love to feature you next- drop us a note at hello@whitesight.net 👋

Pledge your access to fintech analysis and exclusive insights ⚡

🚀 Country Spotlight: AI in India

India is positioning itself as both a massive AI adoption market and a long-term builder of sovereign AI capability.

Anthropic deepens its India commitment: Anthropic opened a Bengaluru office to support regional customers, policy engagement, and partnerships across India.

It also partnered with Infosys to accelerate enterprise adoption of Claude across banking, retail, and regulated industries.

Capital flows accelerate: Public and private capital are converging to build long-term AI capacity. India has approved a $1.1 billion state-backed AI venture program, with plans to attract more than $200 billion over the course of two years. Neysa, an Indian AI infrastructure startup, secured backing from U.S. private equity firm Blackstone in a $1.2B financing round. Additionally, Indian conglomerate Adani Group revealed plans to invest $100 billion over the next decade to build data centers specialized for AI across the country.

The India AI Summit reinforced three defining themes:

Healthcare as a proving ground: AI is being positioned as a force multiplier in diagnostics, efficiency, and national productivity.

Sovereignty as strategy: Emphasis on India-first datasets, governance frameworks, and localized model development.

Accessibility as policy: A push to democratize AI access for developers, enterprises, and public services.

For more updates and insights from the India AI Summit, follow us on LinkedIn and stay tuned to our website.

What’s on the fintech menu today?

🏁 Agentic Highlights: Biggest moves across agentic payments, agentic banking, and agentic commerce

🧩 ‘Byte’ Buzz: Agentic Finance updates, sorted by segment

🔗 Link Up: A curated set of reads worth your time

Sip on bite-sized agentic updates - fresh, sharp, and distilled to keep you ahead in just minutes. Subscribe now! 📨

📢 We’re always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we’d love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition 2 brings you the agentic finance stories that shaped how agents shaped the finance and fintech industry in the first two weeks of February

February’s Top Agentic Tea!♨️

Agentic Payments

⤷ Fiserv deepened ties with Mastercard to support AI-driven commerce across global merchant networks.

⤷ Adyen rolled out an AI-powered system that tailors checkout experiences in real time.⤷ Stripe launched a USDC-based payment rail built for autonomous AI agents.

Agentic Commerce

⤷ Klarna aligned with Google’s Universal Commerce Protocol (UCP) to support AI-driven shopping journeys spanning search, checkout, and post-purchase interactions.

AI Platform Updates

⤷ OpenAI introduced Codex, an AI agent built to assist developers with software creation tasks.

⤷ Oracle revealed a banking-focused AI platform featuring ready-made agent frameworks.⤷ Google debuted Gemini 3, enhancing reasoning capabilities for complex autonomous workflows.

Now, for the ‘byte’-sized fintech buzz –

Agentic payments continued to evolve as AI intelligence was woven into real-time checkout and commerce systems.

Adyen introduces real-time personalized checkout

Adyen launched Personalize, an AI-powered capability that adjusts checkout flows on the fly based on individual shopper behavior and context.

Industry implications: By embedding dynamic intelligence directly into payments UX, Adyen positions checkout optimization as a native layer of commerce, enabling smoother agent-orchestrated transactions with fewer abandoned carts.

Fiserv and Mastercard expand agent commerce support

Fiserv extended its collaboration with Mastercard to equip issuers and processors with tools for interacting with autonomous shopping agents in payments flows.

Industry implications: This move signals issuers’ intent to layer fraud signals, authorization controls, and bank-level decisioning into experiences where AI systems initiate or complete transactions.

Agentic crypto continued to build infrastructure for autonomous value movement and Web3-native payments.

Hedera launches Web3 rails for AI agent payments

Hedera unveiled a set of Web3-oriented standards and primitives designed to support micropayments and autonomous payments by AI agents on its network.

Industry implications: By defining agent-friendly settlement flows native to a public ledger, Hedera aims to make programmable payment execution part of the foundational crypto stack.

Stripe unveils a crypto-based payment system for AI agents

Stripe introduced a dedicated digital dollar payment rail built on stablecoins to facilitate value transfers initiated by autonomous agents.

Industry implications: This positions stablecoins as a settlement layer for AI-driven commerce, potentially lowering barriers for agents to move value without traditional intermediaries.

Agentic commerce continued to shape how AI systems interact with shopping experiences and merchant partnerships

Klarna backs Google’s Universal Commerce Protocol (UCP)

Klarna joined Google’s UCP initiative to enable interactions between AI agents and merchant checkout systems.

Industry implications: By aligning with a common protocol, Klarna is positioning its products to be natively orchestrated by agentic systems across diverse shopping surfaces.

Debenhams opts for PayPal in agentic retail experiences

Debenhams selected PayPal as its preferred partner to integrate AI-driven commerce capabilities into its digital storefront.

Industry implications: Retailers are choosing partners that can support agentic workflows while maintaining trusted checkout experiences, signaling demand for payments that work across both human and autonomous shopper journeys.

Agentic banking saw institutional players embed AI agents into compliance workflows and customer relationship systems

Goldman Sachs deploys AI agents for accounting and risk tasks

Goldman Sachs partnered with Anthropic to integrate advanced AI models into internal accounting processes and risk analysis functions.

Industry implications: By bringing agentic systems into core finance and compliance workflows, institutional banks are ready to leverage AI for operational execution under strict controls.

ANZ launches agentic CRM to enhance business banking

Australia’s ANZ introduced an AI-powered CRM platform that uses autonomous agents to automate client engagement and service tasks.

Industry implications: Embedding agentic capabilities into customer relationship systems allows banks to reallocate human staff toward higher-value advisory roles while maintaining oversight and governance.

AI platform developments continued to push agentic capabilities deeper into infrastructure and developer workflows.

IBM updates FlashSystem with agentic automation features

IBM announced its next-generation FlashSystem portfolio, embedding AI capabilities that enable autonomous storage optimization and predictive workflows.

Industry implications: By adding agentic intelligence to core storage infrastructure, IBM is positioning autonomous operations as part of enterprise data stacks.OpenAI launches a new agentic coding model

OpenAI rolled out its latest agentic model tailored for developer coding tasks, intensifying competition in developer-oriented autonomous systems.

Industry implications: Launches in agentic development tools signal a race to define the default platforms for autonomous software creation.

Agentic infrastructure continued to expand platform foundations and accelerate domain-specific innovations.

Bevri unveils AI-powered point-of-sale for loan origination

Bevri launched a new agentic POS platform that uses AI to automate and streamline loan origination workflows at the point of customer interaction.

Industry implications: By bringing agentic capabilities to the front line of lending, Bevri is reducing friction in credit conversion by enabling consistent underwriting decisions.Rezolve AI acquires Reward to boost AI solutions in banking

Rezolve AI completed an acquisition of Reward for $230 million to accelerate its development of AI-driven banking and commerce infrastructure.

Industry implications: This consolidation signals that building end-to-end agentic systems is now a priority for infrastructure providers aiming to offer fully integrated platforms.

Regulatory activity highlighted emerging policy priorities around AI safety and workforce readiness.

UK government launches deepfake detection initiative

The UK announced a national priority program to develop tools and frameworks for detecting deepfakes and AI-generated content.

Industry implications: Establishing proactive detection standards signals regulators are preparing to mitigate misinformation risks to monitor agentic systems that generate or manipulate media.

U.S. Department of Labor releases AI literacy framework

The U.S. Department of Labor unveiled a framework aimed at improving AI literacy and skill readiness across the workforce.

Industry implications: By focusing on education and workforce adaptation, regulators are pushing institutions to prepare workers for roles in an AI-dominated economy.

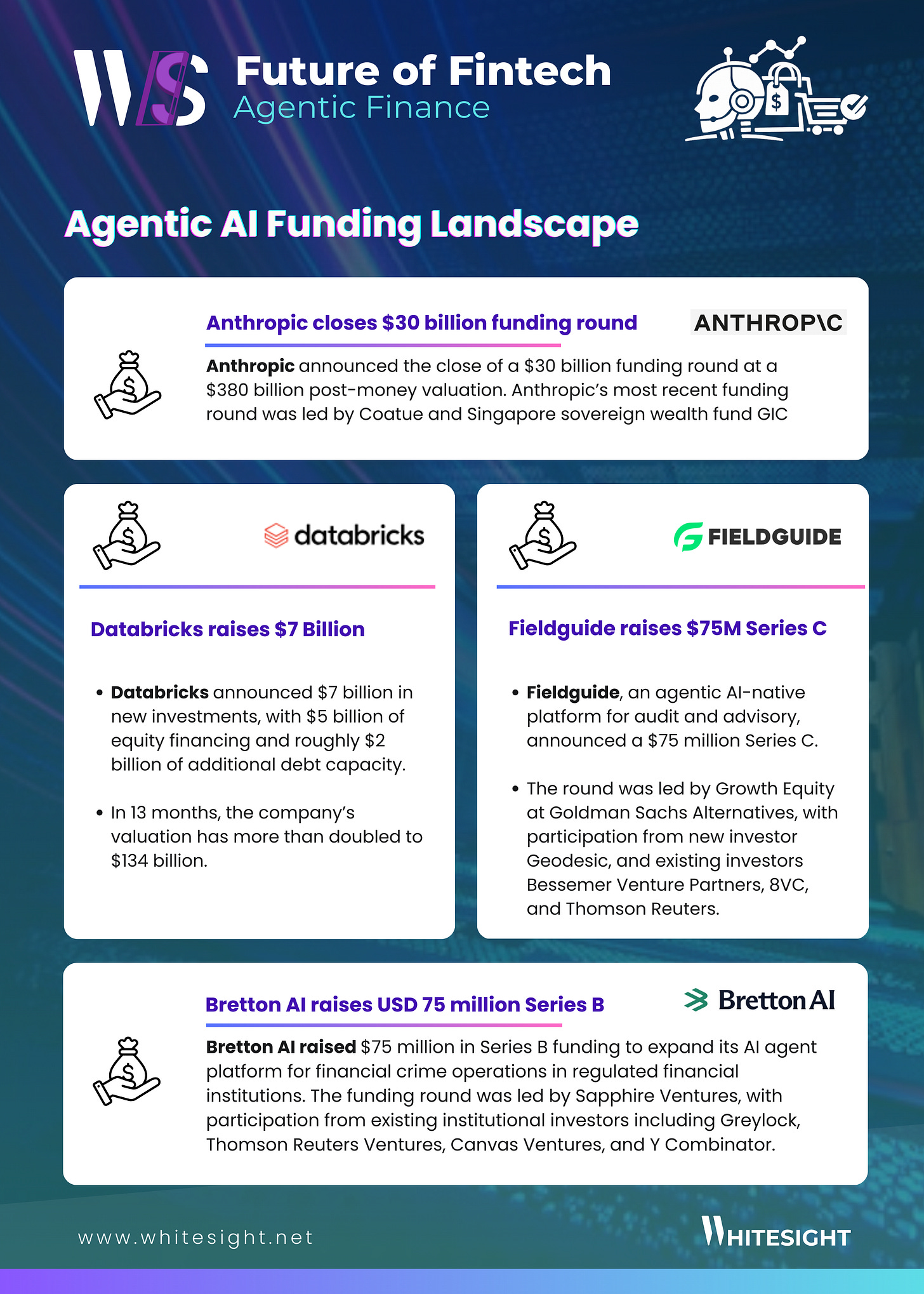

Funding activity underscored continued capital momentum across both foundational AI platforms and agent-oriented infrastructure.

Anthropic closes massive funding round

Anthropic secured a $30 billion financing round at a reported $380 billion valuation, backed by major investors including Coatue and Singapore’s GIC.

Industry implications: This raise reinforces the strategic importance of agent-oriented foundational models, signaling that deep-tech capital is still flowing into platforms that can anchor the agentic stack.

Databricks raises $7 billion to scale agent-oriented AI services

Databricks announced a $7 billion funding round to expand its AI database and infrastructure capabilities, with significant equity and debt commitments.

Industry implications: Investment into agentic data infrastructure suggests that building scalable, production-grade environments for autonomous systems is a priority for both enterprise adoption and ecosystem growth.

And that’s a wrap 👋

We hope you enjoyed this edition of the Agentic Finance Brew!

As a reward for making it this far, here’s a curated set of agentic resources to keep your curiosity (and conviction) topped up. Cheers to continuous learning!

Link Up! –

Supply Chain Financing: Durable Global Trade in the Age of AI - CITI

Agentic AI untangled: Navigating the build, buy, or borrow decision - KPMG

The automation curve in agentic commerce - McKinsey

How Agentic AI Can Power Core Insurance IT Modernization - BCG

If you’re someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don’t be shy to show some ❤️

Thanks for reading Future of FinTech Newsletter! Subscribe for free to receive new posts and support my work.